Bond

Macro Domestic

Macro View in April 2025 (Bond Research).

อ่าน 1 นาที

Key Highlights:

- Corporate bond issuance in April2025: Decreased by 7.05% month-on-month decreased by 35.99% year-on-year Total value: 63 billion baht

- Summary of bond offerings in April 2025: 9 out of 22 companies failed to fully sell their bond offerings

- Credit rating changes in April 2025: Downgraded PF GRAND S ROH SHR ITD

- Bond Offerings in May 2025.

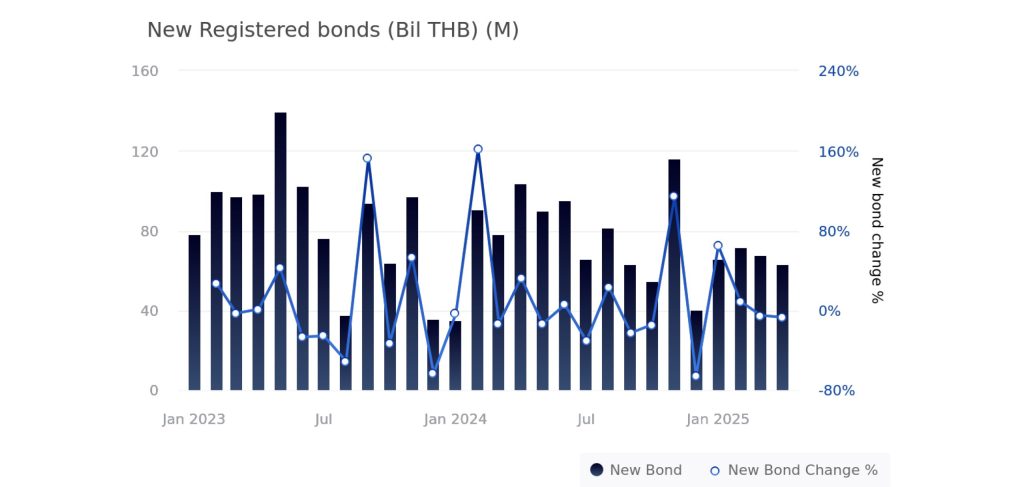

Figure 1 : New Registered Bonds (THB Billion)

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

- In April 2025, we observed a notable decline in the value of new corporate bond issuances in the private sector, falling by 7.05% month-on-month and by as much as 35.99% compared to the same period last year, with a total issuance value of 63 billion baht. This drop is likely due to heightened economic uncertainty.

- Investment Grade Bonds: Representing 87.75% of the total, with a value of 55 billion baht.

- Non-Investment Grade Bonds: Accounting for 12.3% of the total, valued at 7.7 million baht.

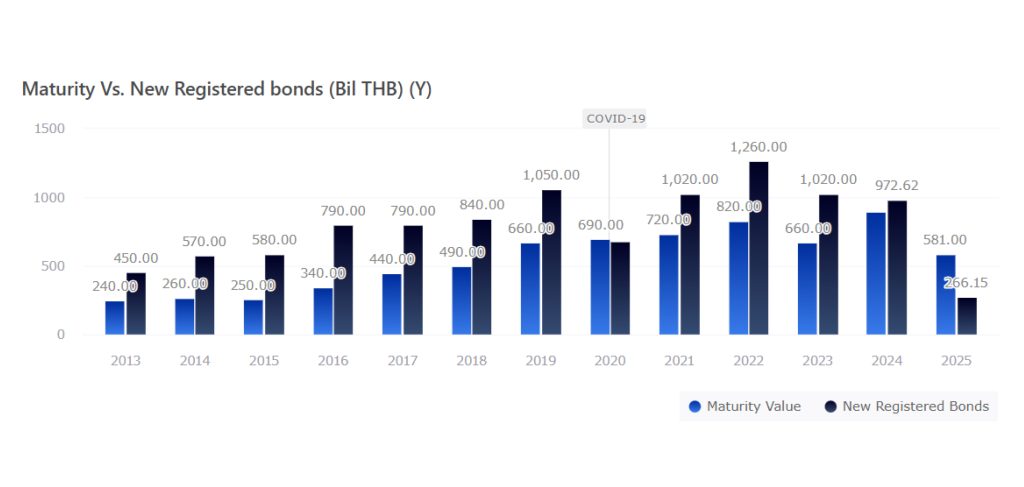

Figure 2 : Maturity Vs. New Registered Bonds (THB Billion)

Figure 3 : Outstanding Value of Long-term Bond with Maturity by Sector

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

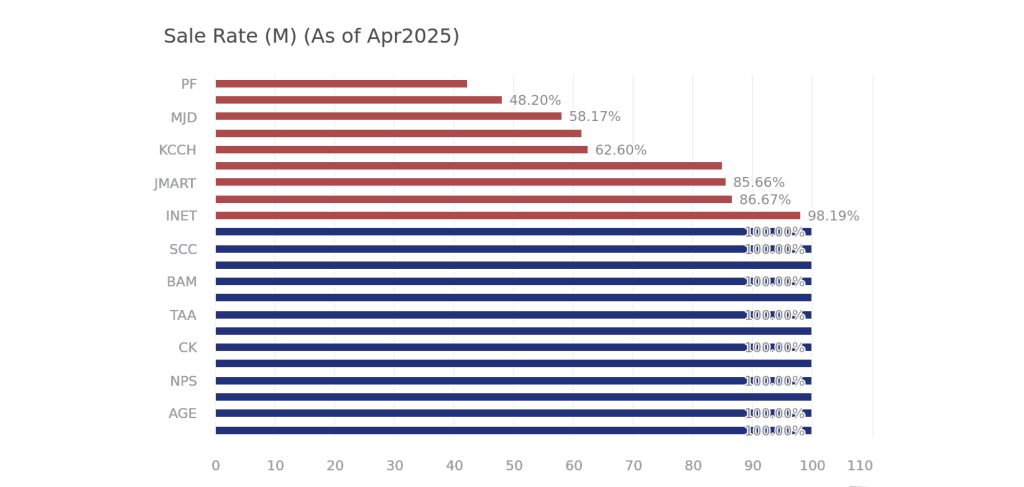

Bonds Offered in March 2025

- In April 2025, Thailand’s corporate bond market saw 10 investment-grade companies issuing bonds (Issue Rating), including MTC SCC TPIPL BAM ORI LH JMART CK NPS BANPU, with a total value of approximately 55 billion baht.

- 12 Non-investment-grade companies (Issue Rating) participated, such as ASW INET PUEAN TAA KCCH PF DAOLS MBK AGE MJD MICRO MUD, contributing around 7.7 million baht.

- Despite higher issuance volumes, 9 out of 20 total issuing companies failed to meet fundraising targets (Reconcile their outstanding with filling).

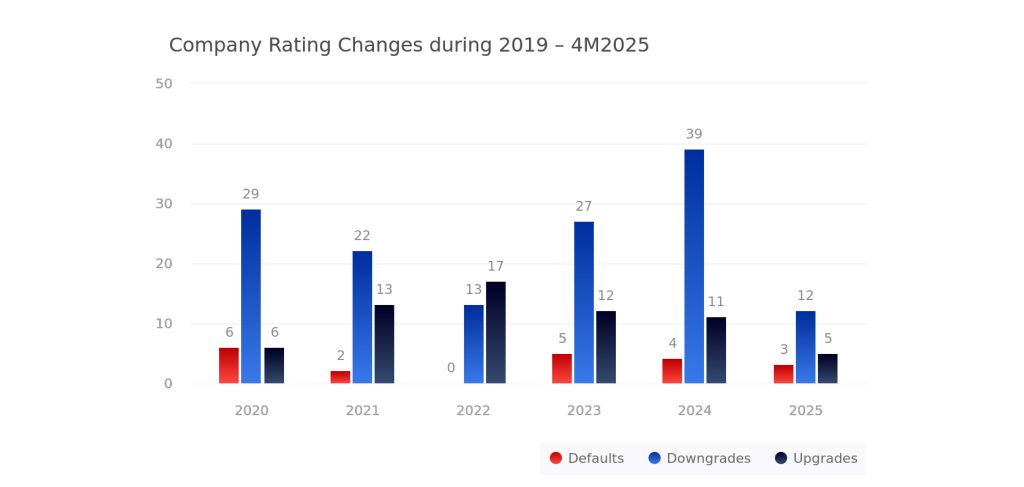

Figure 4 : Company Rating Changes during 2019 – 3M2025

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

Credit change ( Issuer Rating )

TRIS Rating has upgraded 5 companies.

MINT

TRIS Rating has upgraded the company rating of Minor International Public Company Limited (MINT) from “A” to “A+,” with the outlook revised from “Positive” to “Stable.” The rating on MINT’s senior unsecured debentures has also been upgraded accordingly. In addition, the ratings on MINT’s subordinated perpetual debentures (MINT22PA and MINT23PA) have been raised from “BBB+” to “A-”

These upgrades reflect the company’s improved credit quality, driven by a robust recovery in operating performance after the pandemic and a significant reduction in debt levels. MINT’s financial leverage has sustainably improved. The hotel business is expected to return to normal growth, while the restaurant business is projected to achieve moderate growth.

GULFI

From “A+” to “AA-” with a “Stable” outlook

To align with the corporate and debenture credit ratings assigned by TRIS Rating to Gulf Development Public Company Limited (GULF), the newly merged company formed from the amalgamation of GULFI and INTUCH

TISCO

From “A-” to “A” with a “Stable” outlook.

As the company is a non-operating financial holding company (NOHC), its credit rating is one notch below the group credit profile (GCP) of the TISCO Group, which is assessed at “a+”.

The GCP assessment of TISCO Group is based on the consolidated credit profile of TISCO Bank Public Company Limited (TISCOB) (rated “A+/Stable”) and other operating subsidiaries within the group.

TISCOB

From “A” to “A+” with the credit rating outlook maintained at “Stable”.

This rating upgrade results from the upward revision of the group credit profile, similar to TISCO.

KTC

From “AA-” to “AA” with the credit rating outlook maintained at “Stable”.

TRIS Rating has also assigned a credit rating of “AA” to the company’s new senior unsecured debentures, with a total issue size not exceeding THB 15 billion and a maturity of up to 10 years.

This credit rating upgrade is based on the improvement of the company’s Stand-alone Credit Profile (SACP) to “a” from the previous “a-”.

The upgrade reflects TRIS Rating’s assessment of the company’s business position as “very strong,” up from “strong.” The company’s group status remains unchanged as a “strategically important subsidiary” of Krung Thai Bank Public Company Limited (KTB, rated “AA+/Stable”).

TRIS Rating has downgrade 6 companies

PF

From “BB” to “BB-” with a “Negative” outlook.

Additionally, the rating on the company’s subordinated perpetual debentures has been downgraded from “B” to “B-”.

This downgrade reflects weaker-than-expected operating performance in 2024, as well as rising refinancing risk and increasing liquidity pressures that the company is likely to face in the near future.

In 2024, the company’s overall performance was significantly impacted by a slowdown in real estate market demand and a higher loan rejection rate, especially among middle-income customers. As a result, total operating revenue was 9.1 billion baht, representing only about 75% of TRIS Rating’s full-year projection.

GRAND

From “B+” to “B” with a “Negative” CreditWatch.

This downgrade reflects weaker-than-expected operating performance, mainly due to persistently sluggish sales of the company’s residential property projects. High operating and financial costs continue to pressure profitability and cash flow. Although the sale of the Hyatt Regency Bangkok Sukhumvit Hotel proceeded as planned, the company had to make a significant unanticipated investment to acquire a 25% land interest related to the lease agreement for The Westin Grande Sukhumvit Hotel. As a result, the pace of debt reduction was slower than expected.

S

From “BBB+” to “BBB” with the credit rating outlook revised from “Negative” to “Stable”.

The downgrade reflects the company’s residential property business performance being weaker than expected, resulting in a slower-than-anticipated reduction in its debt ratio. The rating also takes into account the company’s hotel asset quality, which remains sound.

ROH

From “B+” to “B” with the “Negative” CreditWatch maintained.

The downgrade reflects the change in the credit status of Grande Asset Hotels and Property Public Company Limited (GRAND), which is the controlling shareholder and the main source of cash flow for the company to fulfill its obligations to repurchase its sole operating hotel asset, “Royal Orchid Sheraton Hotel & Towers,” from the Grande Royal Orchid Hospitality Real Estate Investment Trust with Buy-Back Condition (GROREIT) in 2026. The company’s ability to pay rent and repurchase the asset from the trust primarily depends on interest income and principal repayments from GRAND..

SHR

From “BBB+” to “BBB” with the credit rating outlook revised from “Negative” to “Stable”.

Additionally, the company’s senior unsecured debenture rating has been downgraded from “BBB” to “BBB-”.

The downgrade is a result of the rating downgrade of the parent company, Singha Estate Public Company Limited (rated “BBB/Stable”). The ratings reflect the company’s status as a core subsidiary of Singha Estate, as assessed by TRIS Rating under its “Group Rating Methodology.”

ITD

From “BB-” to “B+” with the credit rating outlook revised from “Developing” to “Negative”.

Additionally, the company’s senior unsecured debenture rating has been downgraded from “B+” to “B”.

The downgrade reflects the company’s weakened business position due to a significant net loss of 5.78 billion baht in 2024, as well as the risk of further losses stemming from the collapse of the State Audit Office building.

These factors have contributed to increased uncertainty regarding the company’s financial stability and outlook.

New Registered Bond in May 2025

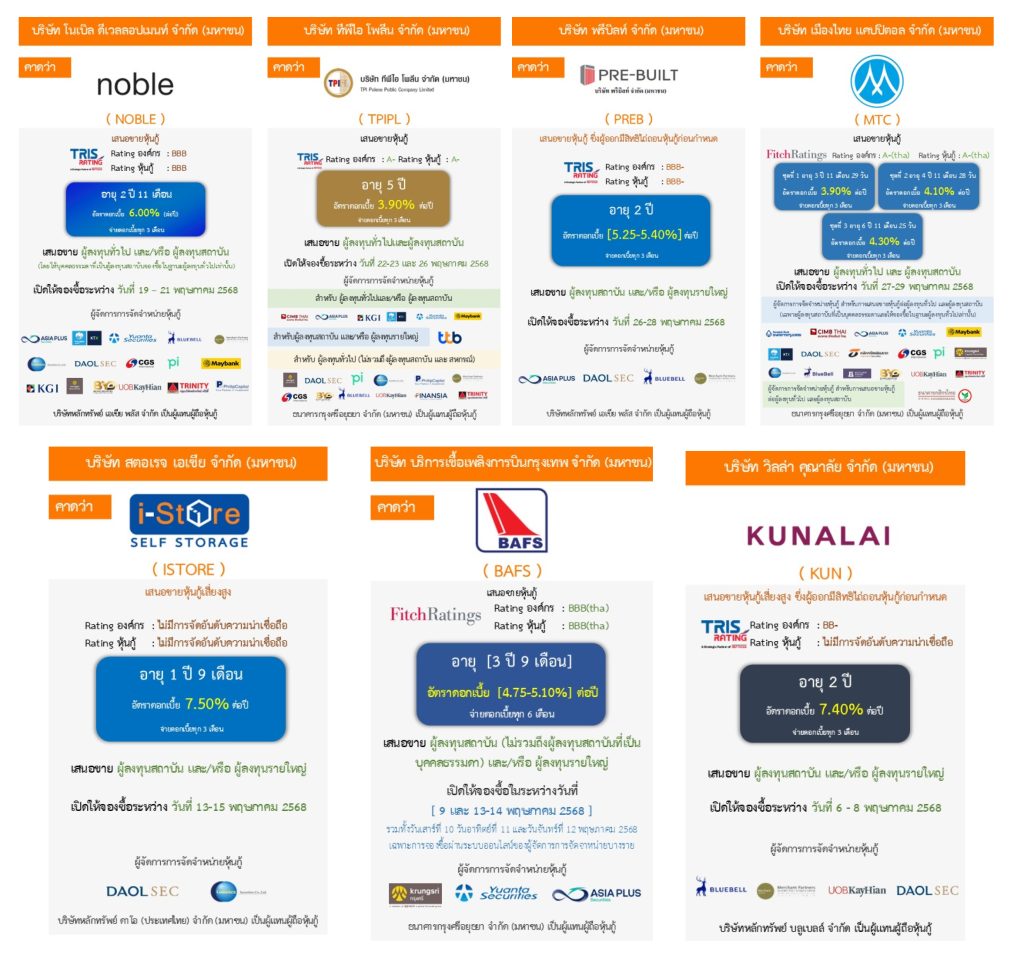

- Examples of corporate bonds set to be offered in May 2025 include NOBLE TPIPL PREB MTC ISTORE BAFS KUN. Additional information can be found on ThaiBMA.

Figure 5 : New Registered Bond in May 2025

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง