Bond

Macro Domestic

Macro View in September 2024 (Bond Research).

อ่าน 1 นาที

Key Highlights:

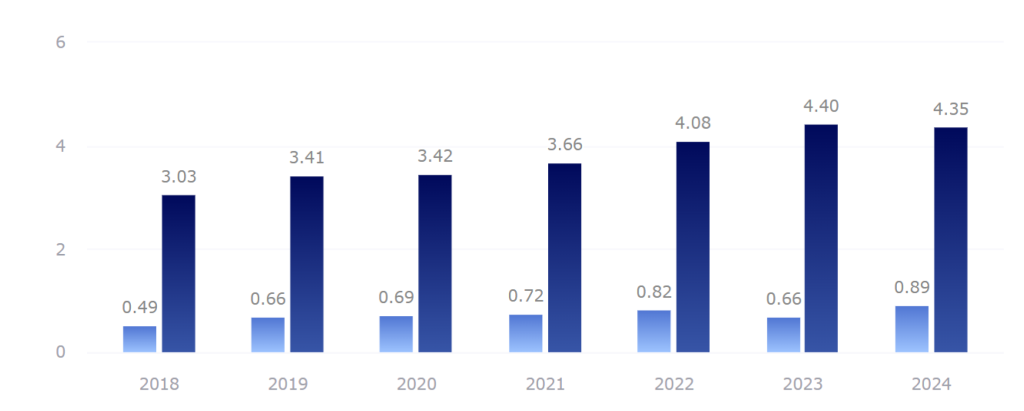

- (Figure 1) As of September 30, 2024, the outstanding value of corporate long-term bonds stood at 4.35 trillion baht, a decrease of 0.46% YoY compared to the same period last year. Currently, there are bonds maturing in 2024 with an outstanding value of 0.21 trillion baht, out of a total maturity value for the year of 0.89 trillion baht, accounting for 4.8% of the total outstanding long-term bonds.

Figure 1 : Outstanding Value of Long-term Bond with Maturity

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

- In September, NWR and EP requested to postpone their bond payments, impacting the overall bond market situation in the first nine months of 2024. The total number of bond issuers requesting payment deferrals reached 12. Meanwhile, the number of bonds with default payments (DP) for the year remained at 3, despite WTX being flagged with a DP marker in September. However, the company managed to pay the interest within the same month.

- From the aforementioned bond market situation, investors have lost confidence, making it more challenging for companies to raise funds through bonds, particularly for new players and companies issuing high-yield bonds. We believe this has contributed to a 32.85% YoY decline in the value of bonds offered for sale in September.

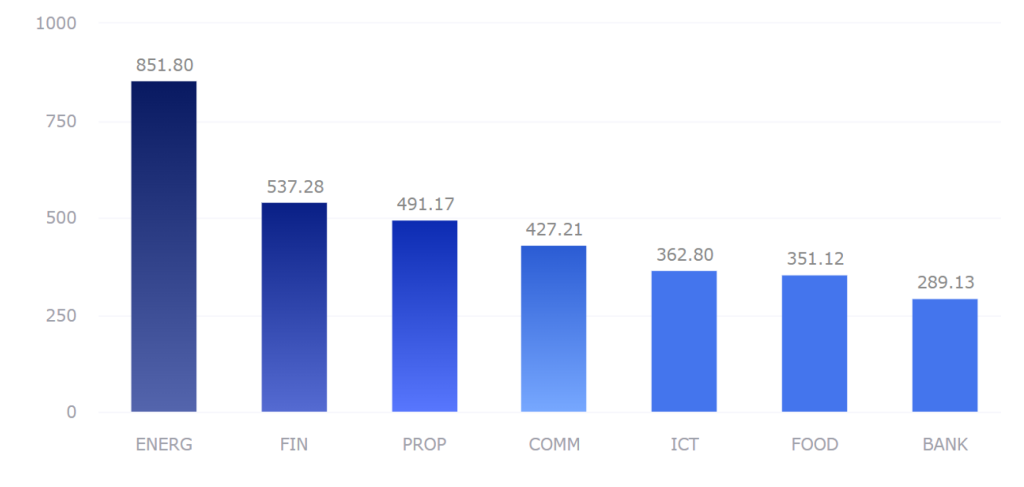

- (Figure 2) The energy (ENERG), financial (FIN), and property development (PROP) sectors remain the top industries with the highest outstanding bonds in the current market. Among these, the financial and securities sector holds the largest proportion of bonds maturing within the year, valued at 45.6 billion baht, or 8.5% of the sector’s total outstanding bonds. Following closely is the property development sector, with bonds maturing within the year valued at 39.1 billion baht, accounting for 8% of the sector’s total outstanding bonds.

Figure 2 : Outstanding Value of Long-term Bond with Maturity by Sector

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

Bonds Offered in September 2024

- In September 2024, a total of 37 issues of corporate long-term bonds were registered with ThaiBMA, representing 18 companies and a combined value of 62.89 billion baht. This marks a decrease of 22.61% (MoM) and 32.85% (YoY). We believe that part of this decline is due to issuers closely monitoring interest rate trends ahead of the upcoming meeting scheduled for October 16, 2024.

- The major issuers in September were GULF and BJC, with a combined bond issuance value of 38.0 billion baht, accounting for 60.42% of the total bond issuance value for this month.

- Excluding financial institutions, the total fundraising amount stood at 61.8 billion baht, reflecting that financial institutions issued fewer bonds compared to previous months of this year.

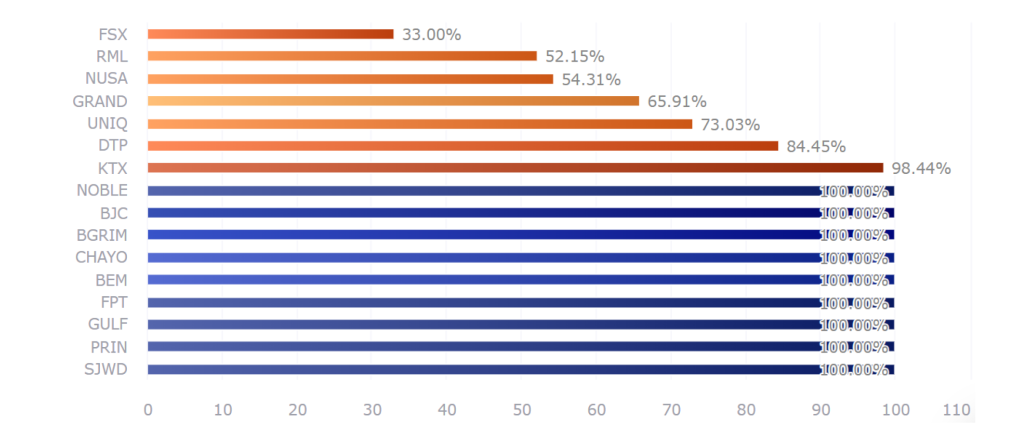

- The corporate long-term bonds offered in September 2024 included 22 issues in the investment-grade category (Issue rating), from companies such as BJC, GULF, NOBLE, BGRIM, BEM, SJWD, PRIN, UNIQ, and KTX.

- Meanwhile, 15 issues with no credit rating (Issue rating) were offered by FSX, NUSA, CHAYO, GRAND, RML, DTP, NCH, FPT, and PTTC.

- FSX (FINANSIA X PUBLIC COMPANY LIMITED) was a new issuer of long-term bonds in September 2024.

- (Table 2) Among the corporate long-term bonds registered in September 2024, we found that most issuers were able to raise funds according to their targets, except for 6 issuers out of the 18 issuers. One factor we see is that investors had options from Major bond issuers with high fundraising amounts, and they remained cautious in their investments.

Figure 3 :Long- Term Corporate Bonds for Sales Registered in September 2024

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

Credit change (Issuer Rating)

- In September 2024, TRIS Rating upgraded the credit ratings of 3 companies: BCP, BSRC, and BBGI.

- TRIS Rating downgraded the credit ratings of 7 companies: PSH, PS, EP, AGE, SG, LALIN, and LH.

Credit Rating Upgrade

- BCP (Bangchak Corporation) had its credit rating upgraded from A to A+ with a Stable outlook due to the company’s stronger business position following the acquisition of Bangchak Sriracha Public Company Limited (BSRC). This acquisition led to an increase in the company’s EBITDA by at least 6.0-7.0 billion baht per year, as well as an increase in refining capacity and sales through marketing channels. Additionally, the improved business position was attributed to the expansion of the petroleum exploration and production business. Vertical integration and diversified investments enhanced flexibility in response to price fluctuations. As a result of BCP’s credit rating upgrade, the ratings of its subsidiaries, BSRC, were upgraded from A to A+, and BBGI from A- to A.

Credit Rating Downgrade

- PSH (Pruksa Holding) had its credit rating downgraded from A- to BBB+ with a Stable outlook due to its continued weaker-than-expected performance. This was coupled with the risks associated with large-scale investments and an increase in the group’s debt burden, amidst high interest rates and household debt levels. As a result, the downgrade also affected its major subsidiary, PS (Pruksa Real Estate), which was downgraded to the same rating .

- EP (Eastern Power Group) had its credit rating downgraded again from BB to BB- with a Negative outlook due to weak liquidity. This has increased the risk that the company may not be able to meet its upcoming debt obligations in the near term. However, the company has already received approval to extend the redemption period of its bonds by one year.

- AGE (Asia Green Energy) had its credit rating downgraded from BBB- to BB+ with a Negative outlook, reflecting the continued decline in its profitability and the uncertainty surrounding its acquisition of a majority stake in Asia Biomass (ABM). TRIS views that the consolidation of ABM’s financials could negatively impact the company’s financial position.

- SG (S 11 Group) had its credit rating downgraded from BBB- to BB+ with a Stable outlook, reflecting weak performance due to a rapid decline in the return on loans following the implementation of an interest rate ceiling for motorcycle hire-purchase loans.

- LALIN (Lalin Property) had its credit rating downgraded from BBB+ to BBB with a Stable outlook, reflecting weaker-than-expected performance and an increased debt burden. This occurred amidst high interest rates and household debt levels, which have weakened purchasing power in the housing market.

- LH (Land and Houses) had its credit rating downgraded from A+ to A with a Stable outlook, reflecting weaker-than-expected performance and a rapid increase in debt levels.

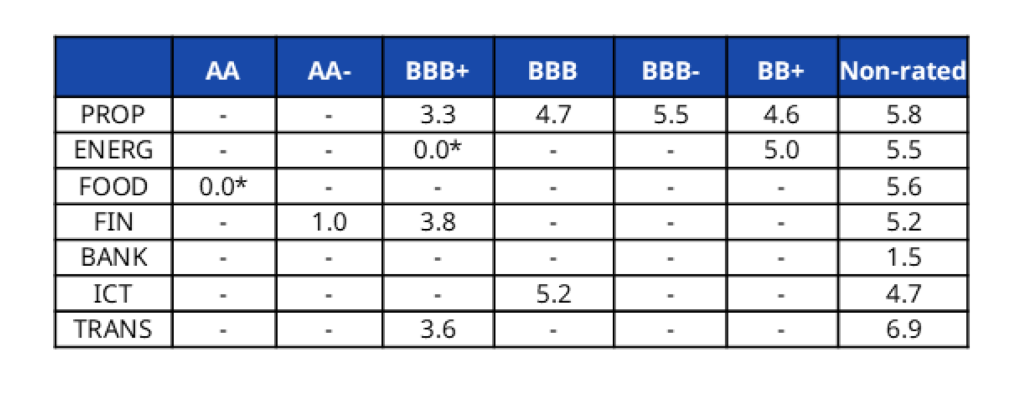

Figure 4 : In the first 9 months of 2024, TRIS Rating downgraded the credit ratings of 33 companies, while upgrading the credit ratings of 12 companies.

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

New Registered Bond in October 2024

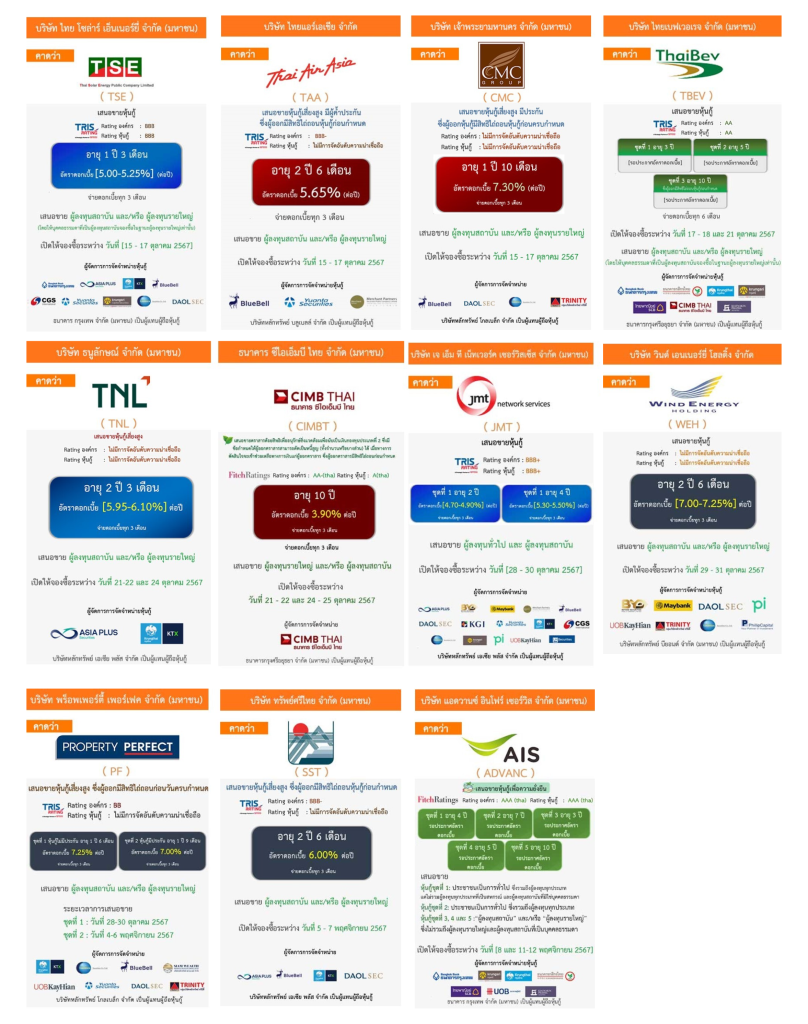

- The corporate bonds to be offered in mid-October include TSE, TAA, CMC, TBEV, TNL, CIMBT, JMT, WEH, and PF. In early November, debt securities from PF, SST, and ADVANC will be offered.

(Source : FynnCorp IAS’s compilation from SEC and ThaiBMA)

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง