Bond

Macro Domestic

Macro View in November 2024 (Bond Research).

อ่าน 1 นาที

Key Highlights:

- November 2024 Bond Issuances value Exceed 100 Billion Baht

- New corporate bond issuances in November 2024 reached 115 billion baht, marking a significant 114%(MoM) increase and a 19.1%(YoY) growth.

- 1 issuer, LPN, experienced a corporate credit rating downgrade.

- The new bond issuance in December 2024 is a “subordinated perpetual bond” from PTTGC.

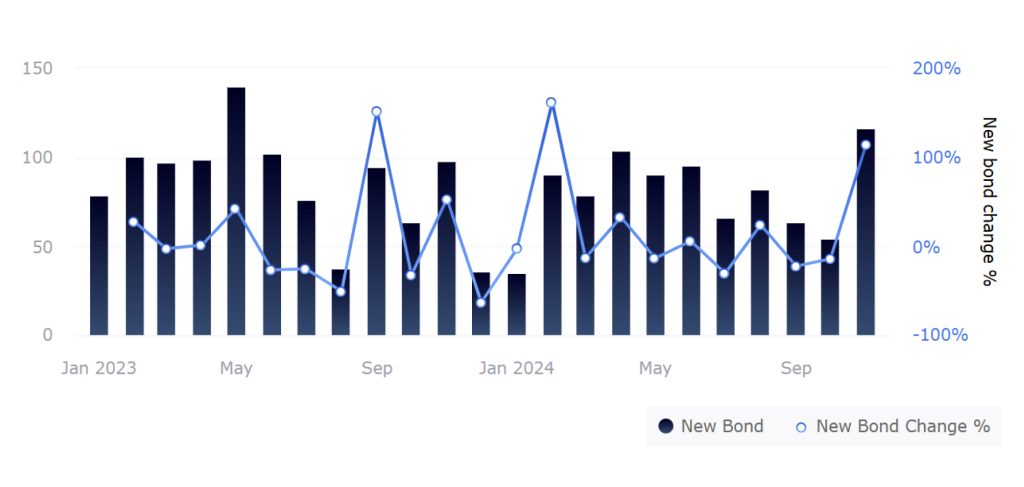

Figure 1 : New registered bonds (THB Billion)

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

- In the past month, we have witnessed a significant surge in corporate bond issuance compared to the previous month. Investment-grade bonds accounted for a substantial 76.3% of the total issuance, equating to 88.5 billion baht, while non-investment-grade bonds made up the remaining 23.7% at 26.9 billion baht. This surge was primarily driven by large-scale refinancing activities from major issuers such as SCC and ADVANC, which collectively accounted for a significant 56.3% of the total bond issuance in November 2024.

Figure 2 : Maturity Vs. New Registered Bonds (THB Billion)

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

Key Bond Market Event in November 2024

- SABUY Technology Public Company Limited (SABUY) reported a default on the seventh interest payment of its bond (SABUY258A) due on November 18, 2024. The company was unable to make the required interest payment, constituting a default under the bond’s terms and conditions. Subsequently, Asia Plus Securities, acting as the bondholders’ representative, notified SABUY to pay the overdue interest amounting to 21.06 million baht. As SABUY failed to make the payment within the specified timeframe, it was deemed to have defaulted under clause 11.1(a) of the bond terms and conditions.

- On November 25, 2024, Asia Plus Securities, on behalf of the bondholders, sent a formal demand to SABUY, requiring the company to repay the principal and accrued interest as stipulated in the bond terms and conditions, totaling 1,316,866,512.47 baht, along with a default interest rate of 8.45% per annum from the due date.

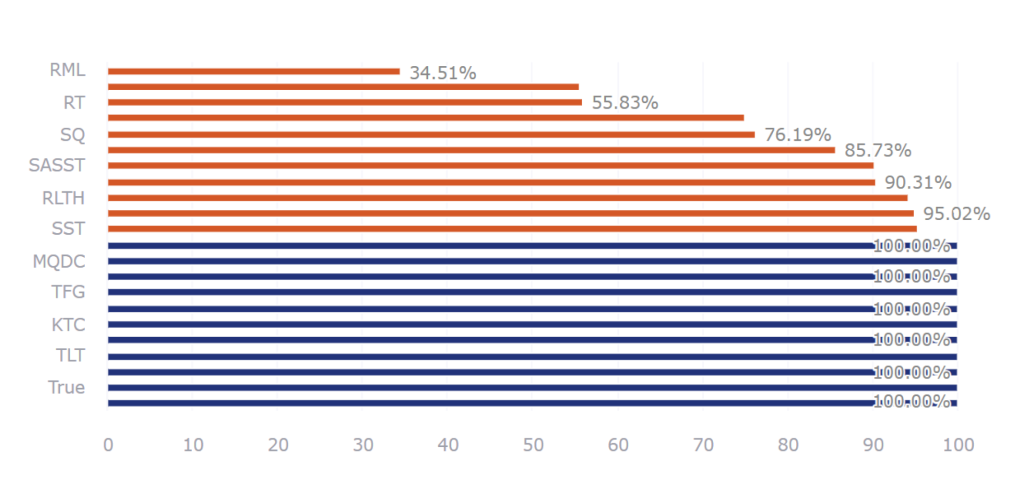

Figure 3 : Outstanding Value of Long-term Bond with Maturity by sector

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

Bonds Offered in November 2024

- 8 companies were rated as Investment Grade: SCC, TPIPL, ADVANC, KTC, BGRIM, TLT, TRUE, and SAWAD.

- 14 companies were rated as Non-Investment Grade: RML, RT, PF, SQ, WEH, SASST, SAMART, RLTH, ACPG, SST, MQDC, KUN, TFG, and PCLV.

- (Figure 3) Despite a significant increase in the total value of long-term private debt securities registered in November, we found that nearly half of the issuing companies, or 11 out of 22, were unable to raise the full amount of funds they had targeted.

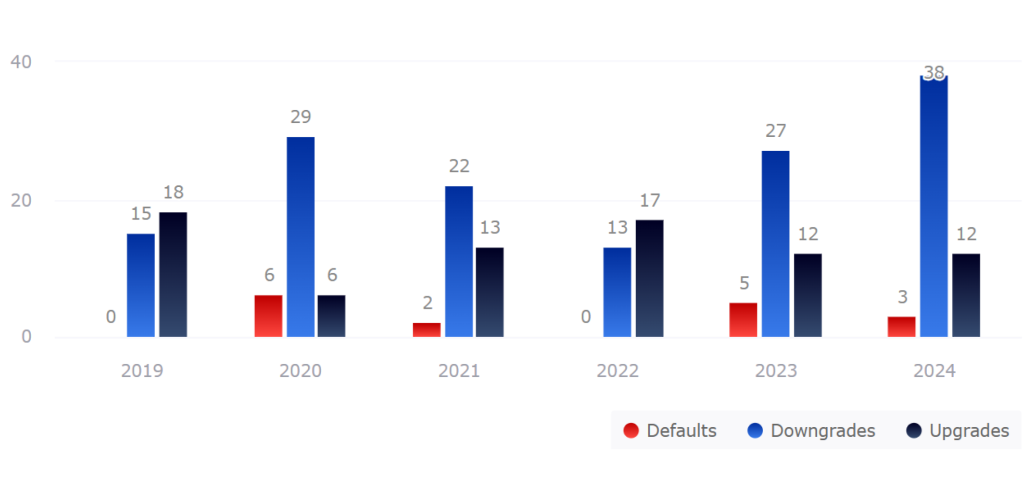

Credit change (Issuer Rating)

Figure 4 : Company rating changes during 2019-11M24

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

Credit Rating Downgrade

- LPN Development Public Company Limited (LPN) has had its corporate credit rating downgraded from “BBB” to “BBB-“. Additionally, the rating of the company’s unsecured subordinated debt has been downgraded from “BBB” to “BB+”, and the outlook has been revised from “Negative” to “Stable”. This downgrade reflects the company’s weaker-than-expected operating performance, which has led to a higher debt burden and weaker cash flow from operations. Although the company’s future performance and financial position are expected to improve, its credit profile will continue to face challenges from an unfavorable market environment.

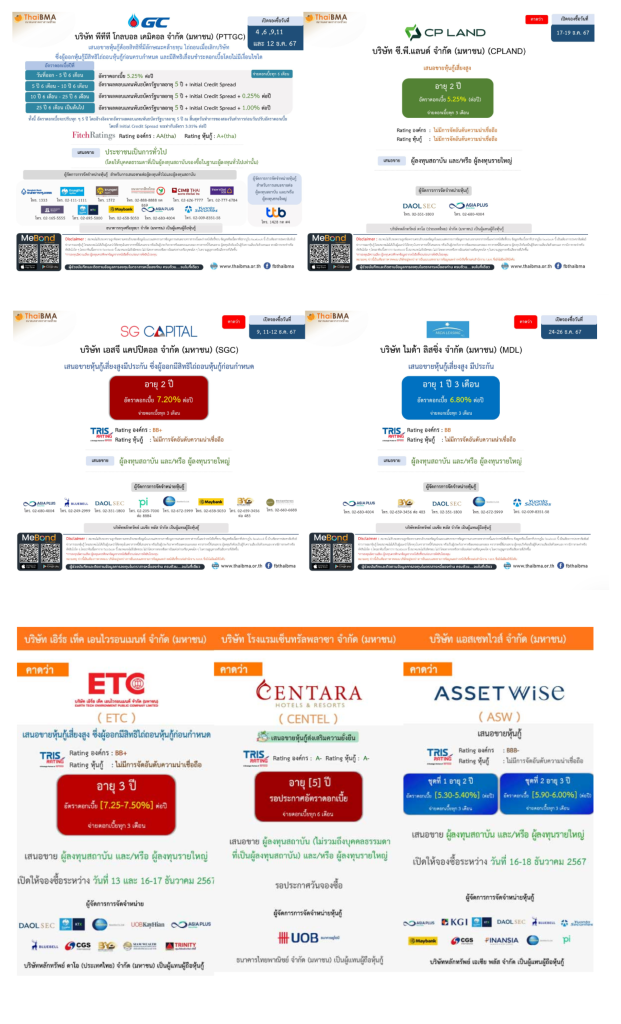

New Registered Bond in December 2024

- Corporate bonds to be offered in December 2024 include: SGC, ETC, J, ASW, PTTGC, CPLAND, CENTEL, NER, SKY, MDL, and FTREIT.

- PTTGC will be issuing a perpetual bond payable semi-annually, offered to the general public.

- Interest Rate from issuance date to 5.5 years: Fixed at 5.25% per annum.

- Interest Rate from 5.5 years to 10.5 years: Equal to the sum of (a) the yield of the 5-year government bond and (b) the Initial Credit Spread.

- Interest Rate from 10.5 years to 25.5 years: Equal to the sum of (a) the yield of the 5-year government bond, (b) the Initial Credit Spread, and (c) 0.25% per annum.

- Interest Rate from 25.5 years onwards: Equal to the sum of (a) the yield of the 5-year government bond, (b) the Initial Credit Spread, and (c) 1.00% per annum.

- The interest rate will be reset every 5 years from the first call date, based on the yield of the 5-year government bond at the end of the second business day prior to the beginning of the relevant interest reset period. The Initial Credit Spread will be fixed at 3.01% per annum.

Figure 5 : New Registered Bond in December 2024

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง