Bond

Macro Domestic

Macro View in February 2025 (Bond Research).

อ่าน 1 นาที

Key Highlights:

- Corporate bond issuance in February 2025: Increased by 8.42% month-on-month Decreased by 21.4% year-on-year Total value: 71 billion baht

- Summary of bond offerings in February 2025: 9 out of 34 companies failed to fully sell their bond offerings

- Credit rating changes in February 2025: One downgrade “PRIME“

- Bond offerings in March 2025.

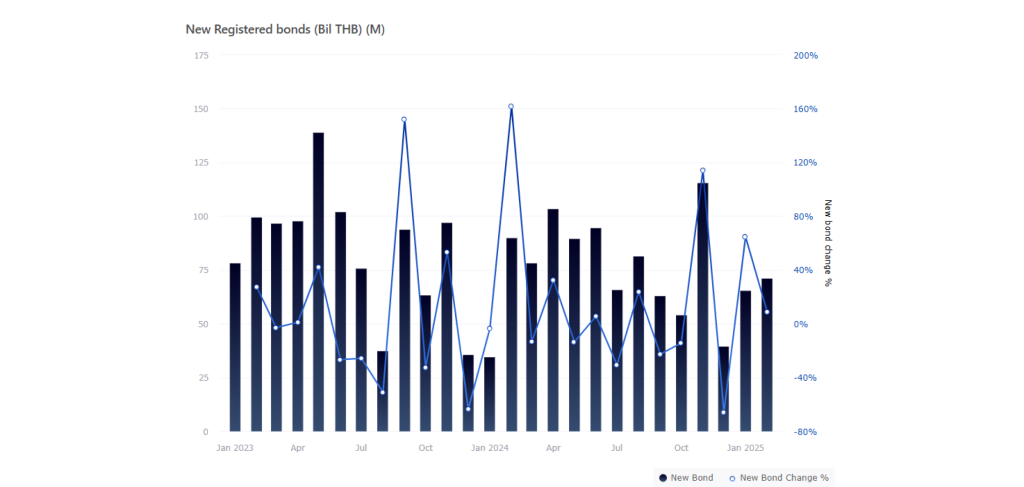

Figure 1 : New registered bonds (THB Billion)

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

- In February 2025, Thailand’s corporate bond issuance saw a month-on-month increase of 8.42% but a year-on-year decline of 21.4%, totaling 71 billion baht. The breakdown comprised 92.5% Investment Grade bonds (65 billion baht) and 7.5% Non-Investment Grade bonds (5.3 billion baht), maintaining the dominance of Investment Grade in new issuances.

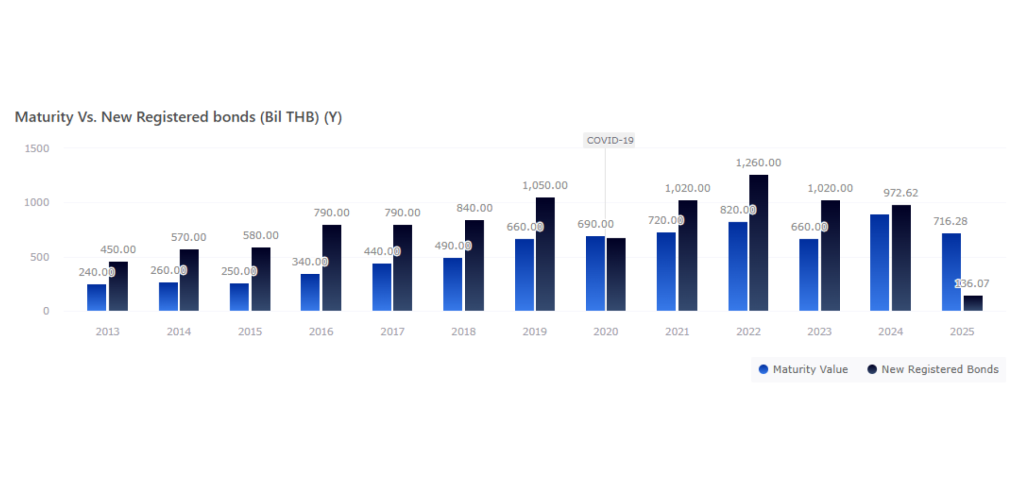

Figure 2 : Maturity Vs. New Registered Bonds (THB Billion)

Figure 3 : Outstanding Value of Long-term Bond with Maturity by sector

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

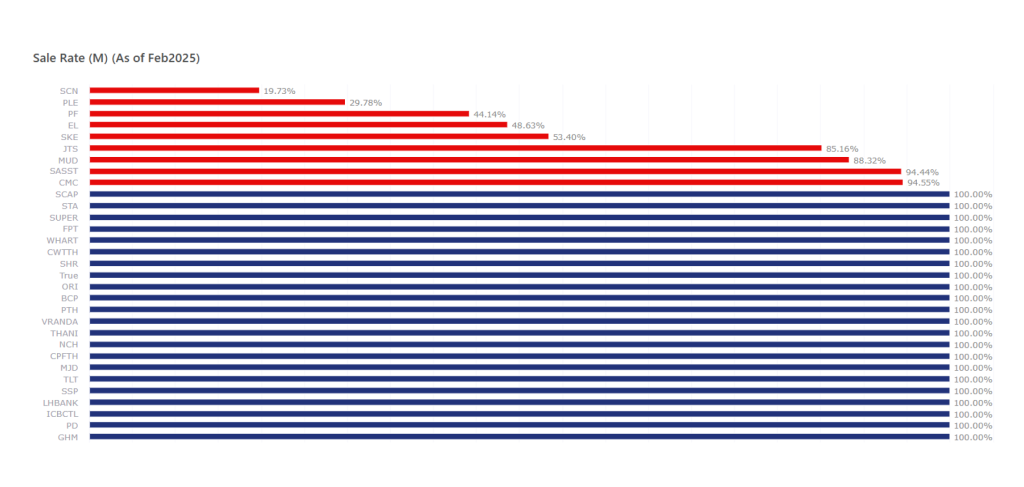

Bonds Offered in February 2025

- In February 2025, Thailand’s corporate bond market saw 16 Investment Grade companies issuing bonds (Issue Rating), including SCAP, STA, SUPER, FPT, WHART, SHR, TRUE, ORI, BCP, AP, THANI, CPFTH, TLT, SSP, LHBANK, and ICBCTL, with a total value of approximately 65 billion baht.

- 18 Non-Investment Grade companies (Issue Rating) participated, such as CWTTH, DCON, CNC, PTH, VRANDA, NCH, PF, SKE, MUD, SASST, JTS, EL, MJD, PLE, PD, SCN, and GHM, contributing around 5.3 billion baht.

- Despite higher issuance volumes, 9 out of 34 total issuing companies failed to meet fundraising targets. Notably, DCON and KUN utilized Right Offerings, granting purchase rights exclusively to their common shareholders.

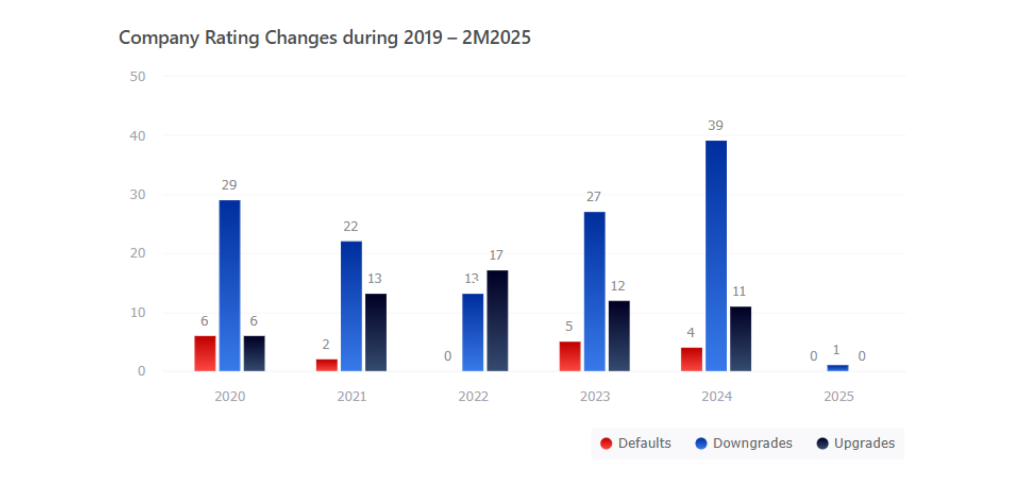

Figure 4 : Company rating changes during 2019-2M2025

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

Credit change (Issuer Rating)

- In February 2025, PRIME experienced a credit rating downgrade from BB+ to BB due to weak liquidity conditions, reflecting broader challenges in corporate credit quality. For the full year 2025, this marked one corporate credit rating downgrade with no upgrades, underscoring persistent risks in Thailand’s debt market.

New Registered Bond in March 2025

- Examples of corporate bonds set to be offered in March 2025 include TPOLY, BWG, ATV, DTP, SCC, PROUD, JMT, STELLA, TPIPL, IRPC, SAWAD, TFG, GULF, PRIN, SENA, and TURBO. Additional information can be found on ThaiBMA.

Figure 5 : New Registered Bond in March 2025

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง