Bond

Macro Domestic

Macro View in March 2025 (Bond Research).

อ่าน 1 นาที

Key Highlights:

- Corporate bond issuance in March2025: Decreased by 4.54% month-on-month Increased by 7.73% year-on-year Total value: 67 billion baht

- Summary of bond offerings in March 2025: 8 out of 20 companies failed to fully sell their bond offerings

- Credit rating changes in March 2025: One downgrade PREB UNIQ ECF TPOLY TPCH

- Bond offerings in April 2025.

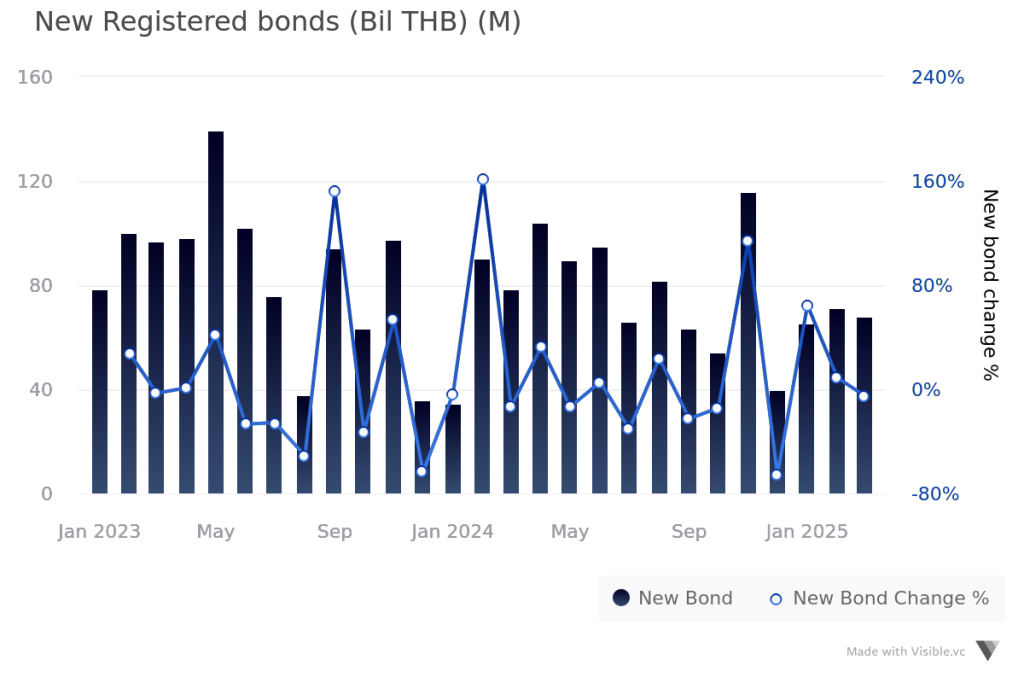

Figure 1 : New registered bonds (THB Billion)

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

- In March 2025, the total value of corporate bond issuances in Thailand slightly decreased by 4.54% month-on-month (MoM) but increased by 7.37% year-on-year (YoY), reaching 67 billion baht. The breakdown of these issuances is as follows:

- Investment Grade Bonds: Representing 83.7% of the total, with a value of 56 billion baht.

- Non-Investment Grade Bonds: Accounting for 16.2% of the total, with a value of 11 billion baht.

- The majority of new bond issuances remained within the Investment Grade category. However, the issuance of Non-Investment Grade bonds saw a significant increase, rising by 105.2% MoM

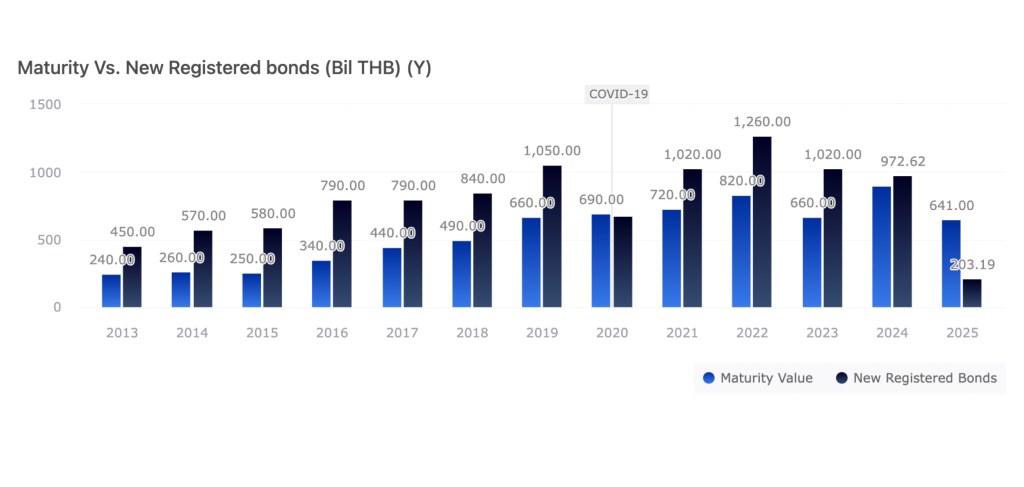

Figure 2 : Maturity Vs. New Registered Bonds (THB Billion)

Figure 3 : Outstanding Value of Long-term Bond with Maturity by sector

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

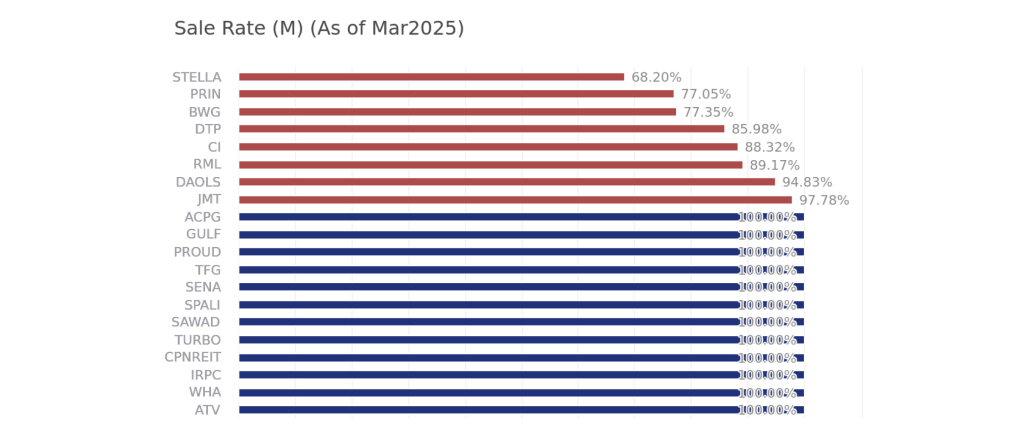

Bonds Offered in March 2025

- In March 2025, Thailand’s corporate bond market saw 10 Investment Grade companies issuing bonds (Issue Rating), including GULF TFG PRIN DAOLS JMT SENA SAWAD CPNREIT IRPC WHA, with a total value of approximately 56 billion baht.

- 10 Non-investment-grade companies (Issue Rating) participated, such as PROUD RML STELLA SPALI CI TURBO BWG ACPG DTP ATV, contributing around 11 billion baht.

- Despite higher issuance volumes, 8 out of 20 total issuing companies failed to meet fundraising targets (Reconcile their outstanding with filling).

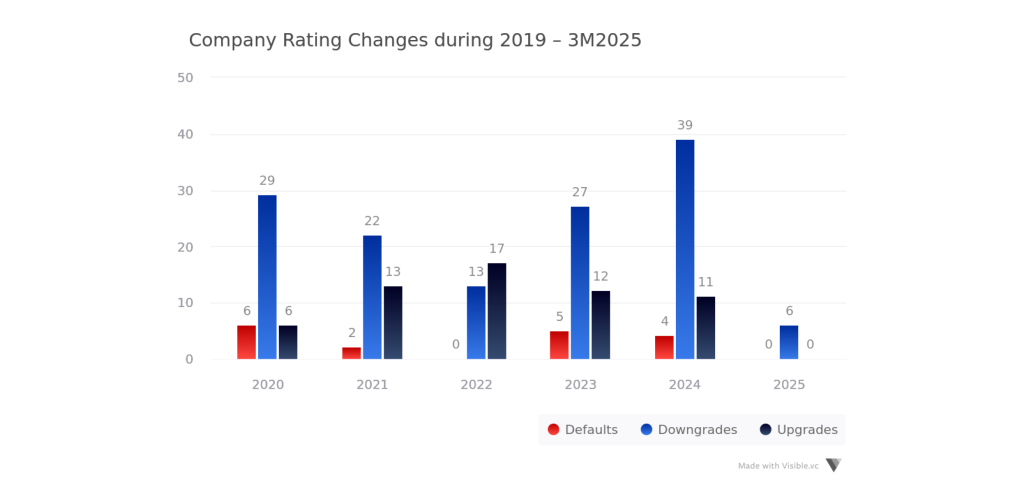

Figure 4 : Company rating changes during 2019-3M2025

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

Credit change (Issuer Rating)

PREB

Tris Rating has downgraded the corporate credit rating of Pre-Built Public Company Limited from “BBB” to “BBB-” with a “Stable” outlook.

Additionally, the credit rating for the company’s newly issued senior unsecured debentures, with a value not exceeding 500 million baht and a maturity of three years, has been assigned at “BBB-” as well. The company plans to use the proceeds from the bond issuance to partially repay existing loans and/or for working capital purposes.

The downgrade reflects the company’s declining profitability and debt levels exceeding specified thresholds. The weaker performance is primarily attributed to construction costs exceeding budget in several projects.

UNIQ

Tris Rating has downgraded the corporate credit rating of Unique Engineering and Construction Public Company Limited from “BBB” to “BBB-” with a “Stable” outlook.

The credit rating for the company’s newly issued senior unsecured debentures, with a value not exceeding 1.5 billion baht and a maturity of three years, has been set at “BB+.” This bond rating is one notch below the corporate credit rating, reflecting its subordinated claims on the company’s assets compared to secured debt, as most of the company’s debt is secured.

The downgrade reflects higher-than-expected financial debt levels, primarily driven by the continuous increase in trade receivables and unbilled trade receivables. The company’s financial debt-to-EBITDA ratio is expected to remain above 8 times over the next 2–3 years.

Furthermore, most of the company’s backlog consists of government projects, which may pose challenges in managing trade receivables effectively.

ECF

Tris Rating has downgraded the corporate credit rating of East Coast Furnitech Public Company Limited from “B” to “B-” with a “Negative” outlook.

The downgrade reflects weaker-than-expected performance in the furniture business and increasing difficulty in restoring profitability. Additionally, there is heightened debt repayment risk due to bonds nearing maturity, especially if the company fails to sufficiently convert its investment in the Minbu project into cash and reinvest the proceeds into the furniture business to revive its operations.

TPCH

Tris Rating has downgraded the corporate credit rating of Thai Polycons Power Public Company Limited from “BB+” to “BB” and assigned a “Negative” CreditWatch outlook.

This adjustment aligns with the credit rating of its parent company, Thai Polycons Public Company Limited (TPOLY), which is rated at “BB/Alert Negative.” The downgrade stems from tight liquidity for short-term debt repayments. The “Negative” CreditWatch was issued following TPOLY’s bondholder meeting to consider extending bond maturities.

Tris Rating may further downgrade the credit rating if TPOLY faces increased difficulty obtaining sufficient liquidity or refinancing its debt. A multi-notch downgrade may occur if there is an expectation of default on debt obligations.

Conversely, Tris Rating may remove the CreditWatch if TPOLY demonstrates clear and effective measures to address its weak liquidity position.

New Registered Bond in April 2025

- Examples of corporate bonds set to be offered in April2025 include JMART MICRO MUD ASW GRAND DAOLS BAM KCCH PUEAN TAA AGE NPS INET ORI BANPU. Additional information can be found on ThaiBMA.

Figure 5 : New Registered Bond in April 2025

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง