หุ้นกู้

SINGER Bond: The business turned around with a profit for five consecutive quarters [FynnCorp IAS Bond Research]

อ่าน 11 นาที

Singer Thailand Public Company Limited [Ticker: SINGER]

Sector: Commerce

Issuer Rating: BB+ (14 March 2024)

Rating Agency: Tris Rating

Overview:

- Leader in sales and offers financing and hire-purchase services for consumers in the country.

- The hire-purchase sales are carried out through its subsidiary, SG Capital (SGC)

- The “Singer” trademark, a world-renowned brand, has been a trusted name in Thailand for over 135 years.

Key Highlights:

- Turnaround performance is reflected in continuous profits for five consecutive quarters, with an upward trend driven by reducing SG&A expenses and leveraging technology to replace back-office staff and the number of direct sales employees. Besides, the income from “Locked Phone” loans under the new business, SG FINANCE+, operated by the subsidiary, is expected to positively contribute to the growth of mobile phone financing.

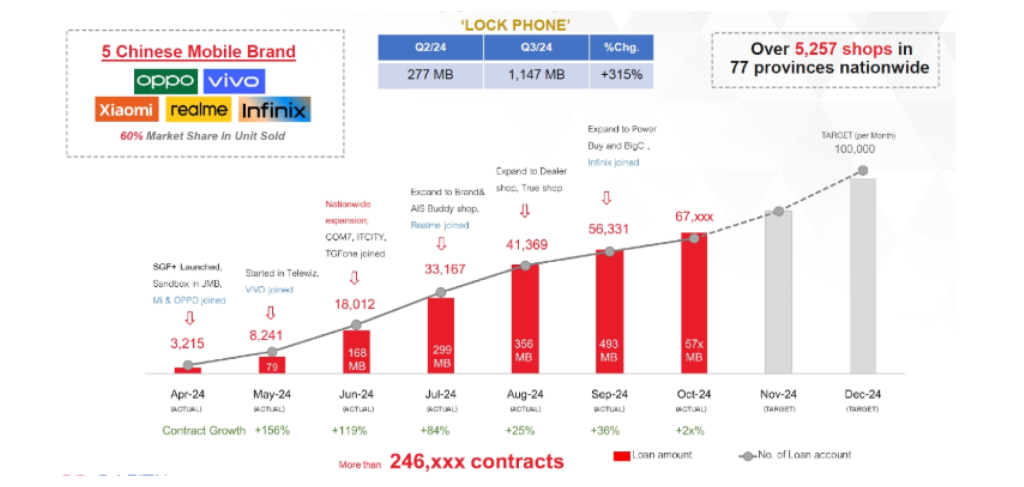

- The new loan product through the SG FINANCE+ platform is a key growth driver. This loan allows customers to pay for smartphones in installments. Full operations began on June 1, 2024, utilizing a Locked System that locks the smartphone if customers fail to make payments. Currently, participating brands include XIAOMI, VIVO, OPPO, realme, and Infinix. The program has exceeded its targets, with over 5,200 participating stores nationwide and more than 246,000 contracts signed.

- Enough cash to repay its bond debt As of September 30, 2024, cash and cash equivalents amounted to THB 2,251 million, while bonds maturing in early 2025 totaled THB 1,700 million. This reflects a positive cash flow from operations throughout 2024, along with a continuous reduction in bond liabilities.

- The debt-to-equity (D/E) ratio has improved compared to the past and the industry average, standing at 0.14x in Q3, an improvement from 0.37x in 2023. This improvement is attributed to bond repayments made during the period, underscoring the company’s strong financial position and enhancing opportunities for business expansion.

- We consider SGC bonds as an attractive investment option. SGC issues bonds to support the expansion of its loan portfolio, with growth drivers such as the Lock Phone business. Additionally, the company benefits from controlling credit costs by managing its debtor portfolio more efficiently and reducing expenses through optimized workforce management.

Company Overview

- Before being SINGER, the journey of Singer Thailand Public Company Limited dated back to 1889, when the Singer Company of the United States appointed Kiam Hua Heng Co., Ltd. as the distributor of Singer sewing machines in Thailand. Later, in 1905, a branch was established in Thailand under the name Singer Sewing Machine Co., Ltd., focusing on the distribution of sewing machines and related imported products. In 1925, the company introduced the hire-purchase installment system for the first time. Eventually, in 1969, Singer Thailand Co., Ltd. was registered to take over operations from Singer Sewing Machine Co., which had ceased its business earlier. The company went public by listing on the Stock Exchange of Thailand in 1994, transitioning into a public limited company, which it remains to this day.

- Business operations: Currently, SINGER engages in the distribution of a diverse range of consumer and commercial products under the “Singer” trademark. The majority of sales, accounting for more than 80%, are conducted through hire-purchase agreements facilitated by SG Capital Public Company Limited (SGC), in which SINGER holds a 74.92% stake. Additionally, the company acts as a distributor of various brands and models of mobile phones to meet the demands of both residential and commercial customers. SINGER’s product portfolio is divided into two main categories: Home Appliances which are Sewing Machines, Household Electrical Appliances, Audio-Visual Products and Commercial Products: Retail Store Solutions, Coin-Operated Machines, Agricultural Equipment

- Shareholding Structure: a significant turning point for SINGER was the restructuring of its shareholder base. This included the entry of Jaymart Group Holdings Public Company Limited in 2015 and Rabbit Holdings Public Company Limited in 2021 as major shareholders.

- As of December 31, 2023, the major shareholders are: Jaymart Group Holdings Public Company Limited: 25.196% Rabbit Holdings Public Company Limited: 23.75%

Business Structure

Source: The company’s website

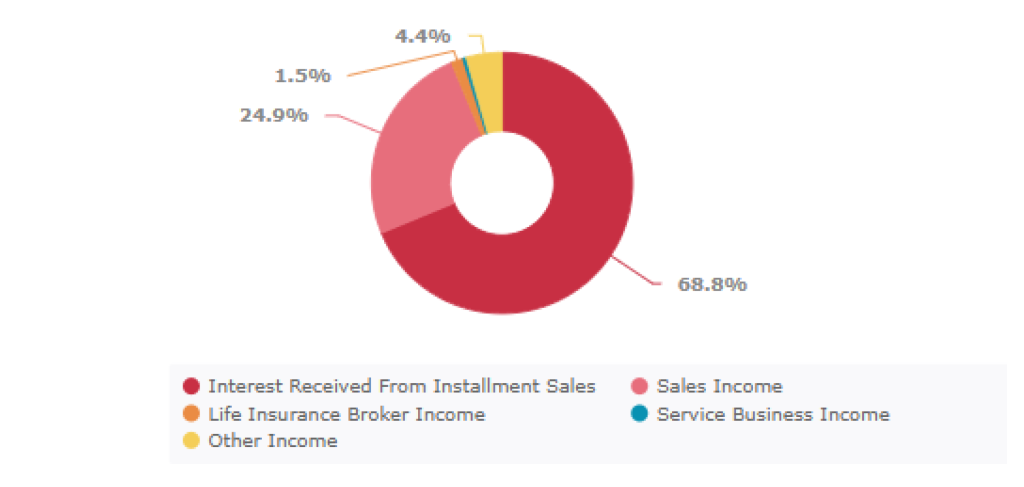

- Revenue structure highlights the reliance on its subsidiary SG Capital (SGC) as the primary driver. In 2023, the majority of SINGER’s revenue came from interest income from installment sales, accounting for 68.8% of total revenue. Of this, 68.4% was contributed by SGC. Other revenue sources included: Sales revenue: 24.9%, Other income: 4.4%, Life insurance brokerage income: 1.5%. This marks a significant shift from 2022, when the primary revenue source was sales income, which contributed 52.1% of total revenue, while interest income from installment sales accounted for 44.5%.

Revenue Breakdown (2023)

(Unit: THB Thousand)

Source: ANNUAL REPORT 2023

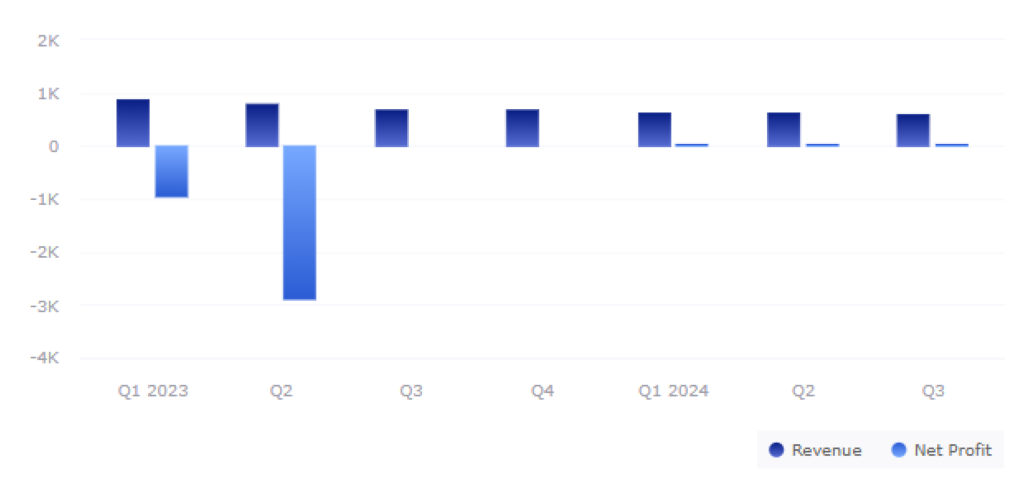

- Financial performance overview: the company’s performance has shown a turnaround with continuous profits over 5 consecutive quarters. In 2023, the company faced a net loss of 3.209 billion baht, a significant decline of 4.145 billion baht, mainly due to efforts to support customers impacted by COVID-19. Measures such as lowering interest rates, extending repayment periods, and offering debt moratoriums in line with the Bank of Thailand’s guidelines contributed to increased provisions for bad debts, particularly in Q2 2023.

- For the first nine months of 2024, total revenue was 1.829 billion baht, marking a 22.34% decrease compared to the previous year, primarily due to a drop in product sales and interest income. This decline was also driven by the subsidiary’s stricter credit policies aimed at improving loan quality.

- However, the company’s performance improved significantly, with net profit for the parent company reaching 76 million baht in 9M 2024, representing an increase of more than 3.3 billion baht compared to the same period last year. This improvement stemmed from a reduction in provisions for credit losses in the subsidiary’s lending business, alongside provisions for inventory obsolescence and depreciation of goods. Additionally, the company successfully reduced management expenses by 85 million baht through its ongoing cost-cutting measures.

Revenue and Net Profit

Unit: THB Million

- Distribution Channels: physical stores with 125 branches nationwide and over 270 franchise stores across the country together with more than 1,200 sales personnel (as of 2023), Including telesales operations for direct customer engagement. Online selling platforms: E-Marketplaces such as Shopee, Lazada, TikTok, NocNoc, and platform Line Singer Connect for seamless customer interactions.

New Business – New Growth Engine

SINGER Thailand

- Positive Outlook on Financial Position and Future Performance through new business including new product mix, new platform and new network with a target to increase product sales revenue by 25% quarter-on-quarter (QoQ).

- New Product Mix: Expanding “Lock Phone” to include TVs and washing machines (Appliance Locking), introducing more multi-brand products, focusing on mobile business with plans to recognize mobile sales in Q4 2024

- New Platform: Using SG Finance+ for financing appliances and mobile products and developing E-Catalog for cash and credit card customers to improve sales efficiency

- New Network: Expanding partnership with Offline Partner “ร้านเตือนใจ” to grow mobile business in rural areas, targeting 30 new branches in 2024 and growing sales agents from 1,100 to 2,000 by year-end, focusing on SG Finance+ dealers.

Source: SET OPPORTUNITY DAY SINGER & SGC 3Q24

SG Capital

- SGC operates in vehicle-secured loans and provides hire purchase services for consumer electronics to SINGER’s retail customers, aligning its business operations with SINGER’s overall strategy.

- SGC launched a new product, “SG Finance+,” allowing customers to purchase smartphones through hire purchase agreements, with full service starting in June 2024 (Lock Phone).

- In September 2024, SGC increased its registered capital to support its new business plan for Lock Phone loans and issued bonds in December to further grow this loan business. As of Q3 2024, Lock Phone loans accounted for 9% of SGC’s total loans, with a loan disbursement of 1,427 million baht and an NPL of 0.3%. The business expanded to over 5,257 dealers nationwide, with contracts growing by double digits each month, bringing the total number of contracts to over 246,000.

Source: SET OPPORTUNITY DAY SINGER & SGC 3Q24

Current Corporate Bonds

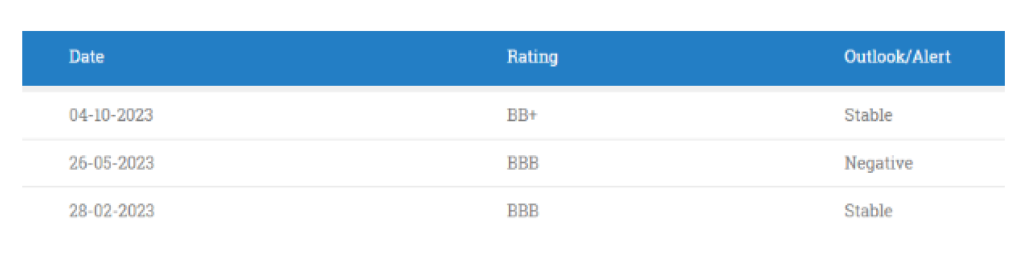

SINGER’s Issuer Credit Rating History

- SINGER has been assigned a credit rating of BB+ with a stable outlook by TRIS Rating as of March 14, 2024. This rating has been maintained since October 2023, reflecting a strong capital base. However, the company faces pressure from declining asset quality, increased operational risks, and slower-than-expected profitability recovery. Despite these challenges, the company has no history of defaulting on principal or interest payments of its debt securities.

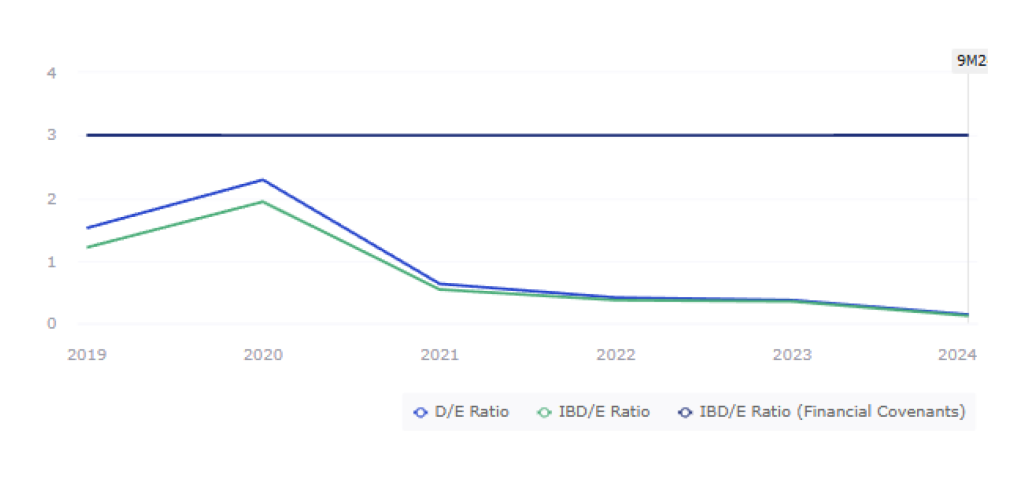

- Singer is required to maintain a debt-to-equity ratio (IBD/E) of no more than 3:1, as per the terms of its bond issuance. As of the end of Q3 2024, the company’s ratio stands at 0.12, showing an improvement from 0.35 in 2023. This is significantly lower than the industry average, which is approximately 1.02.

D/E & IBD/E Ratio

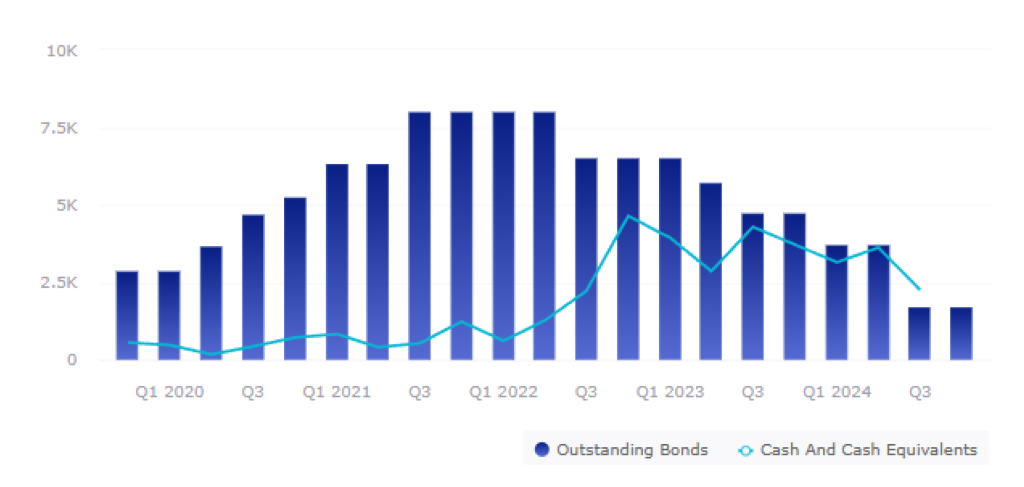

- As of Q2 2024, Singer’s outstanding bonds have steadily decreased since Q2 2023. The last remaining bond to be repaid is in Q1 2025, with a value of 1.7 billion THB (SINGER252A). The company has already prepared funds for this repayment and has no plans to issue additional bonds at this time. As a result, Singer has mitigated the risk of reliance on debt financing. However, as of Q2 2024, the total outstanding bond value was 3.69 billion THB, which accounted for 98% of all interest-bearing liabilities. This poses a potential risk for the company if it cannot secure additional funding sources.

SINGER’s Outstanding Bonds

Unit: THB Million

Note: The outstanding bonds as of 3Q24 stood at 1,700 million baht, compared to cash with the value of 2,251 million baht.

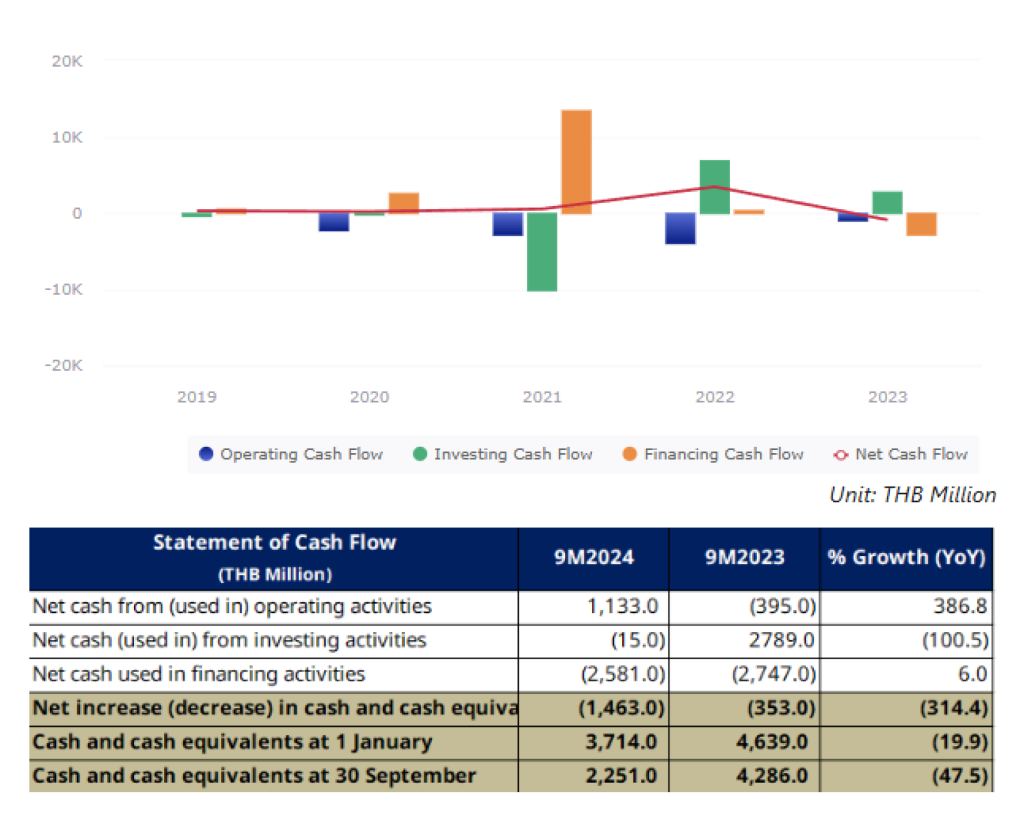

SINGER’s Cash Flow

Source: Management Discussion and Analysis Q3/2024

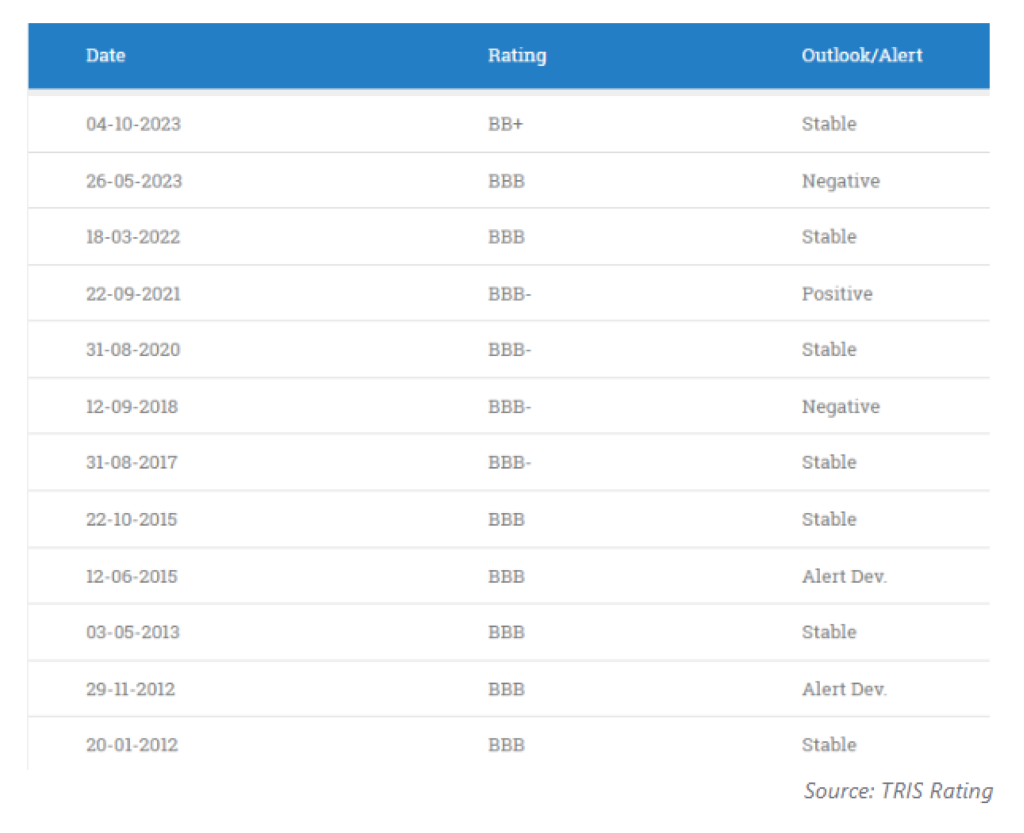

SGC’s Issuer Credit Rating History

- SG Capital has received an issuer credit rating of BB+ with a stable outlook from TRIS Rating as of March 14, 2024. This rating has been maintained since October 2023, reflecting its position as a key subsidiary of Singer.

Source: TRIS Rating

- SGC is required to maintain a Debt-to-Equity Ratio (D/E ratio) of no more than 3:1, as per the bond covenants, at the end of each financial period throughout the life of the bonds. As of June 30, 2024, the company’s D/E ratio was 0.07, well below the required criteria.

- SGC issued bonds to secure funding for its growth. Meanwhile, SG Capital (SGC), a subsidiary of Singer, currently has no outstanding bonds in the market. However, it plans to offer non-subordinated bonds to expand its loan portfolio, supporting the growth of the Lock Phone business, which saw a 315% increase in loan disbursements in Q3 compared to the previous quarter following its launch.

- The bonds will be available for subscription between December 9, and 11-12, 2024. They are secured bonds backed by claims against Stage 1 loan debtors, with the value of the collateral at least 2.5 times the value of the bonds issued. The bonds have a 2-year maturity, with an interest rate of 7.00-7.25% per annum, paid quarterly. The issuer has the right to redeem the bonds before maturity. Additionally, SGC has reserve credit lines from financial institutions and its parent company, totaling approximately 760 million baht, yet to be utilized.

- Given the continuous growth of the new Lock Phone business and the synergy with SINGER, this will positively impact the company’s future performance, making SGC’s bonds an attractive investment option.

Key Risk Factors:

- Risks in Accounts Receivable Quality: The company faces risks regarding the quality of hire purchase receivables, which may lead to defaults and non-performing loans (NPLs). Despite rapid expansion of credit offerings in recent years, the company has set aside significant provisions to account for the impairment of receivables, particularly amid the Bank of Thailand’s debt relief measures due to COVID-19. However, some customers have failed to repay as agreed after the measures expired, causing an increase in NPL ratio and the provision for doubtful debts, which reached 22.02% and 17.04% of total loans as of June 30, 2024, respectively.

- Risks in Debt Repayment Ability: The company’s debt service coverage ratio (DSCR) stood at 0.14x as of June 30, 2024, compared to the industry average of 0.37x. This is primarily due to the impact of write-offs of bad debt and provisions for losses from seized goods.

- Risks from Asset Sales Insufficient to Cover Outstanding Debt: There is a risk that the company may not be able to sell collateralized assets, such as vehicles, trucks, and electrical appliances, for amounts sufficient to cover the outstanding debt. If the company cannot recover these assets or sell them for adequate value, it may negatively impact both financial performance and position.

ข้อจำกัดความรับผิด (Disclaimers):

กดด้านล่างเพื่อดูรายละเอียด ข้อจำกัดความรับผิด:

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง