หุ้นกู้

INET Bond: Full Range of ICT Service Provider [FynnCorp IAS Bond Research]

อ่าน 9 นาที

Internet Thailand Public Company Limited [INET]

Sector: Information & Communication Technology

Issuer Rating: Unrated

Rating Agency: –

Overview

- Provides a full range of ICT infrastructure services with over 4,000 clients

- Renowned for its expertise in Cloud Solutions and Digital Platforms tailored for businesses

- Notable services include One Electronic Billing and One Authen

Key Highlights:

- Strong Financial Performance and Positive Cash Flow from its revenue and net profit for the first nine months of 2024 that grew by 21% and 57% YoY, respectively. This is driven by the growing demand for Digital Transformation among both existing and new business clients.

- Expertise in Cloud Services with a Focus on Platform Service Provider in tandem with Digital Transformation growth , evidenced by the success of the “Mor Prom” platform, which integrates health data from public and private healthcare facilities in Thailand. It is also expanding its services to include E-Tax Invoice, CA (Certificate Authority), and local Data Center development to support in-country data storage.

- Bond Offering for Institutional and High-Net-Worth Investors with 2 series of unsecured, unsubordinated bonds with quarterly interest payments and early redemption options: 2 years 6 months with an interest rate of 5.35-5.45% per annum and 3 years 1 month with an interest rate of 5.70-5.80% per annum. Subscriptions are open from January 7 to 9, and the company has a solid track record with no history of default on principal or interest payments.

Company Overview

- Internet Thailand Public Company Limited (INET) began operations in 1995 as a provider of comprehensive ICT infrastructure services. The company transformed into a public entity and has been listed on the Stock Exchange of Thailand since November 14, 2001.

- Currently, the National Science and Technology Development Agency (NSTDA) and National Telecom Public Company Limited (NT) are its major shareholders, holding 24.9% and 24.1%, respectively.

- A comprehensive ICT infrastructure service provider, recognized for its excellence in Cloud Services

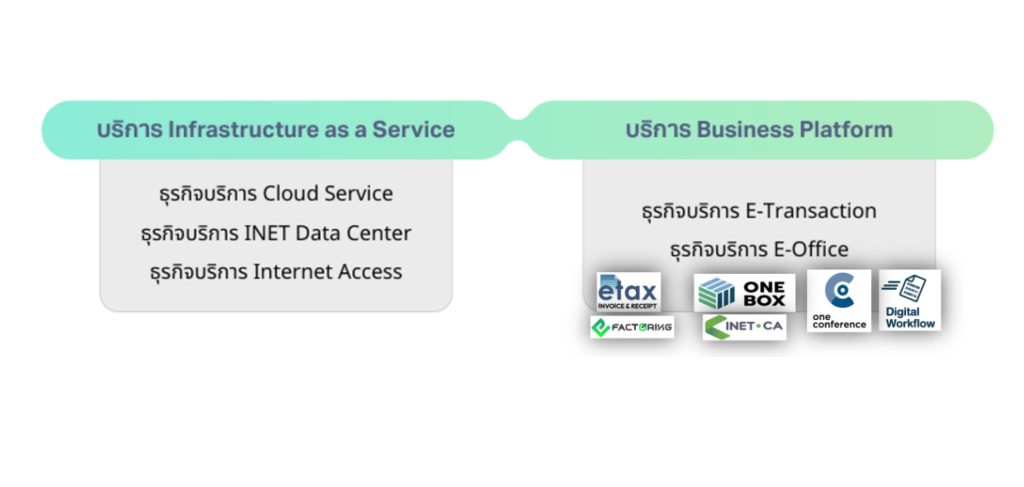

The company’s business operations can be categorized into two main groups:

- Infrastructure as a Service is a comprehensive service model integrating three key components that form the foundation for other digital services: Cloud service, INET Data Center and Internet Access

- Cloud Service provides shared computing resources via the internet. INET has been offering public Cloud Services for enterprises for over 10 years and is the first in Thailand to receive certification for personal data protection standards (ISO/IEC 27018:2019). The services are categorized based on the types of technology provided as follows:

- Infrastructure as a Service (IaaS): Providing core infrastructure services such as Servers, Storage, and Networks, enabling clients to reduce costs associated with purchasing and maintaining their own equipment.

- Platform as a Service (Paas): This service enables users to deploy applications on the platform without the need for investment in hardware or software. Examples include electronic tax invoice services, digital document management systems (Paperless), and cybersecurity preparedness services.

- Software as a Service (SaaS): This service delivers applications and software via the internet, eliminating the need for users to install software on endpoint devices or maintain hardware. Examples include Email on Cloud services.

- INET Data Center such as Co-Location provides secure server hosting for organizations requiring advanced security features. These include backup power systems, cooling systems, and high-speed network connectivity. Customers can place their existing servers in designated spaces within INET’s three data centers: Bangkok Thai Tower (INET-IDC1), Thai Summit Tower (INET-IDC2), and Kaeng Khoi District, Saraburi (INET-IDC3). All three centers are interconnected via high-speed networks and serve leading organizations in Thailand, including internet-based securities trading businesses, website providers, and international clients aiming to reach users in Thailand.

- Internet Access Service for businesses, covering all provinces nationwide.

- Cloud Service provides shared computing resources via the internet. INET has been offering public Cloud Services for enterprises for over 10 years and is the first in Thailand to receive certification for personal data protection standards (ISO/IEC 27018:2019). The services are categorized based on the types of technology provided as follows:

- Business Platform Services consist of:

- E-Transaction such as E-Tax Invoice Service to allow businesses to create electronic data and deliver it to buyers of goods or services through a system linked to the Revenue Department, E-Factoring helps companies with receivables quickly and efficiently sell their debts to finance companies. Certification Authority (CA) is an agency that issues electronic certificates to ensure that users can carry out transactions with confidence, verifying the true identity of individuals involved, such as certificates for legal entities, corporate officials, and individuals.

- E-Office like Digital Workflow enable organizations to transform business processes into digital systems, such as reducing paper usage and speeding up data management, along with systems for signing documents from paper to Digital Signature. Additionally, E-Meeting (One-Conference) and One Box help organizations manage files securely and effectively.

INET Services

( Source: One Report 2566 )

- The company’s revenue structure is primarily driven by Cloud Service, accounting for approximately 85% of revenue in 2023, followed by Co-Location services at 10% and other services. In 2024, the revenue proportion for each business segment is expected to remain similar to the previous year.

INET Revenue Structure

( Source: One Report 2566 )

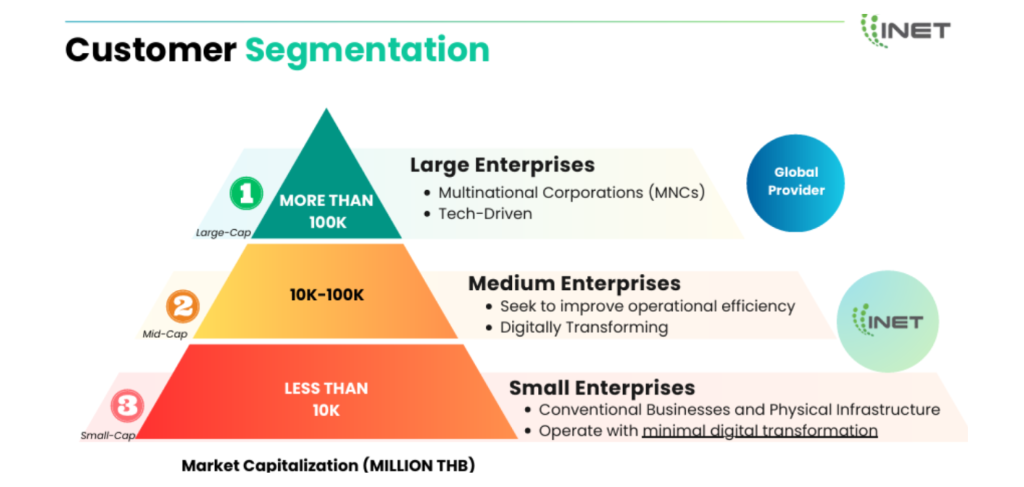

- The company’s customer base consists primarily of government agencies and private sector medium enterprises, followed by small enterprises. Customers are categorized into organizations looking to reduce IT infrastructure costs, medium and small-sized enterprises seeking IT infrastructure or Software as a Service, and organizations aiming to cut costs related to IT personnel and address skill gaps.

- The company employs targeted marketing strategies, offering products and services to each customer group through sales representatives, the company website, and Thaidotcom Marketplace. Additionally, the company partners with allies to provide Cloud Services, expanding its customer base with a focus on private sector clients interested in innovation.

Customer Segmentation

(Source: Opportunity Day 3Q2567)

- In comparison with others in the same industry, there are 222 licensed internet service providers approved by the National Broadcasting and Telecommunications Commission (NBTC), as reported in the 2023 annual report. INET is considered a medium-sized company among these 222 competitors.

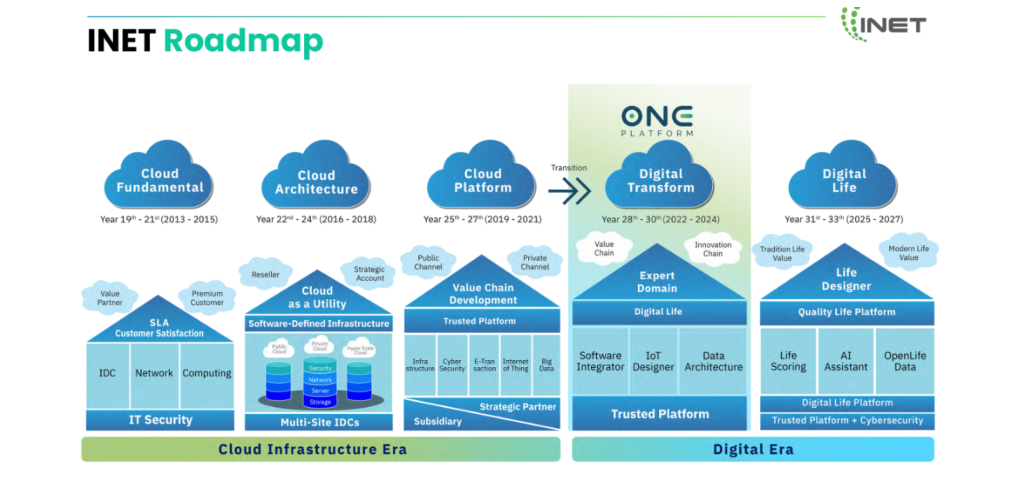

Aims to be Trusted Platform Service Provider

The company plans to evolve beyond just being a Cloud Service Provider by focusing on investing in various platform services to enhance the use of its cloud services, while also prioritizing cybersecurity. According to its roadmap, the company has moved beyond being a cloud provider to creating platforms (Digital Transformation) that focus on organizing data into electronic systems.

INET Roadmap

(Source: Opportunity Day 3Q2567)

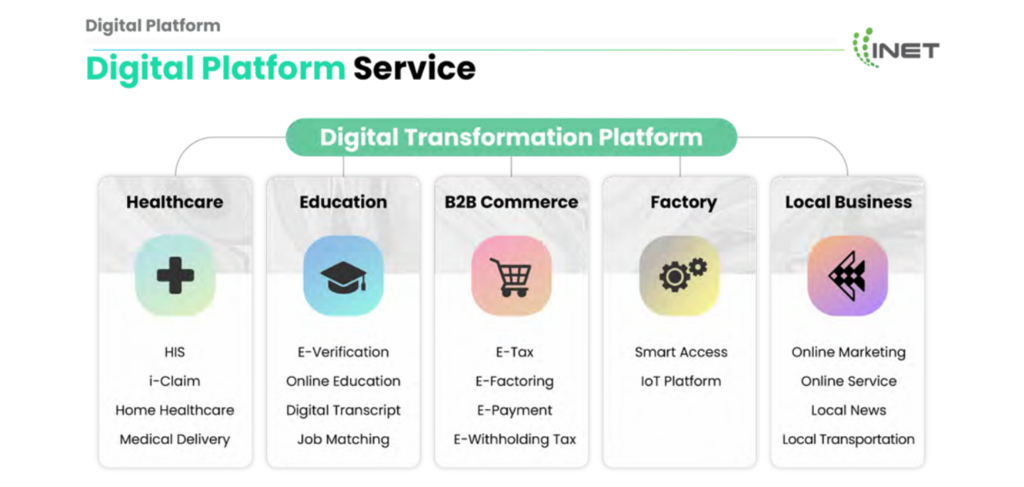

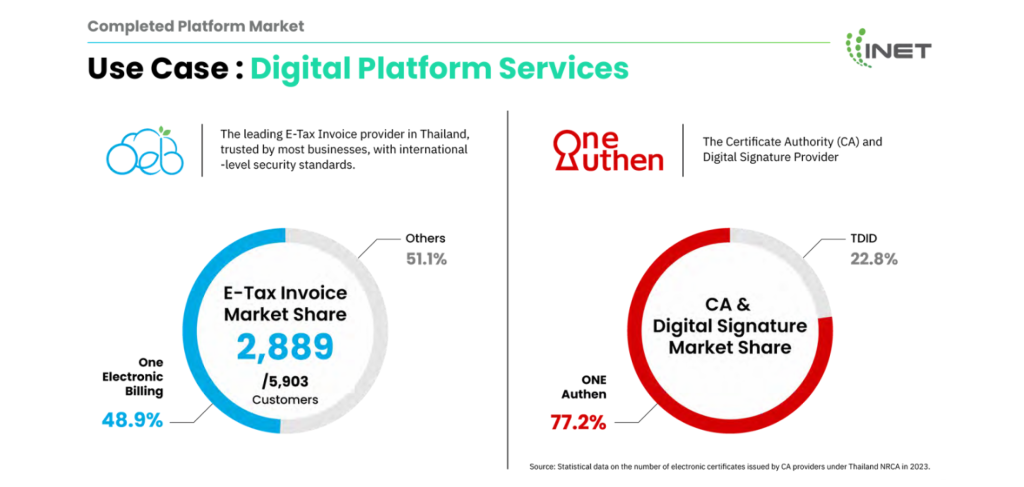

- Currently, the company offers recognized Digital Platform Services such as One Electronic Billing, which provides E-Tax Invoice services with a market share of 48.9% and 2,889 customers, and One Authen, which provides CA or Digital Signature services with a market share of 77.2%. These services have been developed in-house and are proprietary, certified by NRCA (National Electronic Certification Authority). This has led to lower long-term costs for the company.

Use Case: Digital Platform Services

( Source: Opportunity Day 3Q2567 )

Market and competition situation:

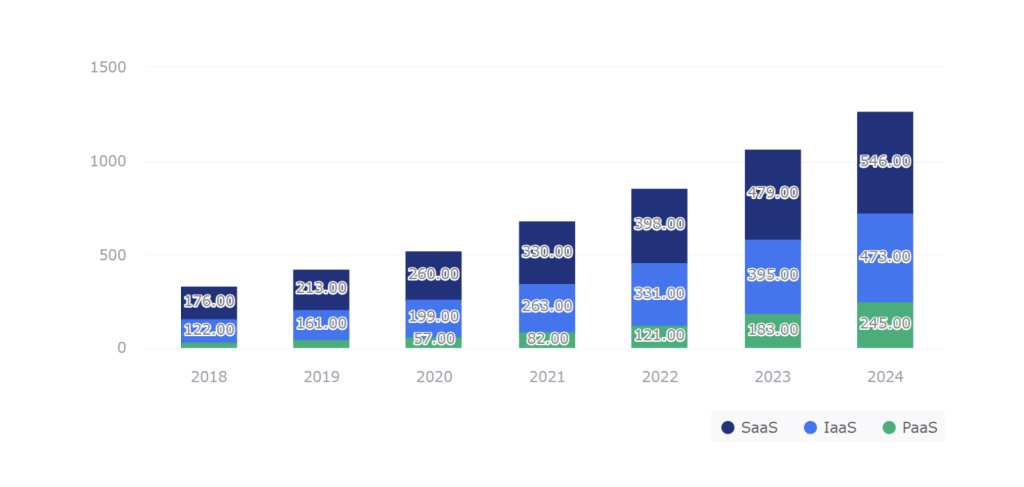

- The cloud market in Thailand is currently valued at over 58 billion baht. The growing trend of digital adoption, especially after the COVID-19 pandemic, is expected to drive continuous growth in cloud or platform service users. According to a report from the IDC APeJ Public Cloud Services Tracker, the market value of public cloud services in Thailand is projected to grow at an average annual rate of 20.33% from 2018 to 2024. Software as a Service (SaaS) holds the largest market share, accounting for 50% of the total market across all service types.

(Unit: USD Million)

(Source: IDC APeJ Public Cloud Services Tracker 2023 (Company Data) )

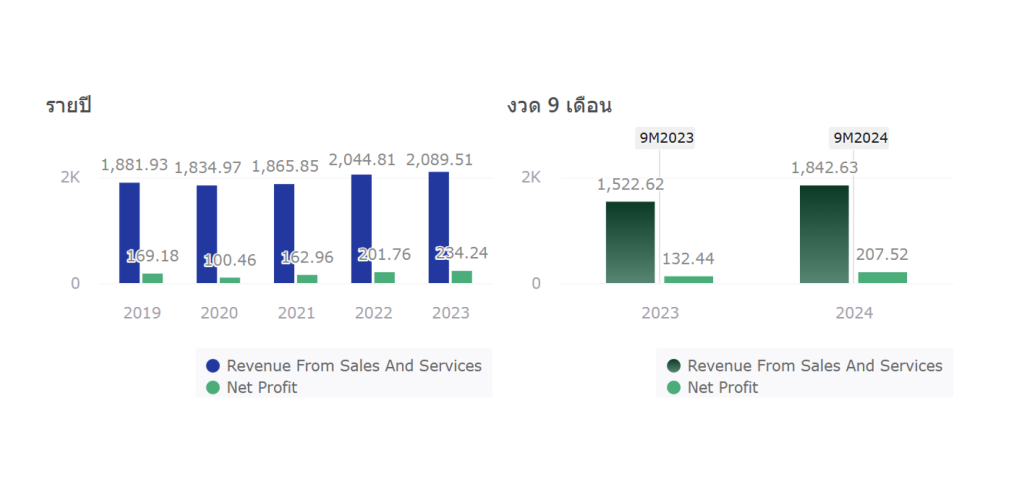

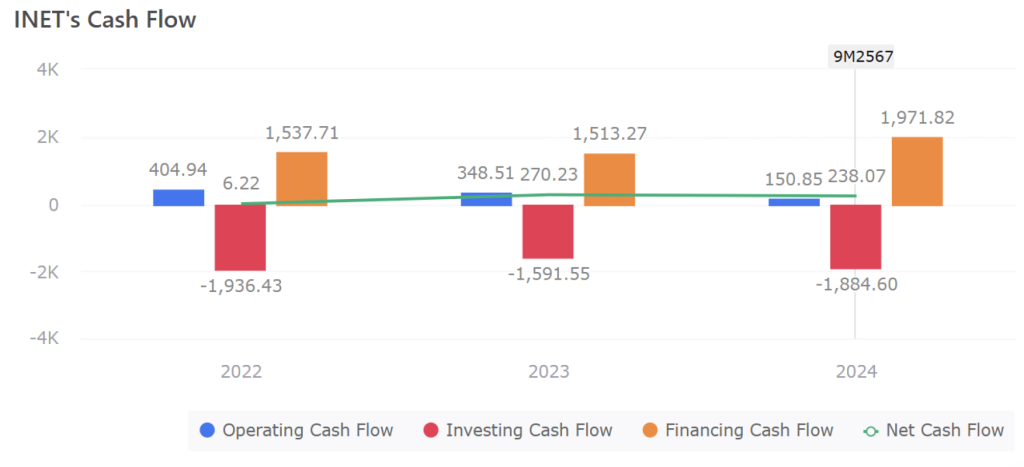

Financial Performance

- The growth of revenue especially in Cloud Service และ Digital Platform Revenue from sales and services in the first nine months of this year increased by 21.02% YoY, reaching 1,842.63 million baht, up from 1,522.62 million baht in 9M2566. This growth was driven by the rising demand from the private sector seeking to adapt to the digital era.

- Net profit also rose nearly 57% YoY in 9M2567, reaching 207.52 million baht, driven by the growth in revenue as well as effective cost management.

Revenue from Sales and Service & Net Profit

(Unit: THB Million)

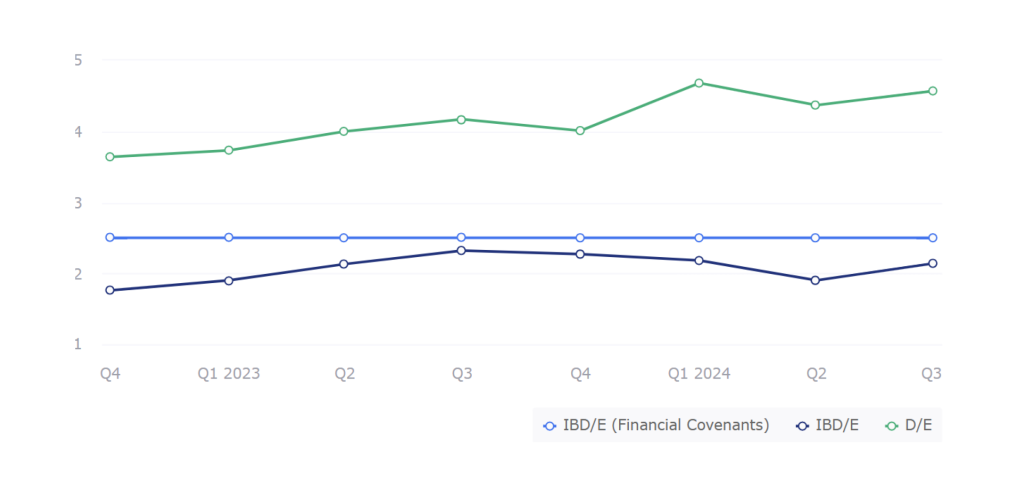

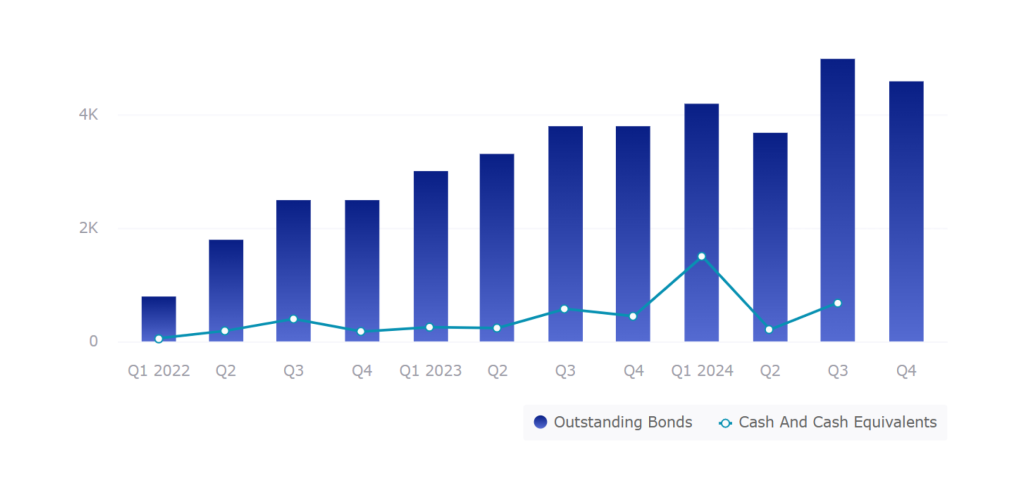

Current Corporate Bonds

- Financial Covenants ดor bond issuance, the company is required to maintain an Interest-Bearing Debt to Equity Ratio (IBD/E) not exceeding 2.5 times throughout the life of the bonds in the consolidated financial statements, as of the end of each fiscal year. As of the third quarter of this year, the company maintained this ratio at 2.14 times, which represents an improvement from 2.27 times at the end of 2566, due to significant repayment of short-term and long-term loans.

Key Ratios (IBD/E & D/E)

Outstanding Bonds

- INET has issued a total of 13 long-term bonds since 2019, with 8 outstanding bonds that have not yet matured. Among these, 3 bonds are due for repayment in January 2024, namely INET251A, INET251B, and INET251C, with a total principal value of 1.5 billion THB. As of now, the company has outstanding bonds totaling 4,578.3 million THB. The company is currently in the process of offering two new bond series, aiming to repay the 3 maturing bonds in early next year (rollover) and use the funds as short-term working capital for business operations. However, the company has additional sources of funding if the bond issue does not raise the full amount, including internal cash flow or other financing sources.

( หน่วย: ล้านบาท )

New Bond Issued

( Source: ThaiBMA )

Risk Factors

- Liquidity risk: As the company is in an expansion phase to gain a competitive advantage, additional funding is required. The company relies heavily on debt financing (D/E = 4.57) and has high-interest-bearing debt, as reflected by the increase in the EBITDA ratio to 8.77 times in the first 9 months of 2024. This exposes the company to interest rate fluctuations and potential difficulties in debt repayment if business performance deviates from expectations. However, the company plans to raise capital in the future and implement systematic cost reduction to maintain manageable liquidity.

- Financial ratio risk: The company is required to maintain a debt-to-equity ratio of no more than 2.5 times on its interest-bearing debt. As of the end of Q3 2024, the company has a ratio of 2.14 times, and it is confident that it will maintain this ratio by the end of 2024.

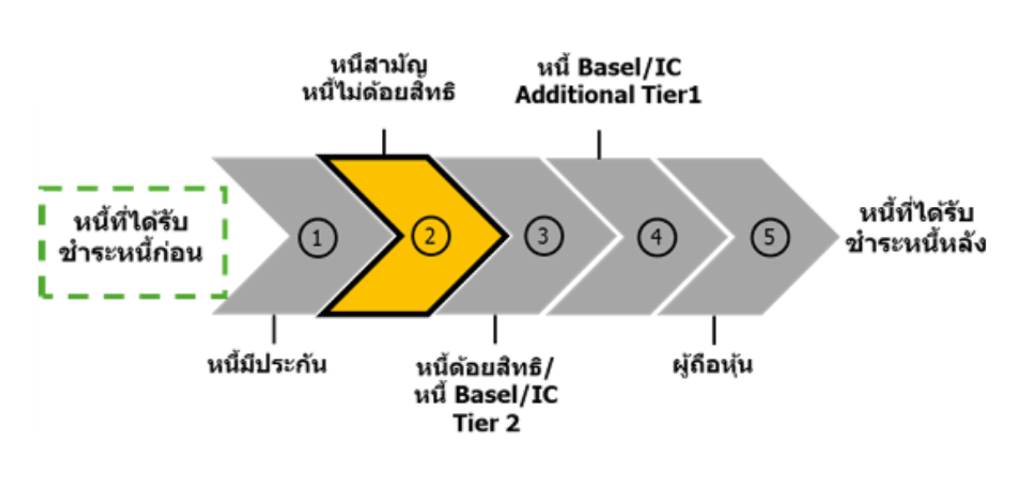

- Subordination risk of bonds: The bonds being issued are unsecured and non-subordinated, which means they have a lower priority for repayment compared to secured debt (collateralized debt). This could result in significant subordination in case of default.

( Source: Company’s Factsheet )

ข้อจำกัดความรับผิด (Disclaimers):

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง