หุ้นกู้

ASW Bond: Strong Cash Flow with ability to repay bonds as scheduled [FynnCorp IAS Bond Research]

อ่าน 12 นาที

AssetWise Public Company Limited [Ticker: ASW]

Sector: Property Development

Issuer Rating: BBB- “Positive” (31 Jul 2024)

Rating Agency: Tris Rating

This analysis was conducted by FynnCorp IAS, a securities advisory firm, with support from the issuer. However, the issuer did not participate in providing opinions or analysis in this report.

ASW Q3/2024: Continued Growth from Backlog and Property Transfers, Confident in Cash Flow to Meet All Bond Repayments as Scheduled

Key Highlights:

- Strong Revenue Growth: In the first 9 months of 2024, ASW reported total revenue of 7,633 million Baht, a 63% YoY increase, driven by significant project transfers such as KAVE Town Island and The TITLE Halo, along with accumulated presale of 14,578 million Baht.

- Stable Financial Position: ASW holds more than 1,900 million Baht in cash with a Debt-to-Equity (IBD/E) ratio of 1.52 times. The company has the potential to secure additional funding to support future growth.

- Ability to generate cash flow: It is expected that ASW will generate more than 2,500 million Baht in operating cash flow in 2024, backed by a backlog exceeding 23,700 million Baht and transfers from new projects like KAVE Series and The TITLE Artrio Bang-Tao.

- Opportunities and Risks in Bond Investment: The issuance of new bonds by ASW is aimed at funding new projects and rolling over existing bonds, reflecting a clear long-term growth strategy. The company has sufficient cash flow from real estate sales awaiting transfer to repay the bonds.

ASW New Project

(Source: ASW Opportunity Day, 3Q24)

Asset Wise Public Company Limited (ASW) launched 3 new projects in Q3/2024 with a total value of 4,500 million Baht, which include:

- The Arbor Ramintra-Watcharapol: A premium single-house project designed for families in the suburban area, with a total project value of 1,500 million Baht and 127 units.

- Chann The Riverside: A riverside condominium emphasizing living close to nature, featuring luxurious common areas, with a project value of 1,800 million Baht and 112 units.

- The Title Cielo Rawai: A condominium in a prime tourist location in Phuket, blending local uniqueness and luxury, with a project value of 1,200 million Baht and 171 units.

Among these projects, The Title Cielo Rawai has been particularly successful, receiving excellent market feedback, with sales reaching 90% of the total project value.

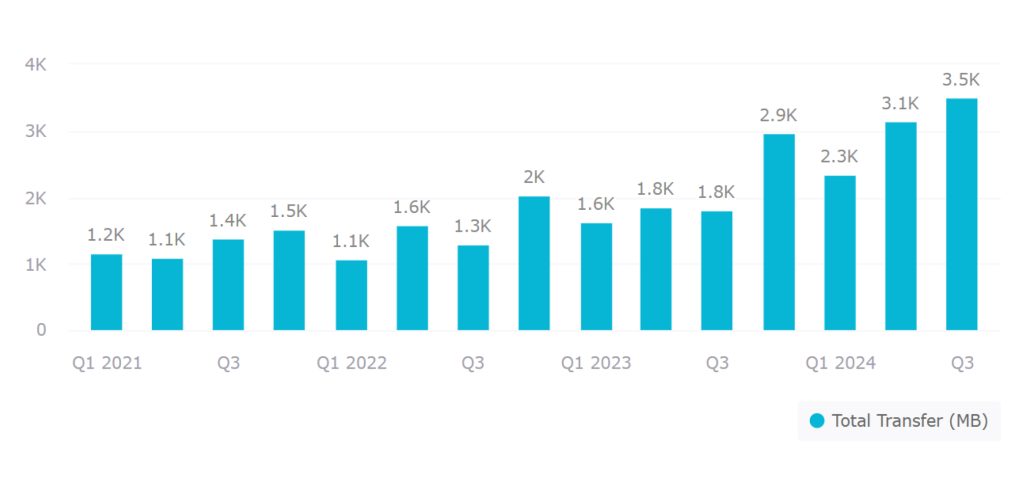

ASW set a new record with a transfer value of 3,489 million Baht in Q3/2024, marking the highest transfer value in the company’s history, driven by projects that received significant interest, with many units already reserved beforehand. Key projects that contributed to this strong transfer performance include:

- KAVE Island: 49% of total transfer

- The TITLE Halo: 13%

- KAVE Seed Kaset: 6%

- Others: 32%

ASW Total Transfer

(Source: Company’s financial statement, One Report)

The presale figures reflect strong growth. ASW’s presales for Q3/2024 totaled 3,848 million Baht, bringing the accumulated total for the first 9 months of 2024 to 14,578 million Baht, a 24% YoY increase. Despite the slowdown in the overall Thai real estate industry, this growth demonstrates ASW’s ability to consistently generate sales and maintain strength in the market.

Total Presale & Backlog

( Source: Company’s financial statement, One Report )

- The TITLE series has become a major driver for ASW. In the first 9 months of 2024, presales from TITLE projects amounted to 6,308 million Baht, representing 43% of total presales. This highlights the significant role of TITLE in supporting ASW’s business growth.

- The backlog remains strong, continuing to support ASW’s growth. As of Q3/2024, the backlog stood at 23,070 million Baht, which is sufficient to support ASW’s revenue for 2025 and beyond. This robust backlog boosts confidence in the company’s ongoing growth potential and supports plans for future project developments.

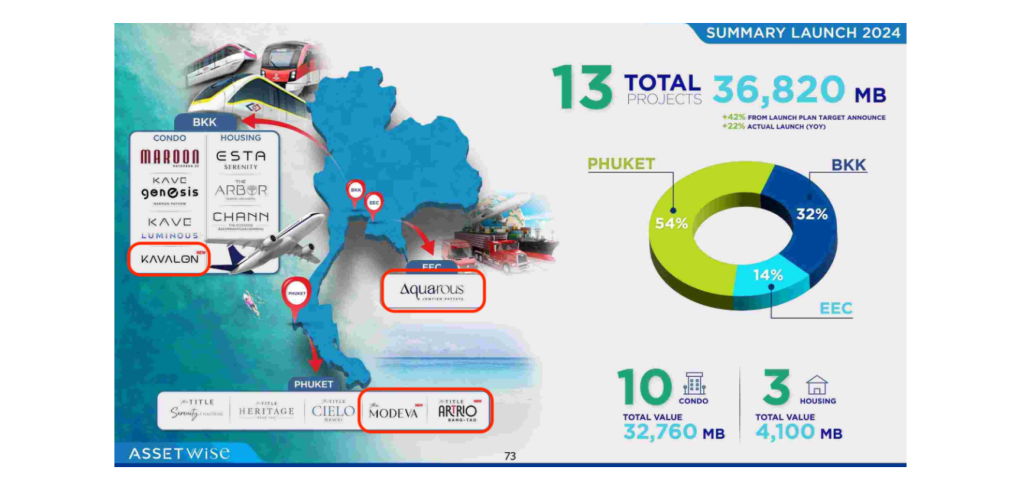

ASW Summary Launch 2024

( Source: Opportunity Day 3Q24 )

- New Projects Set to Launch in Q4/2024: ASW is moving forward with its plan to launch four new projects in Q4/2024, focusing on diverse locations and targeting specific customer segments to cater to varying demands in the real estate market. These new projects have a combined value of over 18,300 million Baht and include:

- Aquarous Jomtien Pattaya: ASW’s first project in Pattaya, with a total value of 5,000 million Baht. This project will target international customers, with the company aiming to replicate the success of its Phuket project sales to capture the international market in Pattaya.

- KAVALON: A new project in the KAVE series, with a total value of 4,500 million Baht. Located next to Bangkok University Rangsit, this project is designed to cater to the needs of students’ parents and investors seeking rental properties with strong potential.

- The MODEVA and The TITLE Artrio Bang-Tao: Both projects are located in the Bang Tao area of Phuket, known for their prime locations.

- The MODEVA is located by the beach, with a total value of 6,200 million Baht.

- The TITLE Artrio is adjacent to Porto De Phuket, a well-known shopping mall in the area, with a total value of 2,600 million Baht.

- ASW’s Potential for Strong Growth in 2025-2026:

- KAVE Series’ Success Beyond Market Expectations: ASW’s KAVE series projects have received strong market feedback, with a loan rejection rate of just 10%, well below the market average of 30-40%. This reflects the strength of the projects in meeting the needs of students, parents, and investors seeking condos near universities. With plans to expand to new universities such as Thammasat University, Burapha University, and Rajamangala University of Technology Thanyaburi, areas with high demand, KAVE is expected to continue generating sales and provide stable long-term revenue for ASW.

- Proven Strength of the Phuket Market: Phuket remains a key revenue source for ASW, especially with the popularity of The Title project among foreign customers. With strong sales in the past year and Phuket’s status as a popular destination for international tourists, which is forecast to generate 400 billion Baht in tourism revenue in 2024, the demand for real estate in the region will continue to support growth. We believe Phuket will remain a strong market with substantial growth potential.

- Expansion into Pattaya to Capture the Foreign Customer Segment in a New Area: The launch of Aquarous Jomtien Pattaya marks ASW’s expansion into a new, high-potential market, particularly targeting foreign customers such as Chinese and Russian investors seeking property investments in Thailand. With the development of infrastructure in Pattaya, including U-Tapao Airport and improved transportation connections, the market’s appeal will increase. This project not only helps diversify risk but also opens new opportunities for ASW to expand its customer base and increase revenue from foreign investors in the future.

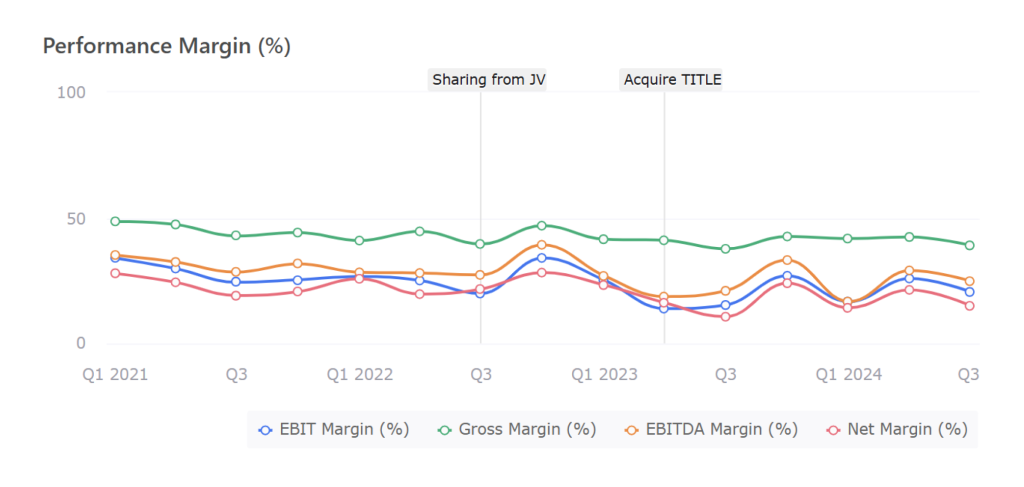

Performance Margin (%)

( Source: Company’s financial statement, One Report )

- ASW’s Strong Performance in the First 9 Months of 2024: In the first nine months of 2024, ASW demonstrated significant growth with total revenue reaching 3,158 million Baht, marking a 77% YoY increase and a 9% QoQ growth. The primary revenue source was real estate sales, amounting to 3,029 million Baht, up 93% YoY. The major contributors to this were the KAVE Town Island project, which accounted for 57% of sales, followed by The TITLE Halo in Phuket generating 15%, with other projects filling in the remaining 28%.

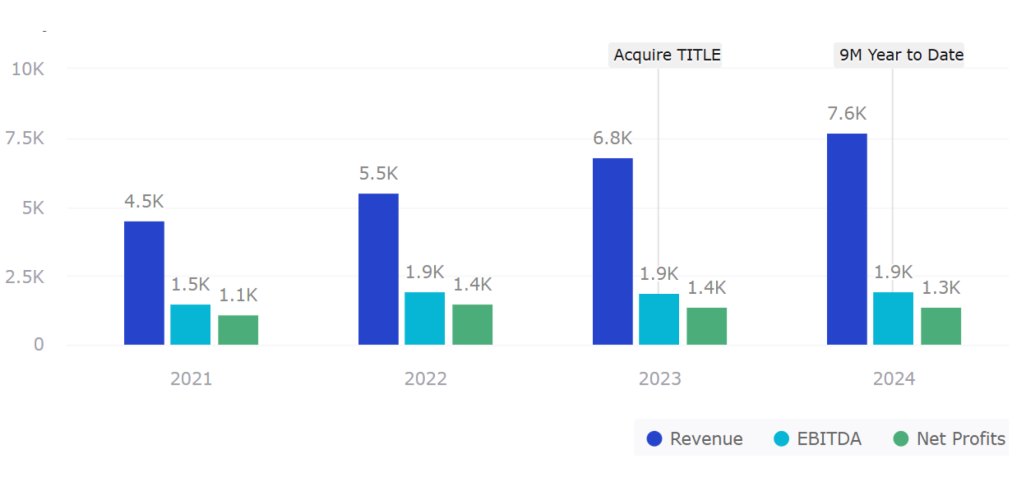

- Consistent Revenue Growth: ASW’s total revenue for the first nine months of 2024 reached 7,633 million Baht, a 63% YoY increase from 4,684 million Baht in the same period of 2023. This growth was driven by expanding into new markets like Phuket and strong responses to the KAVE series projects. The continued revenue growth since 2021 highlights ASW’s ability to increase sales from existing projects while successfully launching new ones that align with market demand.

Yearly Revenue & Net Profits

- Net Profit Trend in Q3/2024 from Increased SG&A: Although ASW has shown consistent long-term profit growth, the company’s Net Profit Margin in Q3/2024 decreased to 15% from 21% in the previous quarter. The primary cause for this reduction was the increase in SG&A expenses. This rise was driven by investments in marketing to support the launch of new projects in Q4/2024, totaling over 18,000 million Baht, along with higher commission expenses in Phuket due to increased sales from The Title project. Despite this decline in profit margin, the increase in SG&A is seen as an investment for long-term growth, reflecting ASW’s commitment to expanding its market presence moving forward.

- Financial Outlook for ASW in 2024 and 2025 remains positive

- Revenue target for 2024: With accumulated revenue of 7,633 million Baht in the first 9 months of 2024, we believe ASW has a high chance of achieving a full-year revenue target of 8,700 million Baht for 2024. This growth is supported by strong transfer revenue in Q3 and steady transfer expectations in Q4 from both existing and new projects in the pipeline.

- Revenue Growth in 2025: Revenue for 2025 is expected to continue growing due to the transfer of projects that began in 2024, such as KAVE Town Island and The TITLE Halo, along with new projects expected to start transferring in 2025, such as KAVE Series (with 2-3 new projects) and The TITLE Artrio Bang-Tao. These projects are aimed at both domestic and international buyers, especially in Phuket and Pattaya, where demand is strong.

- Factors Supporting Transfers and Presales: With a backlog of over 20,000 million Baht as of Q3/2024 and accumulated presales of 14,578 million Baht in the first 9 months, ASW has a strong revenue base for transfers in 2025, enabling the company to consistently generate new revenue.

- Cost and Profitability: Although SG&A expenses may increase in the short term due to the launch of high-value projects, efficient cost management and a strong gross margin of 39% will help sustain the company’s long-term profitability.

Financial Position of ASW

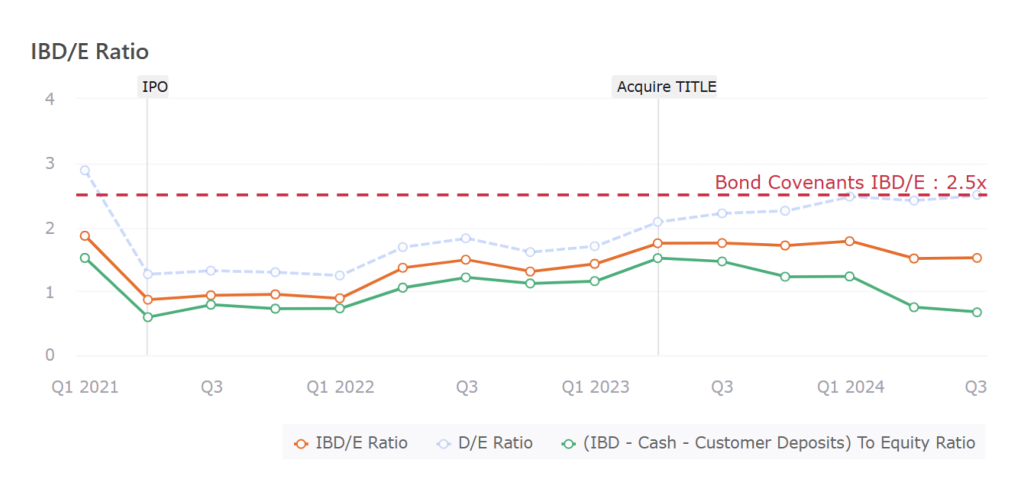

- IBD/E Ratio Remains at a Safe Level, Supporting Future Growth: As of Q3/2024, ASW maintains an interest-bearing debt to equity ratio (IBD/E) of 1.52 times, well below the bond covenant limit of 2.5 times. This demonstrates the company’s effective debt management and provides sufficient room to issue new bonds to fund upcoming projects without breaching its covenants. The company’s strong financial position supports its growth plans for market expansion and new project launches in the coming years, while also bolstering investor confidence in its long-term growth potential.

Cash And Equivalents

Cash Flow

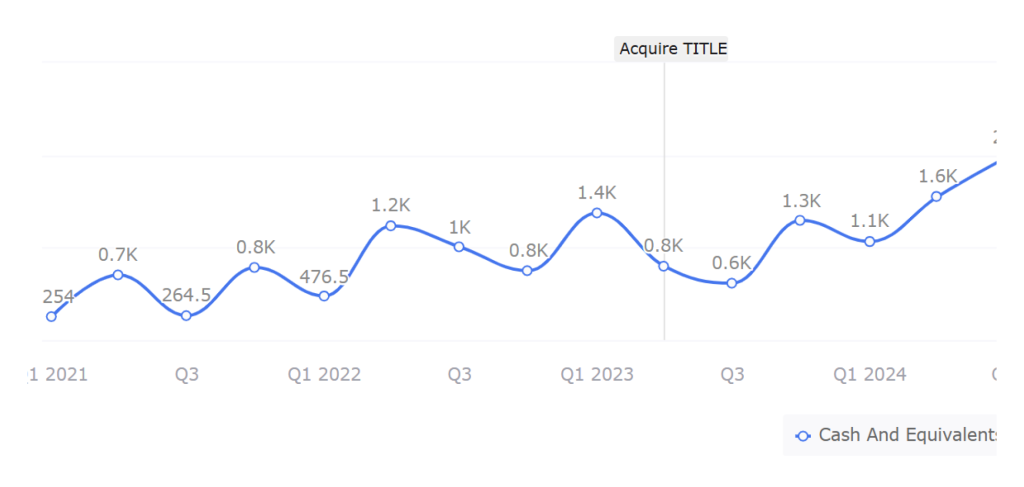

- Current Cash Position is Strong: As of Q3/2024, ASW has cash and cash equivalents of 2,000 million Baht, marking the highest level since 2021. This growth in cash is a result of accumulated transfers in the first 9 months of 2027 totaling 7,800 million Baht, reflecting effective liquidity management.

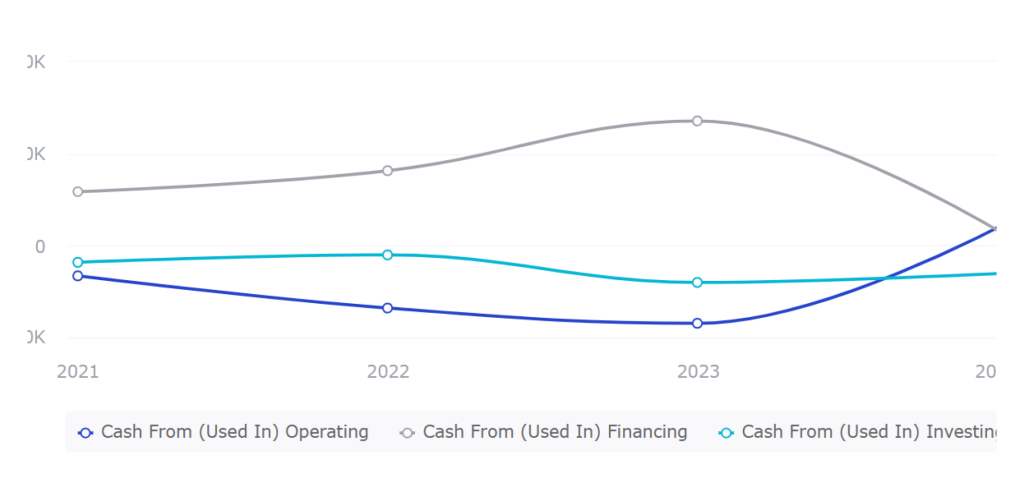

- Cash Flow Forecast for 2025: ASW is expected to generate operating cash flow in 2025 between 2,000–2,600 million Baht. This projection is based on converting a backlog of 23,700 million Baht into revenue at a conversion rate of 30–40%, which is expected to generate total revenue between 7,100–9,500 million Baht. With a stable gross margin of around 39% and SG&A expenses estimated at 10–12% of revenue, this forecast highlights ASW’s strong cash flow management and its ability to support its growth plans for the upcoming year.

Bond Outstanding

Bond Maturity Analysis

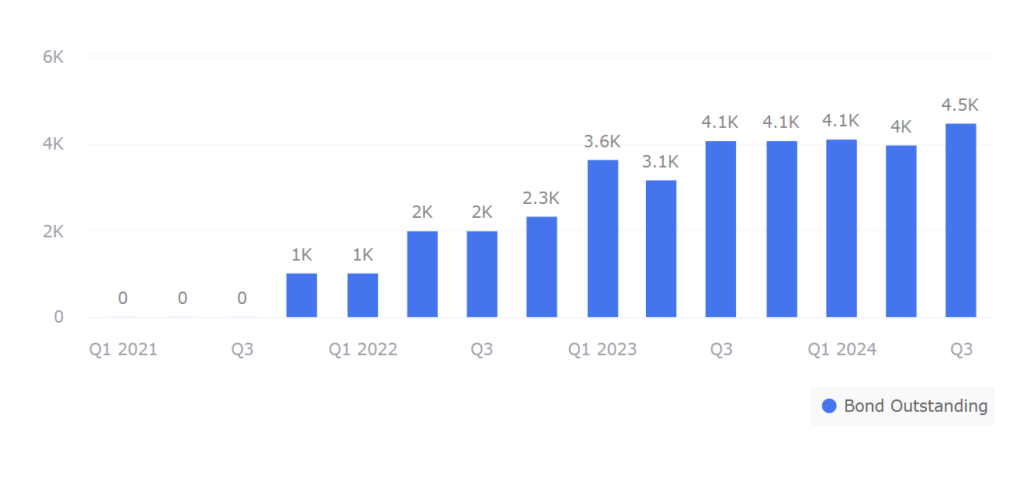

- Outstanding Bonds and Maturing in 2025: As of Q3/2024, ASW has outstanding bonds totaling 4,500 million Baht, of which 2,000 million Baht will mature in 2025. This amount is considered manageable in relation to the company’s financial position.

- Debt Repayment Ability: The company’s debt repayment ability remains strong, with 2,000 million Baht in cash on hand and an expected operating cash flow in 2025 between 2,000–2,600 million Baht. ASW has sufficient resources to repay the maturing bonds without needing additional external financing.

- Contingency Plan for Unexpected Events: ASW maintains a solid contingency plan in case of unforeseen circumstances. With an IBD/E ratio of 1.52, well below the bond covenant limit of 2.5, the company can easily roll over its bonds or raise additional funds without impacting its core operations or growth plans.

Risk Factors

- Over-reliance on the KAVE Project: The KAVE project, which focuses on student condominium markets, is a major source of revenue for ASW. However, if demand in this market decreases, such as due to a decline in student populations or changes in consumer behavior, it could significantly affect the company’s revenue.

- Risk of Converting Backlog: With a backlog worth 23,700 million Baht, this is a crucial source of income for ASW. However, delays in construction or legal approvals, such as permit issuance, may cause delays in project handovers, negatively impacting both revenue and cash flow in the short term.

- Risk of Projects Focused on Specific Areas: Projects in Phuket, such as The Title, depend on demand from tourists and foreign investment. If global economic downturns or travel restrictions occur, such as economic slowdowns or geopolitical issues, demand in this market may decrease, affecting the company’s performance.

- Risk from Expanding into New Business Ventures: Entering new business areas, such as the Rocket Fitness and Vitala health and fitness projects, carries uncertainty. If these projects do not receive a positive market response, it could result in inefficient use of resources and divert attention from the company’s core real estate business.

ASW issued new bonds

- Information and Purpose of the Bond Issuance: ASW is preparing to issue a new bond between December 16-18, 2024, to roll over maturing bonds and raise capital for the development of new real estate projects. This bond is part of ASW’s long-term debt management strategy aimed at promoting sustainable financial growth.

- Strong Financial Position as of Q3 2024, ASW’s debt-to-equity ratio (IBD/E) stands at 1.52x, well below the bond covenant limit of 2.5x. The company has 2,000 million Baht in cash and expects sufficient cash flow from operations to meet its bond repayment obligations. Additionally, its backlog of 23,700 million Baht will support future revenue.

- Investment Recommendation the ASW bond is attractive for investors seeking returns from a company with a solid financial position and a clear debt management strategy. However, investors should consider the risks associated with the real estate market, such as economic fluctuations that may impact project handovers and future sales, before making an investment decision.

ข้อจำกัดความรับผิด (Disclaimers):

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง