Bond

Macro Domestic

Macro View in October 2024 (Bond Research).

อ่าน 1 นาที

Key Highlights:

- The estimated value of corporate bonds to be offered in November 2024 is expected to exceed 100 billion baht.

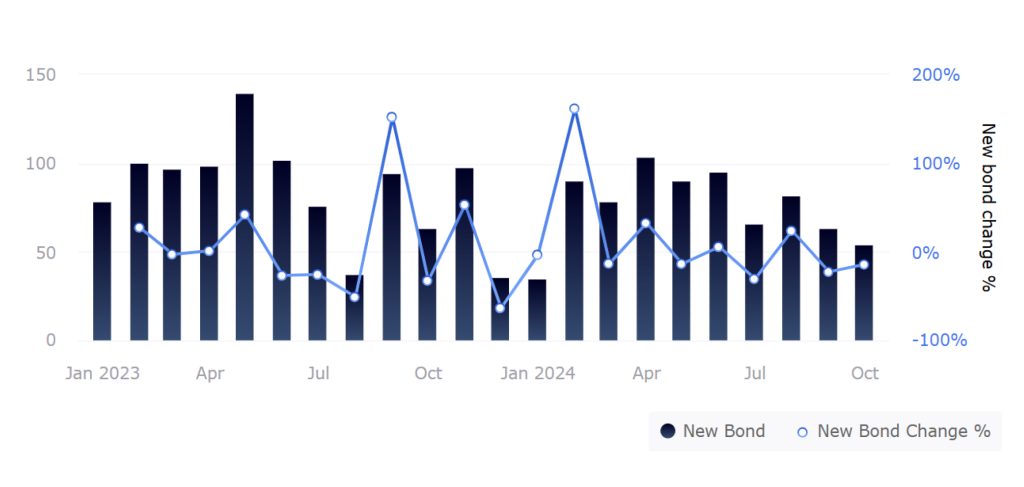

- In October 2024, newly issued corporate bonds amounted to approximately 54 billion baht, a decrease of 14.22%(MoM) and 14.72%(YoY). This reflects a slowdown in the growth of the corporate bond market following the Bank of Thailand’s (BOT) interest rate cut on October 16, 2024.

- Notably, new corporate bonds to be offered in November include Perpetual Bonds, such as those issued by BGRIM.

- 2 companies have requested to deferred payment of their bonds.

- 6 companies have experienced credit rating downgrades.

Figure 1 : New registered bonds (THB Billion)

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

- By comparing the maturity of bonds each year with the newly issued bonds in the same year, we found an average ratio of approximately 59% over the past 9 years (excluding the COVID-19 period). In 2024, maturing bonds have a value of 890 billion baht. Based on this ratio, the estimated value of newly issued bonds in 2024 should be around 1.5 trillion baht. However, in the first 10 months of 2024, the total value of newly issued bonds was 810 billion baht. Therefore, we expect to see the issuance of bonds exceeding 100 billion baht in the remaining two months of this year.

Figure 2 : Maturity Vs. New Registered Bonds (THB Billion)

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

2 companies, SNW and A, have requested a deferral in their bond payments.

- At the bondholders’ meeting of SNW, Siam Nuwat Co., Ltd., it was resolved to defer the payment of all three bond series

- SNW224A by an additional 10 months and 4 days

- SNW231A by an additional 1 year

- SNW233A by an additional 1 year

- Additionally, the bond interest rate was increased from 8.00% per annum to 8.50% per annum. Furthermore, a waiver was granted allowing the bond issuer to not maintain an interest-bearing debt-to-equity ratio of no more than 5:1, which is expected to appear in the 2024 annual financial statements.

- At the bondholders’ meeting of A, Ariya Property Public Company Limited, it was resolved to defer the payment of all 14 bond series.

- Agenda item 1: Consider and approve a waiver allowing the bond issuer to propose to the bondholders’ meeting to approve an extension of the maturity date of all 14 bond series by an additional 2 years from the original maturity date. This case is considered as the commencement of negotiations or the entering into of any agreement with creditors for the purpose of restructuring debt, which is in the nature of a waiver of the bond issuer’s debt repayment, including the postponement or change of the payment due date, with a total debt exceeding 400,000,000 baht, in accordance with clause 11.1.10 of the bond terms and conditions, shall not be considered a default under such terms and conditions.

- Other agenda items of all 14 series were either approved or disapproved, and some meetings were postponed due to insufficient quorum. For more details, please visit https://www.thaibma.or.th/EN/News/Detail.aspx?id=4b269ccf-4a90-ef11-a31e-a4821249f081

Figure 3 : Outstanding Value of Long-term Bond with Maturity by sector

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

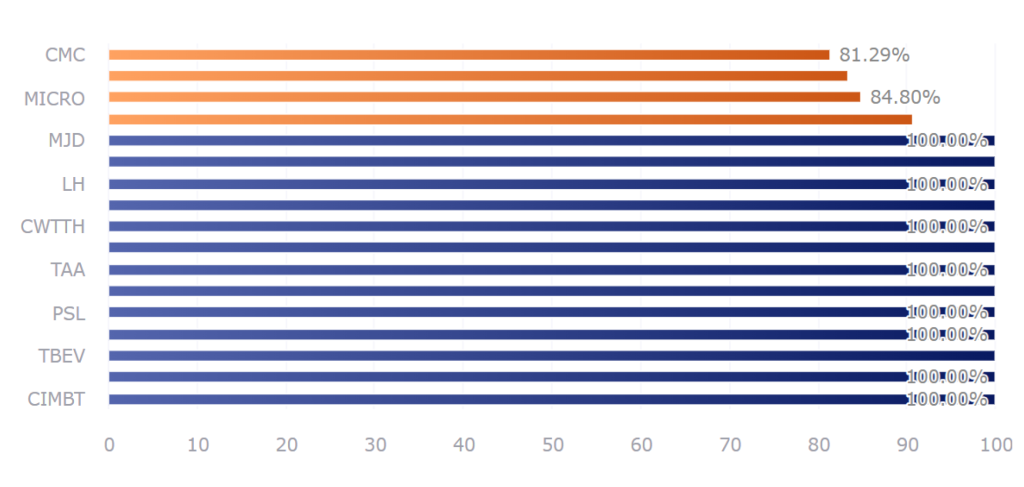

Bonds Offered in October 2024

- TBEV was the largest issuer in September, accounting for 20 billion baht or 37.62% of the total bond issuance value in October.

- 12 companies issued investment-grade bonds (Issue rating), including SENA, LH, THANI, TIDLOR, TCAP, PSL, TSE, TBEV, CIMBT, ICBCTL, JMT, and MTC.

- 9 companies issued non-investment-grade bonds (Issue rating), including MJD, CWTTH, PD, MICRO, SGF, TAA, CMC, TNL, and PF.

- (Figure 3) Based on the long-term private debt securities registered in September, we found that most companies were able to raise funds as targeted, except for 4 out of the 21 issuing companies.

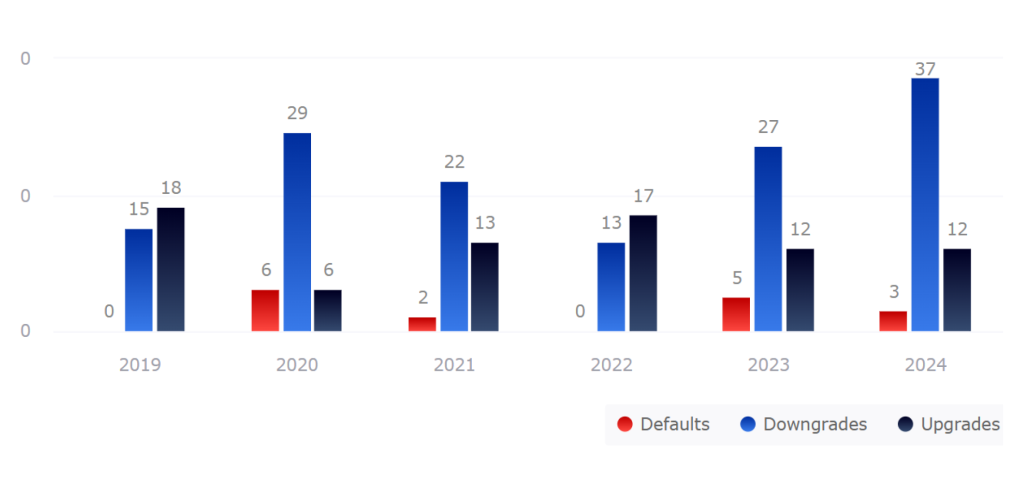

Credit change (Issuer Rating)

Figure 4 : Company rating changes during 2019-10M24

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

Credit Rating Downgrade

- CGH: Country Group Holdings Public Company Limited (CGH) has had its corporate credit rating downgraded from BBB- to BB+ and its outlook revised to Stable from Negative. This downgrade reflects the expectation of declining future earnings and the current weakness in earnings, primarily due to the increased expenses of Pi Securities Public Company Limited (Pi), a major subsidiary. This increase in expenses is attributed to significant investments in developing the Pi Application, which has negatively impacted the company’s profits. Pi has also been downgraded to BB+ from BBB- with a stable outlook, in line with the downgrade of its parent company, CGH.

- CPNREIT: CPN Retail Growth REIT has had its corporate and unsecured subordinated debt ratings downgraded to A+ from AA- and its outlook changed to Stable from Negative. This downgrade is due to the company’s debt-to-EBITDA ratio remaining above 7.5 times for the next 2-3 years, which exceeds TRIS Rating’s criteria for a downgrade.

- A (Ariya Property): Ariya Property Public Company Limited has been downgraded by TRIS Rating to B- from B, with a Negative outlook. This downgrade is due to weaker-than-expected operating results in the first half of 2024 and potential significant deterioration in the company’s financial risk profile from its investment in the high-value “Sunitra Rajdamri” project. Additionally, the company is expected to face increased refinancing and liquidity risks in the near future.

- TPOLY: Thai Polycons Public Company Limited has been downgraded to BB+ from BBB- with a stable outlook. The downgrade reflects the company’s construction business, which continues to experience weak earnings amid unfavorable market conditions, resulting in the company’s credit metrics being inconsistent with the previously assigned rating. Additionally, TRIS Rating has downgraded the corporate rating of TPC Power Holding Public Company Limited (TPCH), a subsidiary of TPOLY, to BB+ from BBB- with a stable outlook, following the downgrade of its parent company, TPOLY.

New Registered Bond in November 2024

- Corporate bonds to be offered in November 2024 include: ACPG, PF, SASST, SAWAD, MQDC, KUN, SAMART, CENTEL, TPIPL, NER, SQ, SST, RT, ADVANC, and BGRIM.

- BGRIM will be issuing a perpetual bond payable semi-annually, offered to the general public.

- Interest Rate for Years 1-5: Fixed at 5.75% per annum.

- Interest Rate for Years 6-25: Equal to the sum of (a) the yield of the 5-year government bond, (b) the Initial Credit Spread, and (c) 0.25% per annum.

- Interest Rate for Years 26-50: Equal to the sum of (a) the yield of the 5-year government bond, (b) the Initial Credit Spread, and (c) 1.00% per annum.

- Interest Rate for Year 51 onwards: Equal to the sum of (a) the yield of the 5-year government bond, (b) the Initial Credit Spread, and (c) 2.00% per annum.

Figure 5 : New Registered Bond in November 2024

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง