หุ้นกู้

Bond

KUN Bond: A small-cap stock with big dreams, ready to repay its debenture debt on schedule [FynnCorp IAS Bond Research]

อ่าน 12 นาที

VILLA KUNALAI PCL. [Ticker: KUN]

Sector: Property Development

Issuer Rating: BB- (15 Feb 2024)

Rating Agency: Tris Rating (15 Feb 2024)

This analysis was provided by FynnCorp Investment Advisory Company Limited (“FynnCorp IAS”), with support from the issuer. However, the issuer did not participate in offering opinions regarding the suitability or analysis presented in this report.

Overview:

- Develop low-rise development projects in Bangkok and surrounding areas.

- Expand the development zone for housing projects from Bang Bua Thong to Chachoengsao, then to Rama 2-Bang Khun Thian and Pathum Thani-Rangsit Klong 2.

- There is more than 500 rai of land awaiting development, with a total project value of over 12,000 million Baht.

Key Highlights:

- Targeting the high-end housing market with prices ranging from 5-12 million Baht from NAVARA with more than 150 rai and 330 rai in the Bang Khun Thian, Rama 2, and Rangsit Klong 2 areas, respectively.

- The gross profit margin expected to increase from the acquisition of land at prices below market value consisting of large plots of land that have been abandoned for many years. This reflects the opportunity to achieve continuous improvement in gross margins in the future.

- The outstanding debt of the Navara projects remain low compared to the asset value. As of the end of June 2024, the outstanding debt of Navara compared to its asset value is equivalent to an LTV of 0.20 and 0.25 in RAMA 2 and Rangsit Klong 2, orderly.

- Government measures help promote sales, with a backlog of over 240 million Baht, which will be recognized in the second half of 2024, particularly from the Navara projects in Rama 2 and Rangsit Klong 2.

- Raising capital through a PP offering of 50 million Baht, reflecting investor confidence, while improving liquidity and reducing the company’s debt-to-equity ratio.

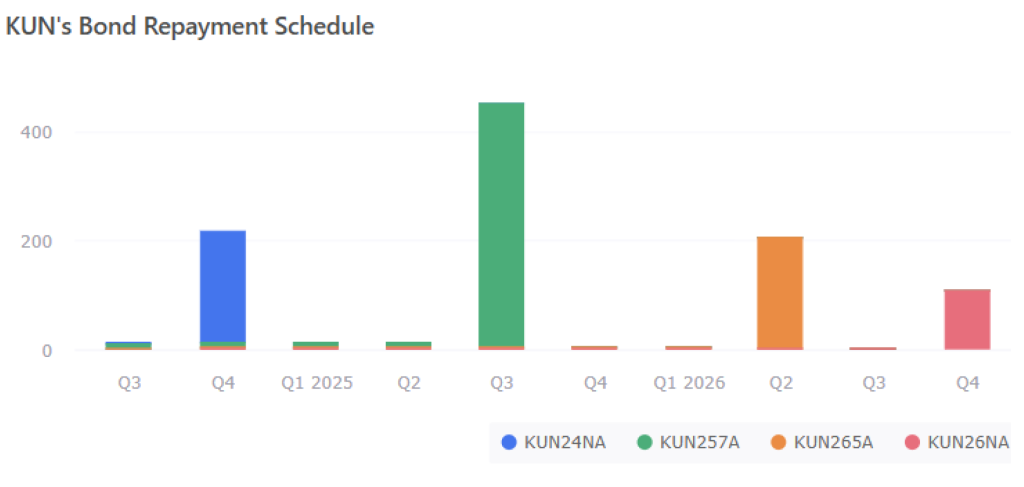

- Ability to manage liquidity and repay its debentures as scheduled. The management is not concerned about short-term debenture repayments within one year, supported by capital increase and the issuance of new debentures, with backing from financial institutions due to the low debt-to-asset collateral ratio.

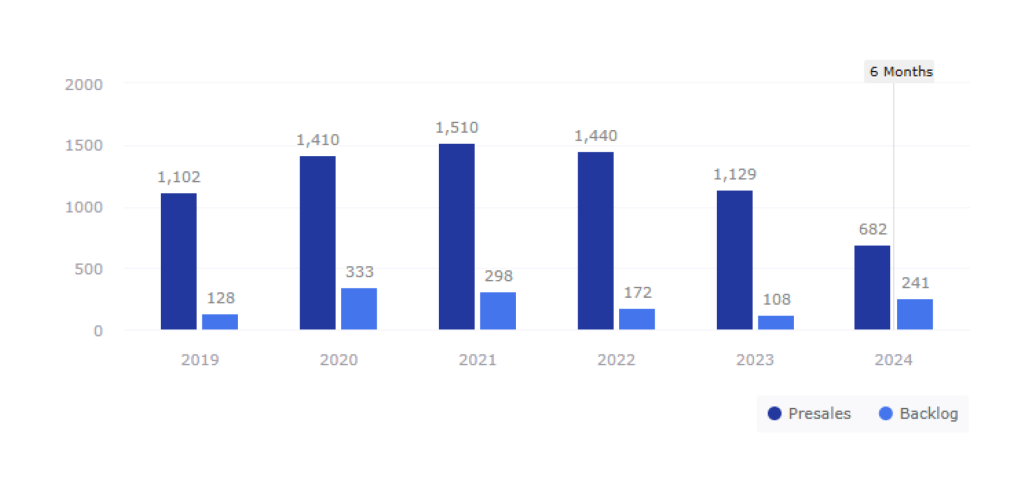

Presales and Backlog as of 1H2024

( Source: Company’s financial statement, One Report )

Presales and Backlog started to improve in 2023, reflecting a positive signal for Navara RAMA 2 and Rangsit Klong 2 projects

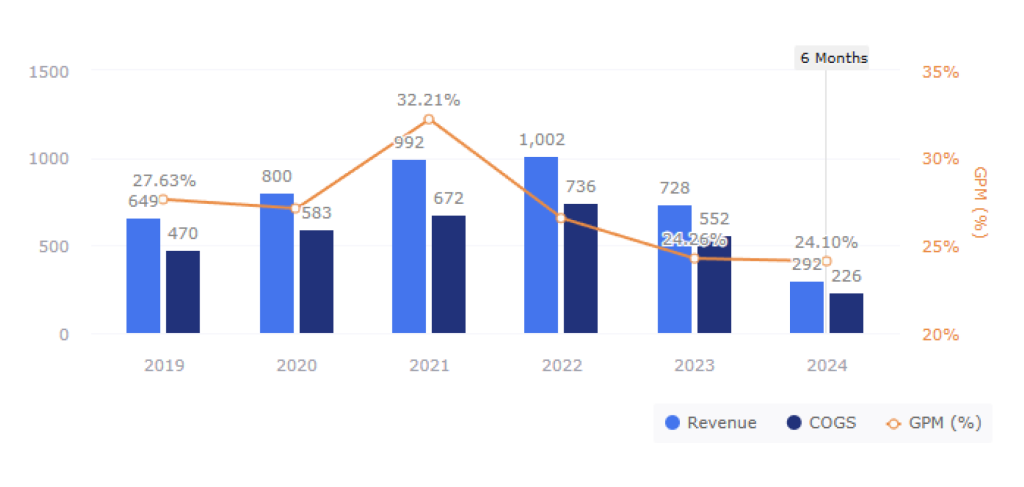

Revenue & COGs (THB Billion) & GPM (%)

( Source: Company’s financial statement, One Report )

FynnCorp IAS believes that the gross profit margin will start to improve from 2025 onwards, due to the land cost values for the Navara projects being lower than market prices for the land awaiting development, as per the accounting records.

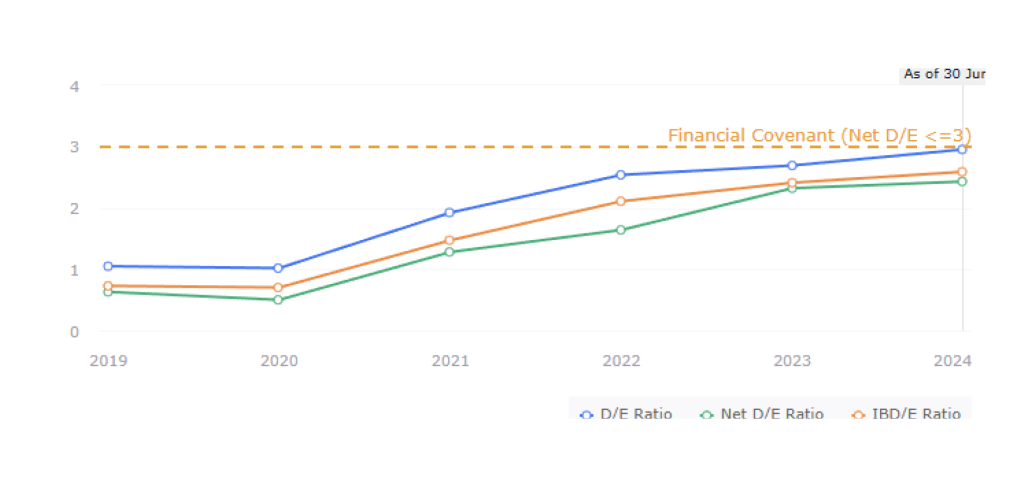

Debt Structure

( Source: Company’s financial statement, One Report )

The pressure from the company’s debt-to-equity ratio will decrease due to the capital increase through a PP offering of 50 million Baht.

Company Profile:

- Founded in 2007, the company engages in the development of low-rise projects for sale, including single houses, semi-detached houses, townhomes, and commercial buildings. It has a subsidiary named Villa Kunalai Co., Ltd. (VV). KUN was listed on the Market for Alternative Investment (MAI) in 2019 and moved its listing to the Stock Exchange of Thailand (SET) on September 11, 2024.

- The company’s core business is the development and sale of residential projects with land, ranging from 2 to 12 million Baht. The company develops and owns projects located in all four directions surrounding Bangkok, including areas in Bangkok (Rama 2 – Bang Khun Thian), as well as the suburbs in areas such as Pathum Thani (Rangsit Klong 2) and Nonthaburi (Bang Bua Thong), where most of the projects are located.

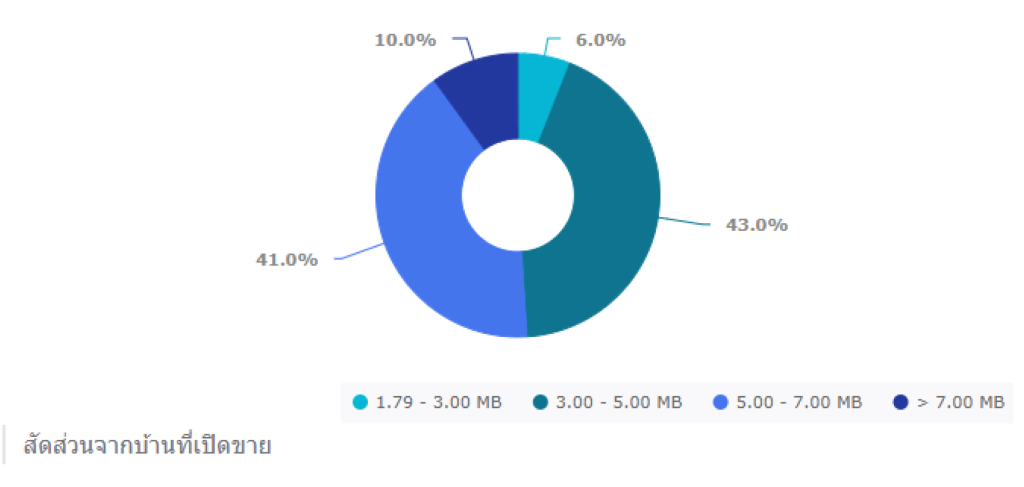

House for Sales by Price in 2024

( Source: Opportunity Day 1Q24 )

- The key selling points of the project are its strategic location near community areas, public transportation hubs, and BTS stations. Additionally, it is situated in a region with increasing demand for residential properties. The company has also set a competitive selling price by comparing it with other projects in the surrounding area and taking into account the project’s costs before determining the selling price.

- KUN diversifies its risks by working on projects of various sizes, from small to large, and constructing a suitable number of homes. Additionally, the sales policy includes starting sales once the show house is completed and also offers a down payment installment plan for customers who choose homes that are still under construction, with the number of installments depending on the construction timeline. On average, the construction takes approximately 16-18 months.

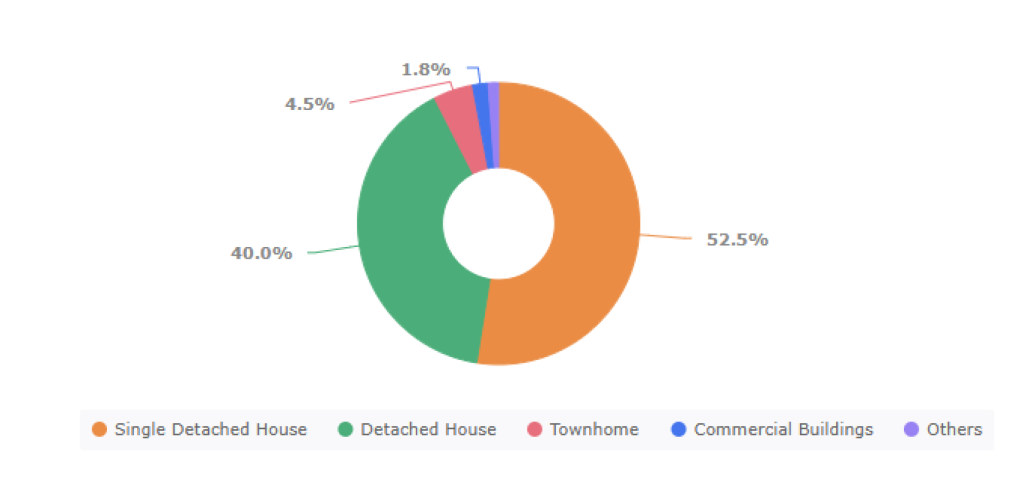

- Its revenue structure is primarily driven by single detached houses, which accounted for 52.5% of total revenue in 2023. This is followed by revenue from semi-detached houses at 40%, townhomes at 4.53%, and commercial buildings at 1.78%. The remaining income is from other sources, such as rental income from clubhouse buildings, among others.

Revenue Breakdown (2023)

(Source: Company’s financial statement, One Report)

The proportion of single detached house sales continues to expand steadily, with the key feature being the “Book, Build, Transfer, Sell” model. This approach helps manage cash flow efficiently, preventing it from being tied up, and reduces interest burden during the transfer and sale of homes with land.

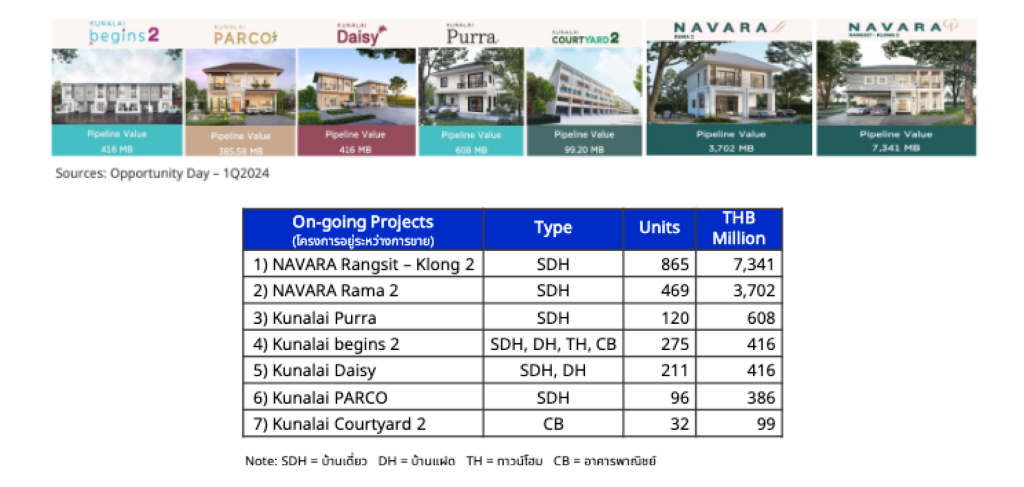

- Currently, the company has 7 projects under sale, with 5 located in the Bang Bua Thong area and 2 in Bangkok and Pathum Thani, namely the Navara projects, with a total value of over 12,000 million Baht. This reflects that KUN is targeting the high-income customer segment, with homes priced between 5 and 12 million Baht.

- The company plans to launch another semi-detached house project, “Kunalai Premlux,” located in the Bang Bua Thong area, around the third or fourth quarter of this year. The project will consist of 94 units, with an estimated value of approximately 390 million Baht.

- In 2024, the company aims for a presale target of 1,600 million Baht and a revenue growth of 10-15%. The company plans to reduce the proportion of revenue from customers in the Nonthaburi area and focus more on projects in the Rama 2, Bang Khun Thian, and Rangsit Klong 2 zones, as the high-income customer segment is becoming more concentrated in these areas.

Industry Analysis:

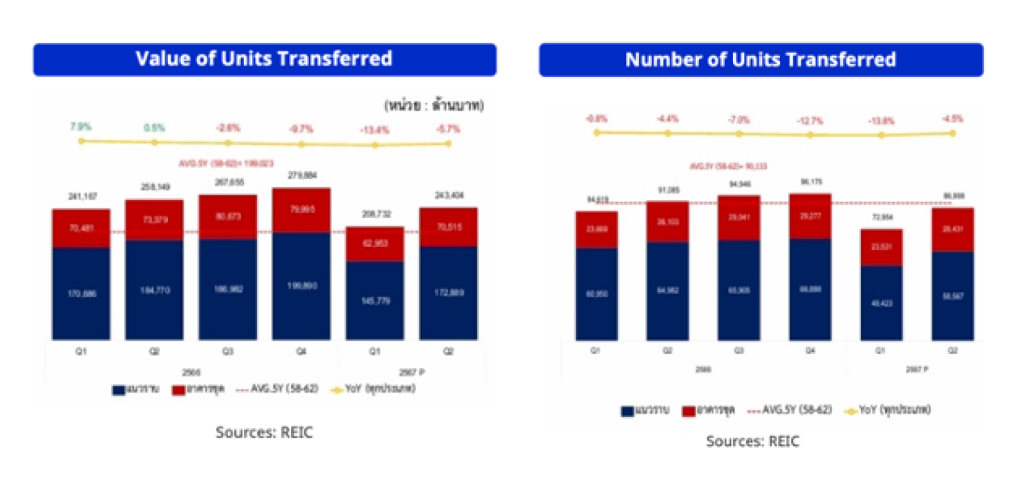

- Housing demand continued to decline since 2023. According to the Real Estate Information Center (REIC), the total number of residential ownerships transfers nationwide in 2023 was 366,825 units (-6.6% YoY), valued at 1,046,855 million Baht (-1.7% YoY). In the first half of 2024, ownership transfers decreased to 159,952 units (-9.0% YoY), with a total value of 452,136 million Baht (-9.4% YoY). The high-end housing segment, with prices above 10 million Baht, still shows strong purchasing power. Meanwhile, the value of ownership transfers for affordable single-house and townhouse segments under 10 million Baht has decreased across all price levels. However, the overall value of transfers for low-rise properties has increased by 11.2% YoY, reflecting that the market above 10 million Baht remains robust.

- In Q2, housing demand remained sluggish but showed signs of improvement thanks to the government’s real estate stimulus measures, which started on April 9, 2024, and financial institutions beginning to approve more loans compared to the previous quarter. Nationwide residential ownership transfers in Q2 amounted to 86,998 units, valued at 243,404 million Baht, a decrease of -4.5% and -5.7% YoY, respectively. However, this decline was smaller than the more than 10% YoY decrease seen in Q1. Low-rise properties saw a decrease in both transfer numbers and value, down -9.9% YoY and -6.4% YoY, respectively. In contrast, the number of condominium ownership transfers increased by 8.9% YoY, though the value decreased by -3.9% YoY, with properties priced below 5 million Baht showing positive growth.

- Low-rise properties accounted for the largest share of ownership transfers, as reflected by the total number of 258,735 units with a value of 742,328 million Baht in 2023, showing a decrease of 9.4% and 4.4% YoY, respectively. In the first half of 2024, the number of horizontal property ownership transfers totaled 107,990 units, valued at 318,667 million Baht, representing a decrease of 14.2% YoY and 10.3% YoY, respectively. The provinces with the highest value of residential ownership transfers in the first half of 2024 were Bangkok, Chonburi, Samut Prakan, Nonthaburi, and Pathum Thani, respectively.

- On the developer side, the focus has shifted towards the higher purchasing power market. According to CBRE, last year saw the launch of more than 1,400 luxury and super-luxury homes, amid high competition in the single-detached house market. The Bangkok and surrounding areas continue to have the highest supply of residential properties, particularly townhouses, single-detached homes, semi-detached houses, and commercial buildings, in that order.

- In the first half of the year, the supply side saw a decrease in land allocation licenses for residential development, both in terms of the number of projects and units. There were 317 projects with 36,563 units, representing a 23.6% YoY and 14.7% YoY decrease, respectively. The Bangkok and surrounding areas accounted for the largest share with 144 projects. Single-detached homes made up the largest share (39.9%) of land allocation licenses, followed by townhouses (39.4%). Pathum Thani, Bangkok, and Samut Prakan had the highest number of land allocation licenses, respectively.

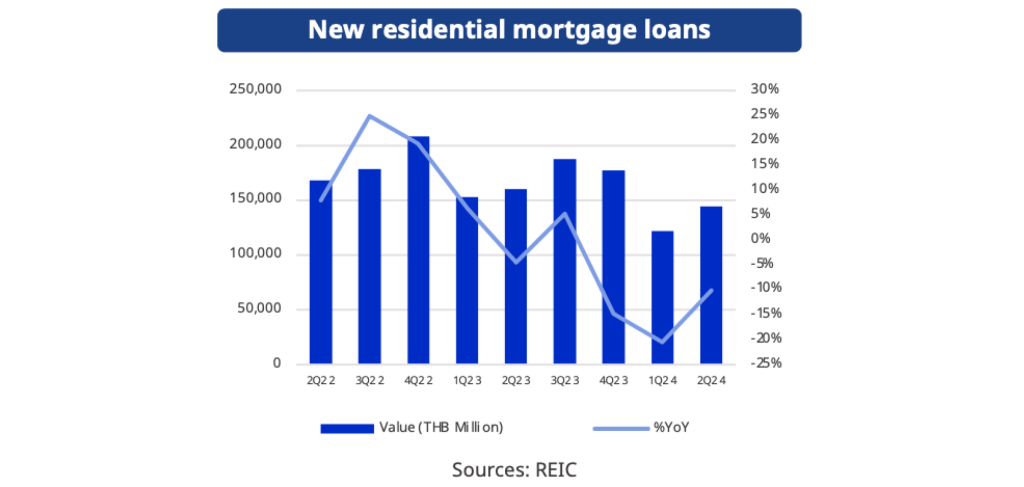

- The market in the second half of 2024 is expected to remain stable or experience slight growth, driven by government measures to stimulate the real estate sector, which were introduced in April. These measures include a reduction in transfer and mortgage registration fees for residential properties priced below 7 million baht, set to expire on December 31, 2024. Additionally, there are expanded economic stimulus measures targeting tourism, including the introduction of a visa-free policy to attract tourists from China, India, and Taiwan. However, the market still faces negative factors, such as the continued high household debt burden, coupled with the policy interest rate remaining at 2.5%. The cancellation of the LTV (Loan-to-Value) relaxation measures, along with a significant 20.5% YoY decrease in new residential loans in the first quarter of this year, are additional challenges that could hinder market recovery.

- We see a slight improvement in the overall real estate market, driven by government measures and sustained demand for high-priced housing. However, there are still risks regarding the demand for mid-range housing, which represents the largest portion of the market. As a result, overall housing demand remains subdued, in line with the decline in nationwide lending since late 2023.

Key Risk Factors:

- The company faces short-term liquidity risk as of Q2/2024, despite having total assets of 2,902.33 million Baht and current assets of 2,596.69 million Baht, which exceed current liabilities, reflected in a current ratio of 2.65 times. However, over 97% of the assets consist of projects that are either completed or under construction, which typically take longer to sell. Additionally, KUN’s cash conversion cycle has increased from 1,201.31 days the previous year to 1,708.96 days in the most recent quarter. This indicates that the company is taking longer to sell its products, resulting in lower liquidity and continued short-term liquidity risks.

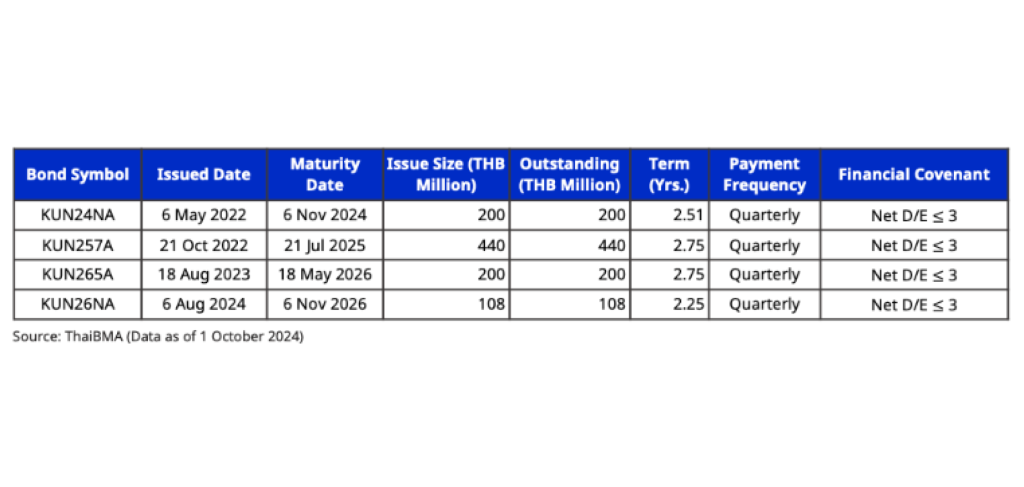

- KUN primarily relies on loans from financial institutions, which account for 53.32% of the company’s total interest-bearing liabilities. Debentures make up 43.36%, while the remaining 3.32% consists of loans from other individuals or lease liabilities (as of June 30, 2024).

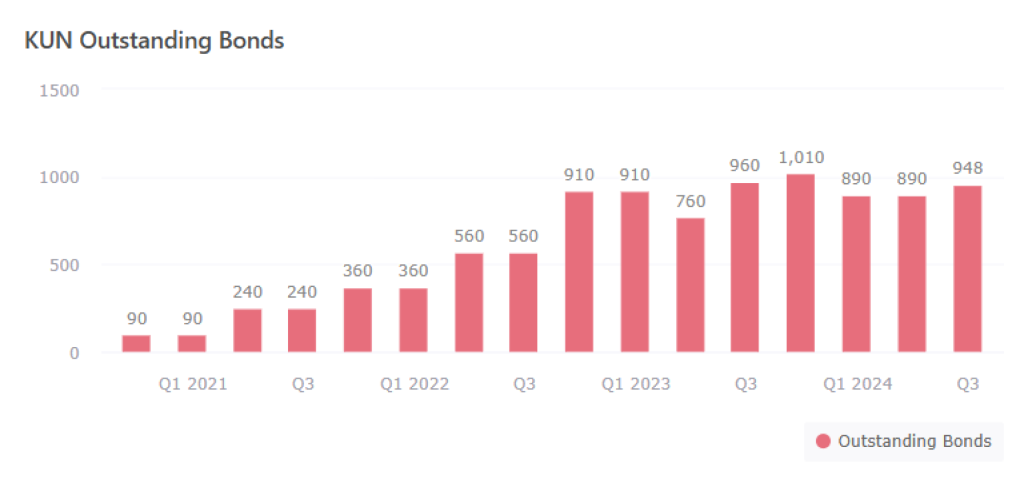

- The company’s debt burden has increased, especially interest-bearing liabilities. As of Q2, the total liabilities stood at 2,117.25 million Baht, marking a 10.88% YoY increase. This consists of current liabilities of 979.28 million Baht and non-current liabilities of 1,137.98 million Baht. The debt-to-equity (D/E) ratio has risen to 2.70 times, indicating a capital structure with significantly more debt than equity. Due to a decline in sales, the company has become increasingly reliant on external loans, resulting in interest-bearing debt (IBD) accounting for over 90%, primarily from loans from financial institutions and debentures. As a result, the IBD-to-equity ratio increased from 2.41 times in 2023 to 2.48 times in Q2 of this year.

- The risk of maintaining its net debt-to-equity ratio as stated in financial covenant that must not exceed 3 times as of the end of the accounting period. The company’s ratio has steadily increased from 0.50 times in 2020 to 2.43 times in Q2/2024. Additionally, with significant debt obligations due in the near future, the company will need additional equity funding sources to manage its financial position.

- The company’s outstanding bonds as of Q3 2024 are 946 million baht

The company’s additional funding sources are as follows:

- Requesting a total credit facility of 60 million Baht from financial institutions.

- Issuing B/E bills or debentures to investors amounting to 50 million Baht.

- Borrowing a loan from financial institutions worth 45 million Baht.

- For the KUN24NA debenture valued at 440 million Baht, the company expects to secure approximately 250 – 300 million Baht from refinancing the Navara Rama 2 project.

Historical Credit Rating Analysis:

- Issuer Rating is BB- with a stable outlook as of February 15, 2024, the downgrade from the previous BB rating is due to the company’s weakened financial performance and position, along with revenue and profit fluctuations amidst an unfavorable market environment, including high interest rates and a depreciating Baht, which have made operations more challenging.

- Never defaulted on or delayed any debenture payments. KUN issued its first debenture in 2020 and currently has outstanding debentures due for repayment at the end of 2024 worth 200 million Baht on November 6, 2027 (KUN24NA).

ข้อจำกัดความรับผิด (Disclaimers):

กดด้านล่างเพื่อดูรายละเอียด ข้อจำกัดความรับผิด:

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง