Equity

BLC, one of the country’s leading manufacturers and researchers of health products [FynnCorp IAS Equity Research]

อ่าน 15 นาที

Bangkok Lab and Cosmetic Public Company Limited [Ticker: BLC]

Industry: Consumer Products (CONSUMP)

Sector: Personal Products & Pharmaceuticals (PERSON)

52 Weeks Range (Baht): 4.30/ 6.30

% Free Float as of 14 Mar 2024: 37.11%

Overview:

- Manufacture and deliver generic drugs, herbal drugs, animal drugs, cosmetics, food supplements, and others

- Being Original Innovative Herbal Medicine

- Develop BLC Research Center for its product upgrade

Key Highlights:

- Over 30 years in pharmaceutical industry, advanced in Thai herbal medicine with a strong presence in modern pharmaceuticals. The products are distributed across hospitals, pharmacies, and clinics, covering more than 10,000 locations nationwide. Notably, BLC successfully introduced a hepatitis B treatment into the National Innovation Drug List and a capsaicin-based herbal extract into the National Essential Drug List, improving patient accessibility to these medicines.

- Strong performance growth from revenues from sales and services and net profit in 9M2024 increased by 12.2% and 20.5% YoY, driven by proactive marketing strategies, brand awareness initiatives, and a continuous pipeline of new product launches, all contributing positively to profit margins.

- Strong growth momentum in 2024-2025 from 1) Quarterly New Product Launches 2) Strategic Partnership with Nichi-iko which gains exclusive rights to distribute Nichi-iko’s modern pharmaceutical products through pharmacy channels in Thailand. 3) Higher Sales from Public Hospitals – driven by BLC’s inclusion in both the National Essential Drug List and National Innovation Drug List, enhancing sales opportunities in the public healthcare sector.

Company Overview

- Bangkok Lab and Cosmetic Public Company Limited (BLC) was founded in 1992, by three pharmacists: Mr. Suvit Ngampoopun, Mr. Subhachai Saibour, and Mr. Somchai Phisphahutharn. The company has operated the business in the current pharmaceutical and health product manufacturing business. The construction of its first factory began in 1993, with regulatory approval and the production of its first formulation following in 1994. BLC was officially listed on the stock exchange in June 2023.

- BLC established the BLC Research Center in 2012 to develop its own technologies and products. The center integrates Thai traditional wisdom with modern pharmaceutical manufacturing, particularly in the production of herbal medicines such as Capsika, Kachana, and Plaivana.

- Currently, the company manufactures and distributes pharmaceutical and health products, categorized into two main segments: 1) Pharmaceuticals includes modern generic drugs and new generic drugs, which contain the same active ingredients as original or patented drugs but are produced after patent expiration. Key therapeutic categories consist of bone & joint, dermatology, gastrointestinal, respiratory. Notable products include Gastro, DiabeDerm, Felgesic gel, and Arotika cool gel.

Source: The company’s website

- Herbal Medicines for non-chronic disease treatments: bone & joint medications such as Capsika, Plaivana, Kachana etc.

Source: The company’s website

- Animal Medicines focuses on veterinary pharmaceuticals for economic livestock, including swine, poultry, dairy cattle, and aquatic animals. These products, marketed under the company’s own brand, are designed to treat infectious diseases commonly found in livestock farms, ensuring animal health and farm productivity.

Source: The company’s website

- 2) Other Health-Related Products such as Cosmetics: Burnova gel, Aloe Vera gel, Vitara Anti Acne, Food Supplements: Calza C, Kacha, Bamion, DeeDay Other products include mosquito repellent spray under the brand JUNGO.

Source: The company’s website

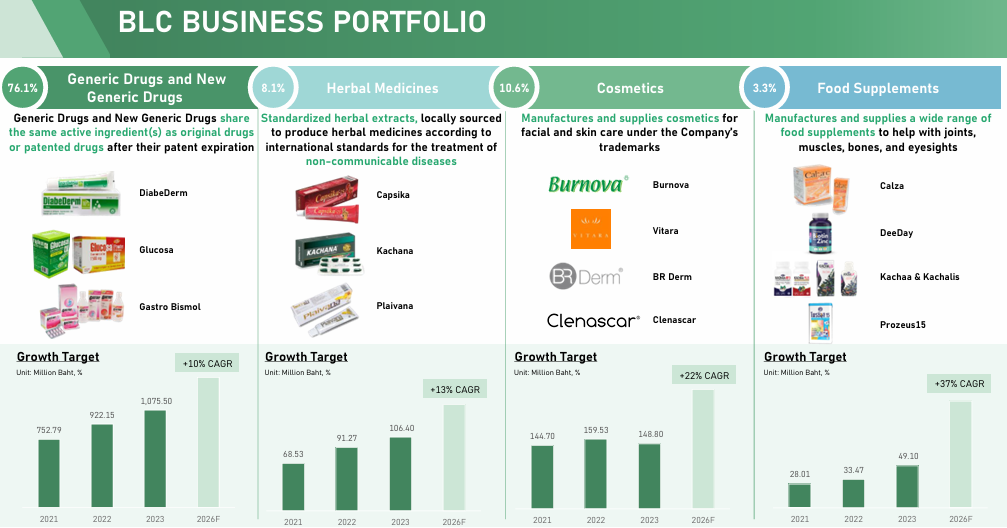

Revenue Structure

- The company’s primary revenue stream comes from modern pharmaceuticals, specifically generic and new generic drugs, which accounted for 76.5% of total sales revenue in 2023. Other key revenue segments include Cosmetic products: 10.6%, Herbal medicines: 7.6%, Dietary supplements: 3.5%, Veterinary drugs and other products: around 1% each. In 9M2024, the revenue composition remained largely unchanged, except for herbal medicines, which saw an increase, contributing 9.2% of total sales.

- The company primarily generates revenue from domestic sales, which accounted for over 94% of total sales revenue in 9M2024. The remaining portion comes from international markets, including Laos, Cambodia, Hong Kong, and other countries.

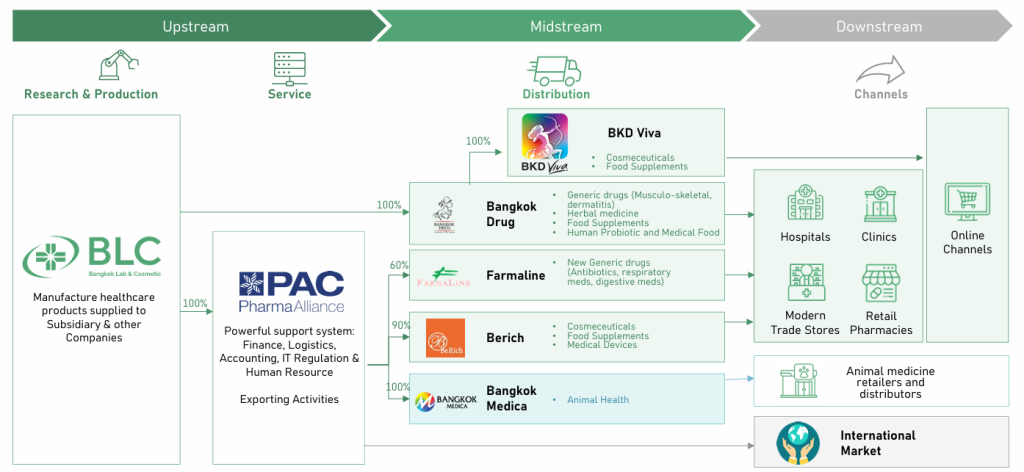

Company Structure and Distribution Channels

- The company’s primary distribution channels include hospitals, pharmacies, and clinics, covering over 10,000 locations nationwide. Additionally, it utilizes approximately five other sales channels, categorized as follows:

- Business-to-Business (B2B) Sales to

- 1. Pharmacy Stores including wholesalers, general retail pharmacies, and chain retail pharmacies such as drugstore chains (Health Up and Icare, for example), as well as pharmacies within convenience stores (7-Eleven).

- 2. Hospitals including government hospitals such as those in universities and medical schools, clinical medical education hospitals, hospitals and medical centers in universities that are not medical production facilities, central hospitals, regional hospitals, and private hospitals. These hospitals may include general medicine clinics, specialized medical clinics, and beauty clinics.

- 3. Modern trade including stores located within shopping malls such as Boots, Watsons, Tsuruha and Matsumoto Kiyoshi.

- 4. Exporting through international distributors (Selling Agent)

- 5. Original equipment manufacturer (OEM)

- Direct-to-Consumer (B2C) Sales via E-Commerce focusing on selling cosmetics and dietary supplements

- To streamline its distribution, BLC relies on subsidiaries with expertise in handling specific product groups. BLC acts primarily as a manufacturer, producing nearly all of its products and supplying them to subsidiaries for sales. BLC holds 99.99% of shares in Bangkok Drug Co. (BDC), which is responsible for distributing modern pharmaceuticals, including generic and new generic drugs. Additionally, BLC owns 99.99% of Pharma Alliance Co. (PAC), which provides back-office support for the sales subsidiaries: Pharmaline Co. (FLC), Berich (Thailand) Co. (BRC), Bangkok Medica Co. (BMC) which specialize in selling pharmaceutical products, cosmetics for skincare, veterinary medicines, respectively.

- In Q3 2024, BLC launched a new subsidiary, BKD VIVA, under BDC to focus on expanding online sales, particularly in the health and beauty sectors. This new initiative aims to boost sales through social commerce and further enhance its e-commerce presence.

Source: Analyst Presentation 3Q2024

In terms of sales distribution across different channels, the company generates the majority of its revenue from pharmacies, accounting for 53.7% of total sales in 9M2024. This is followed by hospitals at 37%, exports at 5.7%, modern trade at 2.0%, and online channels at 1.7%.

Business Strategy

- Aggressive marketing strategy, focusing on building brand loyalty with existing customers and increasing brand awareness with new customers. This is achieved through the use of online media to share health-related knowledge and create engaging content. Additionally, the company sponsors various events, such as: Plaivana at Lumpinee Boxing Stadium, Clena and DeeDay supplements at the Miss Grand Kalasin 2025 pageant, Arotika at sports events like TAAP Qualifier 2 and Spartan Race Thailand 2024

- Launch new products every quarter, including at least two new generic drugs per year. The company plans to introduce 2-3 new generic drug products in 2025 and other product categories, including cosmetics, dietary supplements, and herbal medicines. The new launch is to maintain revenue growth together with profitability and to increase portfolio management with herbal products, cosmeceuticals, and veterinary medicines.

- Establishing product credibility in public hospitals BLC aims to gain acceptance for its products in public hospitals, where large and continuous orders are common. To achieve this, BLC has specialized sales teams in its subsidiaries that focus on public hospitals nationwide, including both Bangkok and provincial areas.

- Partnership with Nichi-iko, a leading pharmaceutical company from Japan, to distribute Nichi-Iko’s current medications exclusively in Thailand via retail pharmacy channels. Sales started in April 2024, with a significant impact on sales anticipated in the second half of 2024. The examples of Nichi-Iko’s medicine in Thailand include NIKP-Glimepiride (3mg) for diabetes treatment, NIKP-Bisoprolol (2.5mg) for heart disease and blood pressure management, NIKP-Pitavastatin (2mg) for cholesterol management.

- A new manufacturing plant is being built to accommodate the continuous increase in production capacity, as the existing capacity is nearly fully utilized, especially the production rate of cream products in tube and jar forms, which was at 129% and 130%, respectively, in Q3 of 2024. The new plant will help increase production capacity for other types of medicines, including tube creams, which will increase from the current 7.5 million tubes to 45.6 million tubes per year, and jar creams from 300,000 jars to 2.4 million jars per year. Construction of the plant began in May 2024 and is expected to be completed in Q1 of 2026.

- A new manufacturing plant is being built to accommodate the continuous increase in production capacity, as the existing capacity is nearly fully utilized, especially the production rate of cream products in tube and jar forms, which was at 129% and 130%, respectively, in Q3 of 2024. The new plant will help increase production capacity for other types of medicines, including tube creams, which will increase from the current 7.5 million tubes to 45.6 million tubes per year, and jar creams from 300,000 jars to 2.4 million jars per year. Construction of the plant began in May 2024 and is expected to be completed in Q1 of 2026.

- Annual sales growth of 200 million Baht target during 2024-2026. Key factors supporting growth in 2024 include the expansion of sales channels, the launch of new products, and the inclusion of herbal medicines, such as CAPSIKA, in the National List of Essential Medicines. This will allow patients to access the medicine through government basic health coverage, leading to a significant increase in order volumes. Additionally, the drug Hepivir (for the treatment of hepatitis B) has been included in the National Innovative Medicine List, further increasing the opportunity to sell products to state hospitals.

Source: Analyst Presentation 3Q2024

Industry Analysis

The Pharmaceutical Industry

- In 2021 – 2023, the pharmaceutical market in Thailand has been growing steadily, reaching approximately USD 5.9 billion in 2023 (CAGR 0.9%) and is expected to grow to USD 6.4 billion by 2027. The key drivers of this growth include Thailand’s transition into an aging society, with over 28% of the population expected to be over 60 years old by 2024, the growing trend of health consciousness, and lifestyle changes that may increase the risk of chronic diseases (NCDs). Additionally, the increasing number of foreign patients coming to Thailand for healthcare also contributes to this growth.

- However, the pharmaceutical industry in Thailand still faces increasing competition, primarily due to the import of cheaper drugs from China and India, amidst the rise of foreign investors (foreign pharmaceutical companies) acting as agents for importing branded or patented drugs. Some foreign companies also use Thailand as a production base. Additionally, the cost of domestic pharmaceutical manufacturers has increased due to the rising price of imported raw materials. Furthermore, most operators in Thailand’s pharmaceutical industry focus on the later stages of production, specifically manufacturing finished drugs. They import active pharmaceutical ingredients (APIs) from abroad and then develop, mix, and produce them into finished drug products.

The Herbal Medicine Industry

- The market value of herbal products in Thailand reached 57 billion baht in 2023, representing a 9.3% increase from the previous year (according to data from the International World Trade of Herbal City 2024). Thailand benefits from over 1,800 types of herbal raw materials and ranks globally in medical tourism and healthcare. In 2022, there were 34,088 foreign patients seeking treatment, generating over 34 billion baht in revenue.

- With 14,023 health-related establishments and the Ministry of Public Health’s policy to elevate the health economy, enhance local wisdom, Thai traditional medicine, herbs, and health products to align with the government’s Medical Hub policy under the National Herbal Action Plan 2 (2023-2027), the consumption of Thai herbs is expected to continue growing. This trend coincides with the aging society.

- Although there is government promotion of herbal consumption, herb cultivators or those involved in the upstream process are still receiving limited compensation. Moreover, the use of advanced innovations for processing herbs, such as extracts, precursors, or herbal-based products like cosmetics, medicine, and supplements, is still largely confined to large-scale businesses with strong financial resources and technology. This has led to limited development of herbal plants in Thailand compared to competing countries such as China, India, and Vietnam, which are known for their herbal resources. This gap presents an opportunity for BLC to lead in herbal medicine innovation and differentiate itself from competitors in the market.

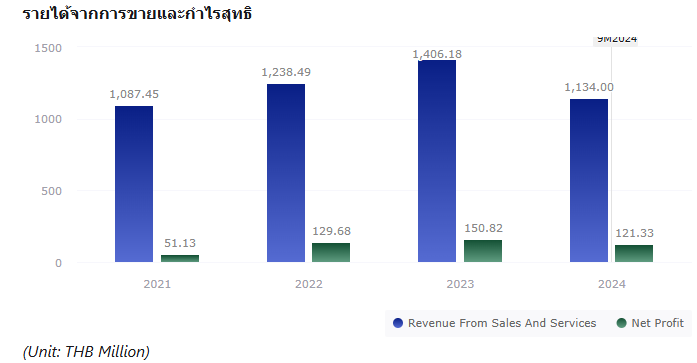

Financial Performance

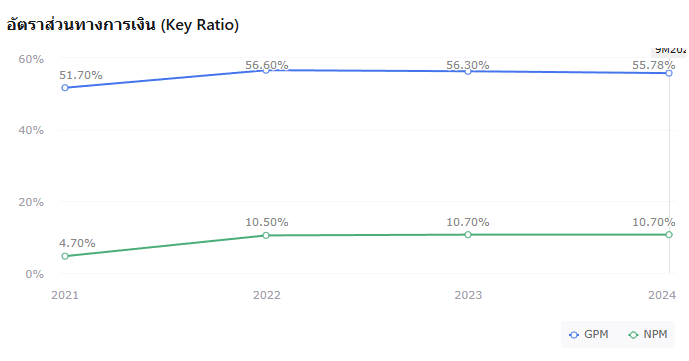

- In 2023, revenue from sales grew by 13.5% YoY to 1,406.2 million baht, an increase of 167.7 million baht from the previous year. This growth was driven by continued proactive marketing strategies, focusing on brand awareness through promotions, product booths, and communication across both offline and online channels. The pharmaceutical industry also showed continuous improvement as patients returned to regular hospital visits, leading to increased demand for medications both domestically and internationally. Additionally, the company launched new generic products in Q4, such as Finasteride, a hair care product for men.

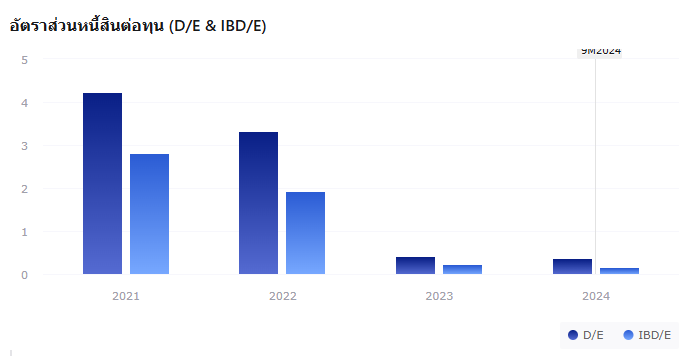

- In 2023, the company’s performance improved by 16.3% YoY, reflecting an increase in the net profit margin from 10.5% in 2022 to 10.7% in 2023. This was attributed to higher sales and service revenue, as well as better control of selling and administrative expenses and reduced financial costs. As a result, the company achieved a net profit increase of 21.1 million baht.

- For the first 9 months of 2024, revenue continued to grow by 12.2% YoY, reaching 1,134 million baht. The growth was mainly driven by increased partnerships with business allies, continuous new product launches every quarter, and the inclusion of medicines in the National Drug List and the National Innovation Drug List, which opened up more sales opportunities in public hospitals. The company also expanded its distribution channels through the establishment of a subsidiary, BKD VIVA, covering more platforms. Additionally, other income from interest on short-term investments contributed to a 20.5% YoY increase in net profit, with the net profit margin remaining at 10.7%.

- For 2024-2025, the company expects continuous revenue growth, supported by the following factors:

- Quarterly New Product Launches: The company plans to launch 2-3 new generic and generic drugs in 2025, and at least one new product per quarter in the dietary supplements and cosmetics segments. New products are expected to contribute about 5% to overall revenue.

- Partnership with Nichi-Iko: Through its partnership with the Japanese pharmaceutical company Nichi-Iko, the company has exclusive rights to distribute Nichi-Iko’s drugs in Thai pharmacies. Currently, the company sells Nichi-Iko products in over 200 pharmacies, with plans to expand to 400 pharmacies by 2025.

- Inclusion in National Drug List: The inclusion of products in the National Drug List is expected to significantly boost sales, especially from public hospitals, leading to larger and more consistent orders.

Risk Factors

- High Competition Risk: The company’s pharmaceutical products mainly consist of generic and new generic drugs, which use the same active ingredients as original patented drugs. When the patent of an original drug expires, the first generic drug manufacturers to enter the market typically enjoy high profit margins since they can offer lower prices compared to imported drugs with similar efficacy. However, as more mid-sized and small manufacturers enter the market, price competition intensifies, leading to reduced profit margins. Additionally, the import of low-cost drugs from China and India further increases competitive pressure on the company’s profitability.

Mitigation Strategy:

The company aims to launch at least two new drugs per year, focusing on treatments for diseases with high prevalence in Thailand. Furthermore, BLC operates a research center and has the capability to produce active ingredients extracted from Thai herbal medicine, which helps differentiate its products and enhance profit margins.

- Product Price Adjustment Limitation: Revenue from government hospitals, the company’s second-largest sales channel after pharmacies, is subject to price reference regulations, preventing the company from pricing its products above the set standard. As more mid-sized and small manufacturers introduce similar generic drugs, pricing pressure may further increase. Additionally, other product segments, such as cosmetics, herbal medicines, and dietary supplements, may not allow for immediate price adjustments, which could impact overall profit margins.

Mitigation Strategy:

The company carefully evaluates its product distribution strategies and aims to launch new dietary supplement and cosmetic products every quarter to maintain overall profitability.

- Foreign Exchange Risk: The production of generic drugs requires importing key active pharmaceutical ingredients (APIs) from abroad after the expiration of original drug patents. In 2022 and 2023, imported raw materials and packaging accounted for 9% and 12% of total purchases, respectively. The majority of these imports were denominated in U.S. dollars and sourced from China, India, and Europe. While the company has not experienced significant impacts from foreign exchange fluctuations in the past, the volatility of the U.S. dollar over the past 1-2 years may affect financial performance in the future.

Mitigation Strategy:

The company has established clear risk management measures by utilizing forward contracts for foreign currency transactions or negotiating to purchase goods in Thai Baht.

ข้อจำกัดความรับผิด (Disclaimers):

กดด้านล่างเพื่อดูรายละเอียด ข้อจำกัดความรับผิด:

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง