Equity

อ่าน 13 นาที

S. KHONKAEN FOODS PUBLIC COMPANY LIMITED (SORKON)

- Business Sector: FOOD

- 52 Weeks Range (Baht): 4.08/ 4.80

- % Free Float: 40.43% (as of 12 Jan 2024)

Overview:

- Operates processed food from pork, seafood business, pig farming, and Quick Service Restaurant (QSR)

- Owned well-known brand such as S.Khon kaen and Entrée

- Expand its customer base with production plants in United States and China

Key Highlights:

- One of the leading Thai food companies for over 40 years, SORKON manufactures and distributes processed meat products under the following brands: 1) S. Khon Kaen 2) Moo Dee 3) Ban Phai 4) Moo Champ 5) Huai Kaew 6) Kan Eng 7) Entrée – a health-focused, high-protein snack brand and its processed seafood under the brand: Tae Chiew, Mahachai, Taipei, and others.

- Financial performance with sustained profitability with revenue from sales in 2Q2024 growing by 10.1% YoY driven by online trend during Songkran, leading to product shortages. S. Khon Kaen has long been recognized for its strong brand and product quality, holding over 80% market share in the fresh food segment within Modern Trade—its core product category. This success comes despite intense competition from major players and SMEs with lower production costs.

- Growing alongside a business expansion plan in the Ready-to-Eat (RTE) catered to consumer lifestyle from over 20,000 distribution points nationwide. The company has maintained its modern trade channels along with expanded to general trade by partnering with a new distributor who specializes in this channel. Additionally, S. Khon Kaen is expanding internationally by establishing a production base in China, a high-potential market, and in the U.S. to cater to the Thais while addressing import restrictions on pork in certain destination countries.

- The performance is expected to grow in 2025, supported by the expansion plan for distribution channels in General Trade, as well as the increased introduction of new products in Modern Trade in 2024. Additionally, revenue recognition from production bases in the U.S. and China is anticipated to begin in 2025, with a goal to balance the contribution from each sales channel more evenly in the future.

Company Profile:

- S. KHONKAEN FOODS PUBLIC COMPANY LIMITED was founded in 1984 by Dr. Charoen Rujirasopon and listed on the Stock Exchange of Thailand in 1994. It operates in four main business segments: 1) Processed meat products, 2) Processed seafood, 3) Quick Service Restaurant (QSR) business, 4) Pig farming, and other related activities.

- The domestic market consists of 90% of its sales revenue and 5% from exports to Hong Kong, Cambodia, and Laos, with Hong Kong being the primary export destination. Regarding channels, the sales of processed food products in both segments are from Modern Trade 65%, General Trade 28%, Export 5% and the remaining from other sources.

SORKON’s Products by Business Unit

Source: ONE REPORT 2566

From the beginning to the elevation of local food standards

- The beginning of the business came from the vision of Dr. Charoen Rujirasopon, who saw many people in Bangkok enjoyed consuming products like shredded pork, dried pork, and Chinese sausage, which led to the idea of bringing these products from Khon Kaen to sell in Bangkok. This is how the brand “S. Khon Kaen” came to be, representing products from Khon Kaen province.

- Later, to improve delivery efficiency and control product quality, a factory was established to produce and sell these products in-house. The company then expanded its customer base internationally by exporting processed pork products to Hong Kong as the first overseas market. In 1995, the company decided to fully diversify into the agricultural sector by establishing a pig farm. The business further expanded into processed seafood, ready-to-eat frozen foods, and Quick Service Restaurant (QSR) businesses, following a strategy to integrate the supply chain from upstream to downstream.

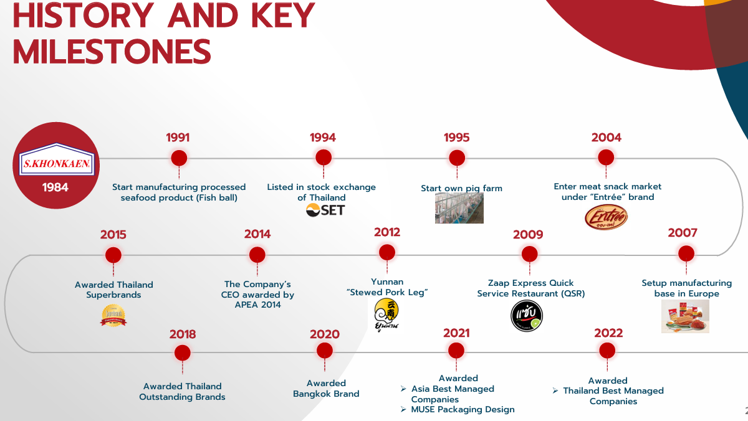

History and Key Milestones

Source: Opportunity Day Year-end-2023

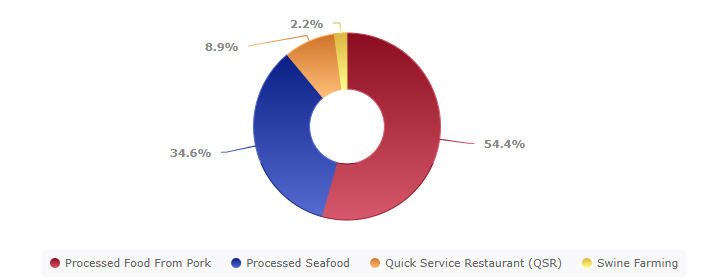

Main business from Processed food

- In 2023, the revenue structure was mainly contributed by processed meat and seafood with 54.4% and 34.5% of revenue from sales, followed by pig farming and QSR with 8.9% and 2.2%, respectively.

Revenue Breakdown (2023) by Business Unit

Source: Opportunity Day Year-end-2023

Distribution Channels

- The company has 4 distribution channels as follows: 1) Modern trade: convenience stores (7-11), Lotus, Makro, modern wholesalers especially hotels, restaurants, and catering businesses. 2) General trade: fresh markets, restaurants, noodle shops which currently expanded to 1,600 stores, mainly in Bangkok, and Fresh shop 3) Distributor 4) Export mainly to Hong Kong – where products like Tae Chiew meatballs and the “Entree” brands are popular.

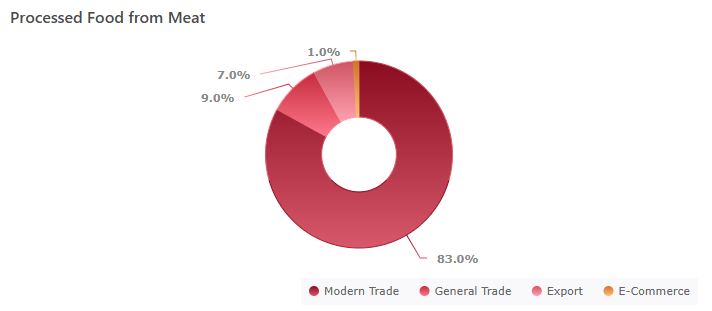

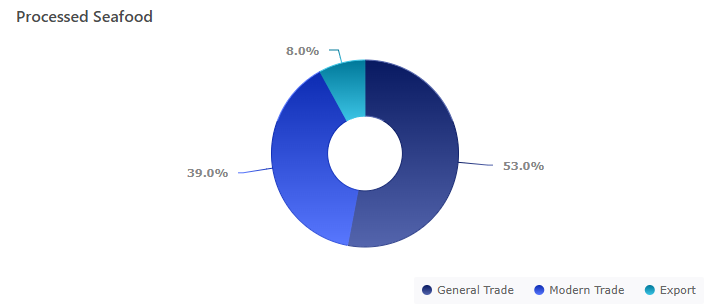

- In 2023, the processed meat business generated the majority of its revenue from the Modern Trade channel, accounting for 83% of total sales in the segment. General Trade contributed 9%, while exports and E-commerce accounted for 7% and 1%, respectively. On the other hand, the processed seafood business primarily generated revenue from General Trade, making up 53% of total sales in the segment, followed by Modern Trade at 39% and exports at 8%.

Revenue Breakdown by Distribution Type (2023)

Source: Opportunity Day Year-end-2023

Production bases domestically and internationally to support growth

- Currently, the company has five production facilities in Thailand, including a pig farm, as well as a production base in the Netherlands that manufactures local food products such as fermented pork, Thai-style sausages, Isaan sausages, and pork meatballs, which are sold to Thai and Asian consumers living in the European Union and the UK. Additionally, the company is establishing a production base in the U.S. due to restrictions on pork imports, and it is in the process of building a plant in China through a joint venture with the local government in that province.

Integrated Supply Chain through pig farming and restaurant businesses

- The company’s Quick Service Restaurant (QSR) business operates under the brands “Zab Classic” and “Yunnan Pork Knuckle,” with over 10 locations currently. Its pig farming business has an annual production capacity of around 60,000 pigs, of which approximately 30,000 are fattened pigs and plans to increase the number of fattened pigs for sale, with a target of over 40,000 pigs.

Industry Analysis:

Processed-meat Industry

- Food Intelligence Center (FIC) reported the current market value of the meat product industry in Thailand is approximately 172 billion baht, with pork and chicken making up roughly equal shares. The Thai meat market has been affected by rising production costs, particularly the prices of animal feed ingredients, which must be imported from abroad, as well as frequent outbreaks of diseases such as African Swine Fever (ASF) in pigs, leading to a decrease in the pig population. Additionally, in recent years, there has been a massive influx of illegally imported, cheaper pork from Western countries, which has been sold in Thailand, amidst the continuous rise in fertilizer and animal feed prices. This situation has forced pig farmers to sell at a loss, causing pork prices to drop significantly. As a result, the number of pig farmers has decreased from over 240,000 to around 40,000.

- However, in 2024, the domestic pork price situation began to improve, reaching over 70 baht per kilogram in the third quarter, showing a 3% month-on-month (MoM) increase and a 2% year-on-year (YoY) rise. This is driven by higher domestic consumption and an increase in foreign tourists visiting the country. According to the Office of Agricultural Economics (OAE), the average price of pigs (hybrid breed) in the third quarter of 2024 was 70.18 baht per kilogram, reflecting a gradual and consistent rise in pork prices since the beginning of the year.

Source: CPF, Office of Agricultural Economics

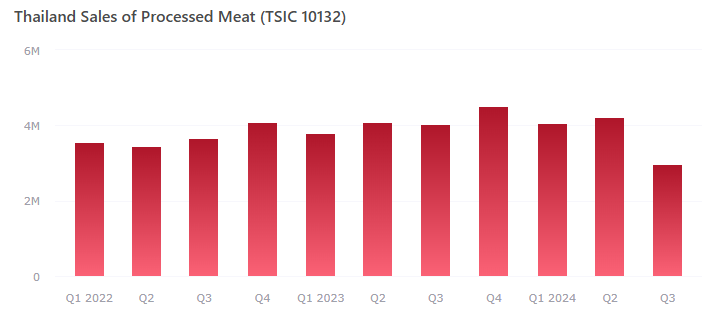

- In the processed meat industry, data from the Office of Industrial Economics (OIE) reported a 6.63% year-on-year (YoY) decline in domestic sales and exports of processed food products (including products made from meat and poultry such as local sausages, Chinese sausages, fermented pork, Thai-style sausages, and similar items) in the first eight months of 2024, with a total value of 11,183.7 million baht. Domestic sales accounted for over 124,000 tons (98%), while exports amounted to about 2,000 tons (2%). This reflects that the main purchasing power comes from domestic consumers, whose demand is expected to increase, while exports have significantly decreased. The decline in exports may be due to consumers abroad having access to cheaper products from other countries.

(Unit: THB Thousand) Note: Data in 3Q24 available only in July and August

Source: The Office of Industrial Economics (OIE)

Processed Seafood Industry

- In 2023, the processed seafood industry faced pressure from rising raw material costs, including feed and fuel for fishing vessels, as well as high energy costs in the processing stages. Krungsri Research predicts that the Thai processed seafood industry from 2023 to 2025 will continue to experience pressure from rising costs, amid fierce competition in the global market, particularly from countries with lower production costs like China, Vietnam, and India. This may lead to Thailand’s main trading partners shifting to import cheaper products from these competing countries.

- Although exports of processed seafood have been affected by these factors, domestic consumer demand, along with the reopening of the country and the recovery of the tourism and restaurant sectors, is expected to benefit companies focusing on the domestic market. Therefore, we believe that S. Khon Kaen, with over 90% of its processed seafood revenue coming from the domestic market, will continue to experience growth in the future.

Financial Performance

- Total revenue in 2023 decreased by 2.6% YoY to 3,132.3 million baht, primarily due to a 31.8% YoY drop in revenue from the pig farming business. This was caused by the sharp decline in pig prices, largely driven by the illegal importation of low-cost pigs. Additionally, revenue from the restaurant and processed seafood businesses declined by 7.4% and 3.9% YoY, respectively.

- Meanwhile, the processed pork segment, which is the company’s core business, contributing more than 50% of annual revenue, grew by 4.8% YoY. This growth was mainly driven by the convenience store channel and the successful rollout of new products as planned. Rental and service income reached 12.8 million baht, marking a 19.8% YoY increase.

- Total revenue in 6M2024 expanded by 3.1% YoY to 1,623.8 million baht. Sales revenue accounted for 1,595.6 million baht, up 3% YoY, with the primary contributor being the processed pork segment, which made up 55.8% of total sales. The processed seafood segment followed, contributing 32.6% of sales. Both key business segments saw growth of 4.5% and 4.4% YoY, respectively.

- This growth was driven by consumer trends where the company’s products were incorporated into new menu creations, gaining traction on social media and positively impacting sales. Additionally, the expansion of distribution channels for ready-to-eat processed seafood through modern trade and increased export channels further supported revenue growth. On the other hand, revenue from the pig farming business declined by 10.9% YoY due to lower pork prices compared to the same period last year. Rental and service income reached 8.8 million baht, marking a 43.8% YoY increase.

- Although 2023 performance was impacted by external factors, it showed a significant recovery in 6M2024. The decline in net profit in 2023 was mainly due to lower pork prices, resulting in a loss from the fair value adjustment of biological assets (pigs) and a decrease in revenue from the pig farming business. Additionally, selling and administrative expenses increased due to workforce preparation for international business expansion.

- As a result, the net profit margin (NPM) dropped from 3.03% in 2022 to 1.61% in 2023. However, in the first half of 2024, the company reported a net profit of 59.6 million baht, nearly 1.46 times higher than the same period last year. This improvement was driven by higher sales, lower pork prices—one of the main raw materials—and better cost management. Consequently, the gross profit margin (GPM) in Q2 2024 increased to 26.2% from 22.48% in Q2 2023, significantly boosting net profit.

- The company’s performance is expected to grow in 2025, driven by key supporting factors, including the expansion of sales channels for both main processed food segments, the restaurant branch expansion plan, and the growth of the farming business, as follows:

- The processed pork products segment plans to expand its distribution channels through General Trade, particularly in restaurants and boat noodle shops, which have already expanded to over 1,600 locations, as well as targeting Industry (OEM) customers. Additionally, the company is introducing more Ready-to-Eat products in Modern Trade channels to align with consumer lifestyles in this segment. The strategy also includes Co-Branding initiatives, such as S.Khonkaen x Guss Damn Good ice cream and snack products Entrée x Garfield and Venom, popular characters from Sony Pictures, to broaden its reach and attract more young consumers.

- The processed seafood segment has been expanding its distribution channels, particularly for Ready-to-Eat products through Modern Trade, while also increasing export channels to further drive growth.

- QSR Business (Zaap Classic) Due to strong sales, the company plans to expand Zaap Classic with 2 new branches in 2024 and an additional 3-5 branches in 2025.

- Swine Farming Business with shifting focus to fattening pigs instead of piglets to increase total weight sold during rising pork prices which are expected to positively impact farm revenue.

- New production bases: USA: Soft-launched in October 2024, with revenue recognition expected in 2025.China: Factory under construction, expected to contribute revenue starting in 2025.

Risk Factors

- Risk of pork price volatility: S. Khonkaen’s business is highly dependent on external factors beyond its control, particularly pork prices, which directly impact the cost of raw materials for its processed food business and revenue from its swine farming business.

- Cost risk remains high Risk of pork price volatility: the company maintains a high cost-to-revenue ratio, averaging around 90% annually, primarily driven by cost of sales.

- To mitigate cost pressures, the company has implemented measures to prevent excessive costs, including operating its own pig farms and closely monitoring pork prices to secure raw materials at optimal costs.

- Risk in Expanding Distribution Channels: the company’s plan to expand its processed pork products into General Trade, particularly through boat noodle shops, faces competition from SMEs that offer lower prices and higher volume. As a result, the expansion in this segment remains concentrated in Bangkok, with limited nationwide coverage. Additionally, increasing distribution through General Trade presents pricing challenges, as products may be considered expensive for this channel.

- To mitigate these risks, the company plans to expand its processed meat products in General Trade while focusing on growing its processed seafood category in Modern Trade.

- Risk in international expansion —comes with increased costs, including preparation expenses and the need for skilled personnel. Additionally, performance in these markets will depend on the capabilities of local distributors.

- However, despite these challenges, the company sees significant growth potential in these markets, making the expansion a worthwhile investment.

ข้อจำกัดความรับผิด (Disclaimers):

กดด้านล่างเพื่อดูรายละเอียด ข้อจำกัดความรับผิด:

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง