Equity

ERW: A Leading Hotel Investment and Development Company [FynnCorp IAS Equity Research]

อ่าน 9 นาที

THE ERAWAN GROUP PUBLIC COMPANY LIMITED [Ticker: ERW]

Industry: SERVICE

Sector: TOURISM

% Free Float as of 8 Mar 2024: 63.15%

52 Weeks Range (Baht): 3.12/ 5.10

Key Highlights:

- ERW is one of the major players in the tourism sector, supported by the continuous increase in tourist arrivals.

- The company invests in and develops hotels in Thailand, the Philippines, and Japan, covering a range from 5-star luxury hotels to budget hotels under well-known brands such as Grand Hyatt Erawan, Novotel, Mercure, Holiday Inn, Ibis, and HOP INN.

- Expansion Strategy: focus on the growing budget hotel segment and increase revenue and profit contributions from international markets

The Hotel Industry Continues to Recover Alongside the Tourism Sector

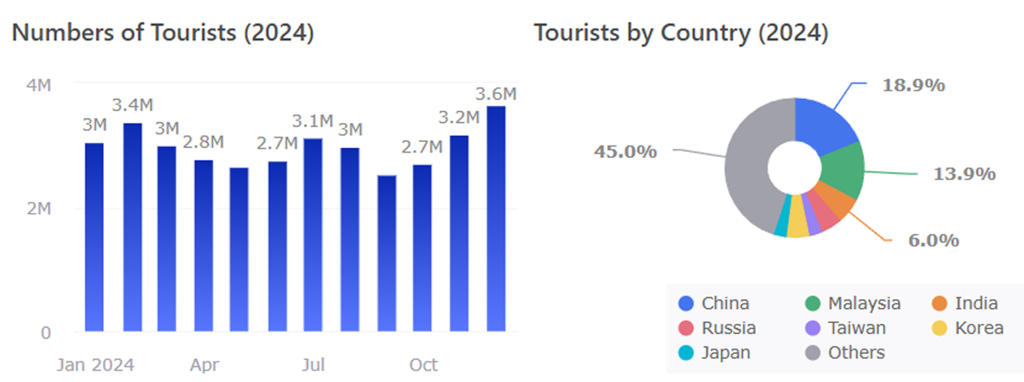

The Ministry of Tourism and Sports reported that the number of international tourists visiting Thailand in 2024 reached 35.5 million, marking a 26.3% increase compared to the previous year. Chinese tourists remained the largest group, accounting for 18.9% of total international arrivals, although still below 2019 levels. They were followed by tourists from Malaysia (13.9%), India (6%), South Korea (5.3%), Russia (4.9%), as well as Taiwan and Japan.

These arrivals generated over 1.6 trillion baht in revenue. Additionally, tourists from the Middle East have shown strong potential, with steady growth in recent periods. The Thai government has also stimulated foreign tourism through a visa-free policy to attract more visitors.

Source: Ministry of Tourism and Sports

At the same time, domestic tourism continues to grow, supported by government initiatives such as tax deduction measures for travel spending, which aim to boost tourism in secondary cities. As a result, tourism in secondary cities saw significant growth in 2024.

The government has set a target for tourism revenue growth of 7.5% in 2025, reaching approximately THB 3.4 trillion. The number of international tourist arrivals is projected at 40 million, while domestic trips are expected to exceed 205 million.

With rising tourist numbers from both international and domestic travelers, along with government support, the hotel industry benefits from higher occupancy rates and room rates. Hoteliers have also upgraded facilities and services, leading to an increase in average room rates, particularly in 4-star and higher-tier hotels.

According to SCB Economic and Business Research Center (SCB EIC), hotel occupancy rates and average room prices in 2025 are expected to surpass pre-pandemic levels in 2019, but the recovery remains gradual. The expected occupancy rate is 74%, with an average room rate of THB 2,056 per night per room.

Company Background

- The Erawan Group Public Company Limited (ERW) is one of the key hotel operators benefiting from the positive factors driving the hospitality industry’s recovery. As a result, the company has experienced continuous growth in its financial performance.

- ERW was founded by three prominent business families—Isara Vongkusolkit, Supol Vadhanavakin, and Wit Jenwattanawit—who incorporated the company in 1982 under the name Amarin Plaza Co., Ltd. Initially, the company focused on real estate development, including office buildings and shopping centers for lease.

- In 1988, the company was converted into a public limited company, and by 1994, ERW had shifted its core business to hotel investment, development, and operations while still maintaining other businesses such as property leasing and building management services.

- Finally, in 2005, the company rebranded as The Erawan Group Public Company Limited and has since remained focused on the hospitality industry, expanding its portfolio and strengthening its market position.

Hotel Business

- Currently, The Erawan Group (ERW) operates a total of 89 hotels and resorts with 11,545 rooms (as of October 31, 2024). The majority of these properties (74 hotels) are located in Thailand, with additional locations in the Philippines and Japan. ERW’s portfolio consists of 10 well-known hotel brands spanning different market segments:

1) Luxury (5-star hotels): Grand Hyatt Erawan, JW Marriott, The Naka Island (a Luxury Collection Resort)

2) Midscale hotels: Courtyard by Marriott, Novotel, Mercure, Holiday Inn

3) Economy hotels: Ibis Styles, Ibis

4) Budget hotels: HOP INN (operating in Thailand, the Philippines, and Japan)

This diversified hotel portfolio allows ERW to capture a wide range of customers, from luxury travelers to budget-conscious guests, strengthening its position in the hospitality industry across multiple markets.

Source: The company’s website, OppDay 3Q2567

- To manage its hotel operations, ERW collaborates with three internationally renowned hotel management companies: Hyatt International, Marriott International, InterContinental Hotels Group (IHG) to oversee the management of five hotels under ERW’s portfolio. Additionally, ERW holds franchise agreements with: AccorHotels, which manages Novotel, Mercure, Ibis, and Ibis Styles brands and IHG, which operates Holiday Inn. Apart from these partnerships, ERW has also developed its own hotel brand, HOP INN, which it fully owns and operates. HOP INN primarily serves domestic travelers and frequent business travelers, offering affordable accommodations with standardized quality across its locations in Thailand, the Philippines, and Japan.

Leasing Space and Building Management Business

- In addition to its hotel business, the company also operates a leasing business with properties such as Erawan Bangkok, a high-end shopping center with approximately 6,554 square meters of leasable space across 5 floors, and Ploenchit Center, an office building with approximately 42,847 square meters of leasable space over 25 floors. The latter is owned by the Prime Office Real Estate Investment Fund.

Source: The company’s website

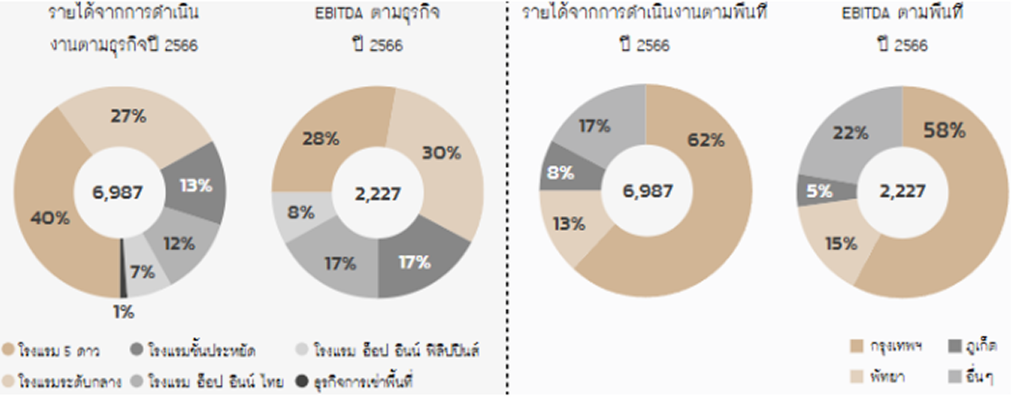

Revenue Structure

- The company generates the majority of its revenue from 5-star hotels, accounting for 40% of its operating income in 2023. This is followed by revenue from mid-range hotels at 27%, budget hotels at 13%, and the HOP INN group in Thailand (12%) and the Philippines (7%). Meanwhile, the leasing business contributes a small portion (1%) of the total revenue. In terms of revenue by location, Bangkok remains the main revenue generator for the group, contributing 62% of the total operating income in the same year.

Revenue by Business Segment and Location (2023)

- In terms of occupancy rate, there was growth across all hotel segments, especially in the mid-range and budget hotels. The average room rate (ARR) increased in proportion to the occupancy rate, leading to a significant growth of over 50% in revenue per available room (RevPAR). This reflects the strong recovery of hotels, driven by higher prices and better occupancy rates.

Room Operations Statistics (2023)

Source: One Report 2566

Financial Performance

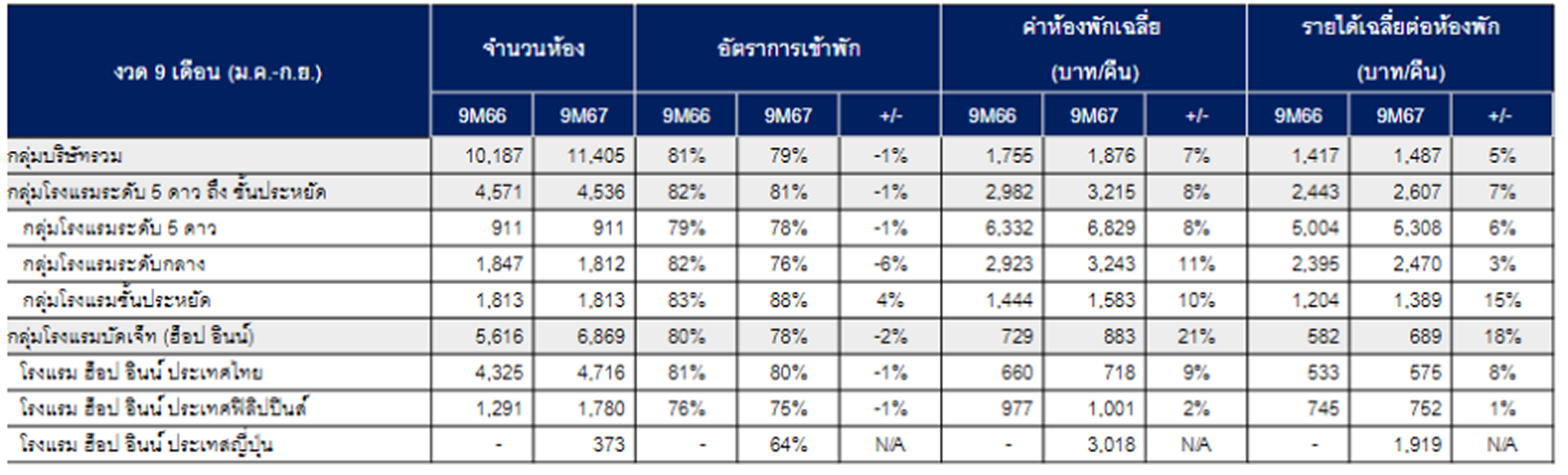

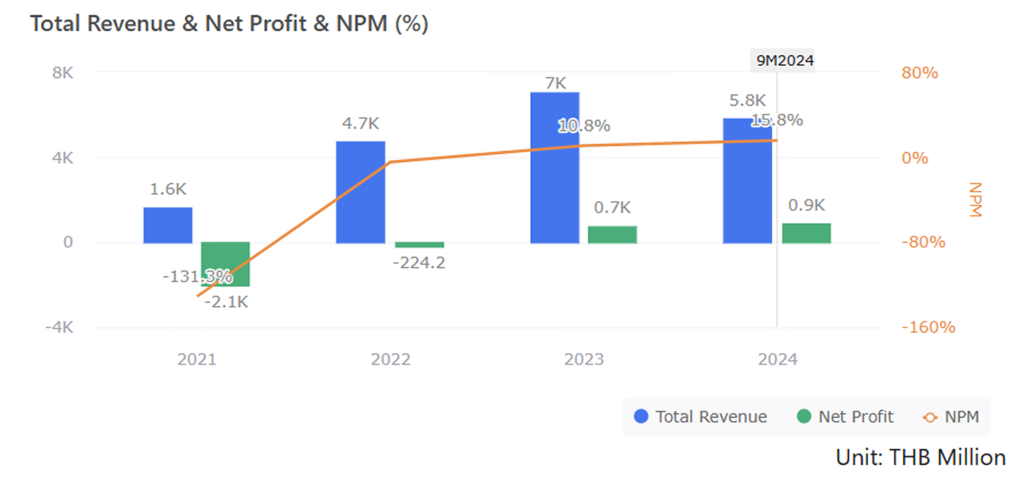

- Revenue from operations (hotel business, rental income, and services) was 5.657 billion baht in the first 9 months of 2024, growing approximately 11% YoY compared to the same period last year. Despite the impact from the rainy season, flooding, and the Hyatt Incident, which were all one-off events, revenue aligned with the increase in net profit, which grew over 71% YoY. This growth was partly driven by the share of profits from investments in joint ventures and profits from changes in lease agreements and asset rights. However, if excluding the special items, net profit would have increased by 5% YoY.

- However, despite a slight decrease in occupancy over the 9 months due to the downturn in tourism trends amid a relatively stronger Thai Baht compared to other currencies, overall occupancy remained strong at around 80%. The company also maintained an increase in average room rates (ARR), leading to a 5% YoY growth in revenue per available room (RevPAR). This growth was driven by positive factors such as increased Chinese and Indian tourists, as well as the government’s visa exemption measures. The budget hotel segment, in particular, saw a 15% YoY growth.

Room Operations Statistics (9M2024)

Source: Management Discussion and Analysis 3Q2567

The Growth Plan via Development and Expansion in the Asia-Pacific Region

- In 2024, the company launched 13 new hotels across Thailand, the Philippines, and Japan, totaling 1,257 rooms. By the end of Q3 2024, the company had 12 hotels under development in Thailand, focusing on budget hotels. The strategy includes increasing revenue and profit from international customer bases while upgrading 3-5 stars hotels to enhance competitiveness and meet changing market demands.

Source: OppDay 3Q2567

Risk Factors

- Asset Concentration Risk: The company’s hotel business is primarily concentrated in Thailand and the Philippines. If significant events or economic, political, or other crises affect tourism in these areas, it could directly impact the company’s performance. Therefore, the company focuses on investments in both major and secondary cities and plans to expand its hotel network in the Asia-Pacific region to ensure continuous asset diversification.

- Competition Risk: The hotel industry is highly competitive, with new entrants continuously entering the market, which may affect financial performance. However, the company benefits from strong brand recognition and prime locations, as well as its expansion into the budget hotel sector, which faces less competition, to better meet current customer demand.

- Risk from International Expansion: With plans to expand abroad, the company faces risks from currency fluctuations, changes in investment values, delays, and regulatory changes. However, the company mitigates these risks by conducting thorough due diligence, planning investment steps carefully, using natural currency hedging, and regularly assessing market and political risks.

ERW Stock

- ERW is considered a major player in the tourism sector, with a market capitalization of 15,833.65 million THB as of February 6, 2025. The company reported impressive net profit growth, reaching 902.9 million THB in the first 9 months of 2024, supported by special items and improved operational performance. As a result, the net profit margin (NPM) increased to 15.8% during the same period, and earnings per share (EPS) rose to 0.19.

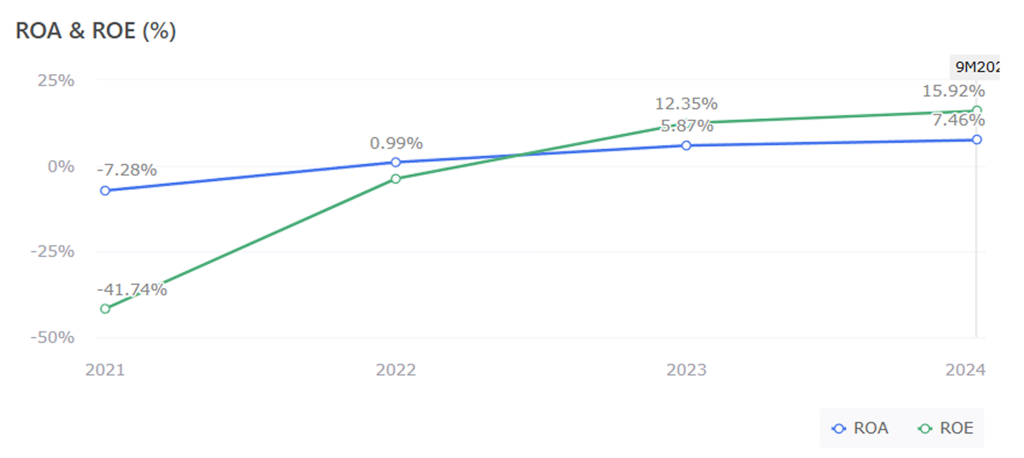

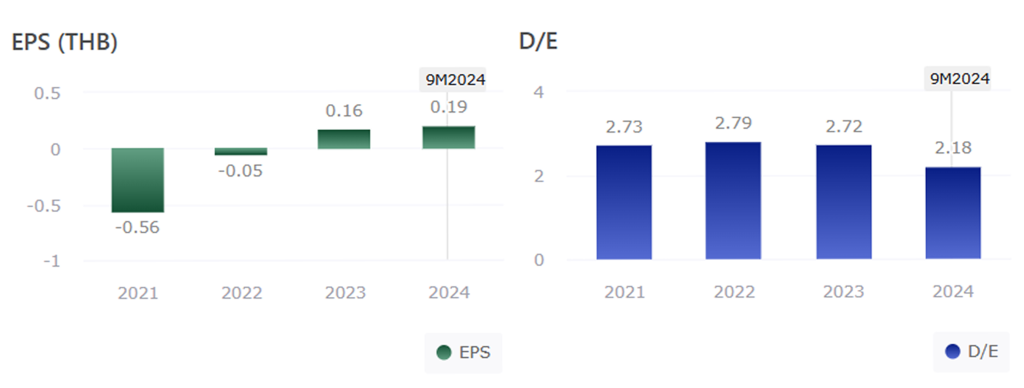

- At the same time, the company saw an increase in return on assets (ROA) and return on equity (ROE), reaching 7.46% and 15.92%, respectively, in the first 9 months. Additionally, the debt-to-equity ratio (D/E) decreased to 2.18 times, reflecting improved profitability, financial stability, and shareholder returns.

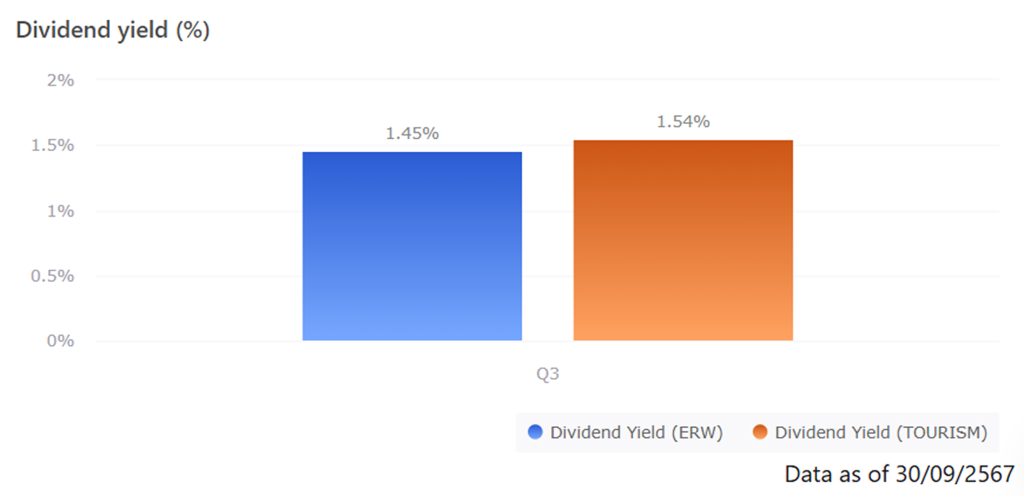

- Regarding dividend payments, ERW had a dividend yield of 1.45% as of September 30, 2024, while the Tourism sector had a yield of 1.54%. This indicates that the company focuses more on expanding its business according to its long-term plans rather than on dividend payouts. When comparing stock price to earnings per share (P/E), ERW’s P/E was 19.2 times, while the Tourism sector’s P/E was 29.8 times during the same period.

ข้อจำกัดความรับผิด (Disclaimers):

กดด้านล่างเพื่อดูรายละเอียด ข้อจำกัดความรับผิด:

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง