Bond

Macro Domestic

Macro View in August 2025 (Bond Research).

อ่าน 1 นาที

Key Highlights:

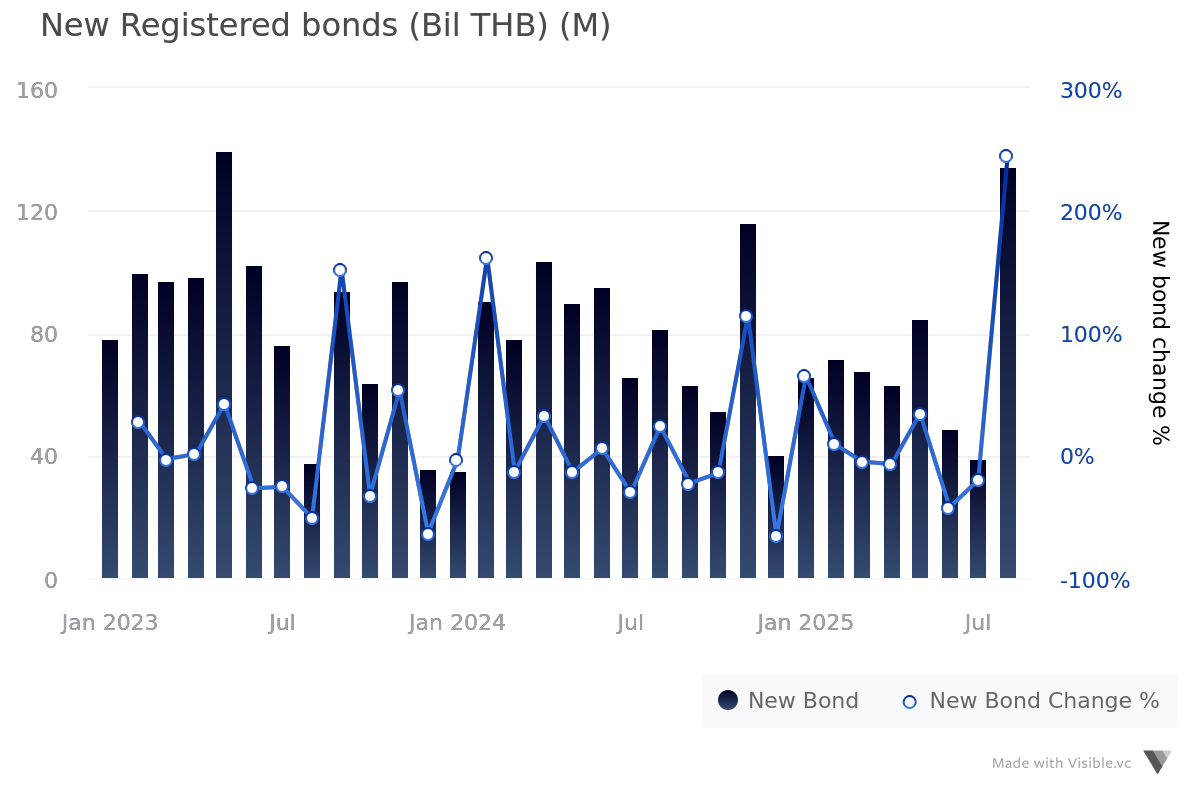

- The corporate bond market experienced a significant surge in August 2025, with total issuance reaching 134 billion Baht. This substantial increase followed the Monetary Policy Committee’s (MPC) decision to cut the policy rate to 1.50%, which revitalized the bond market. Overall issuance grew by a remarkable 244.6% compared to the previous month and 64.6% year-over-year.

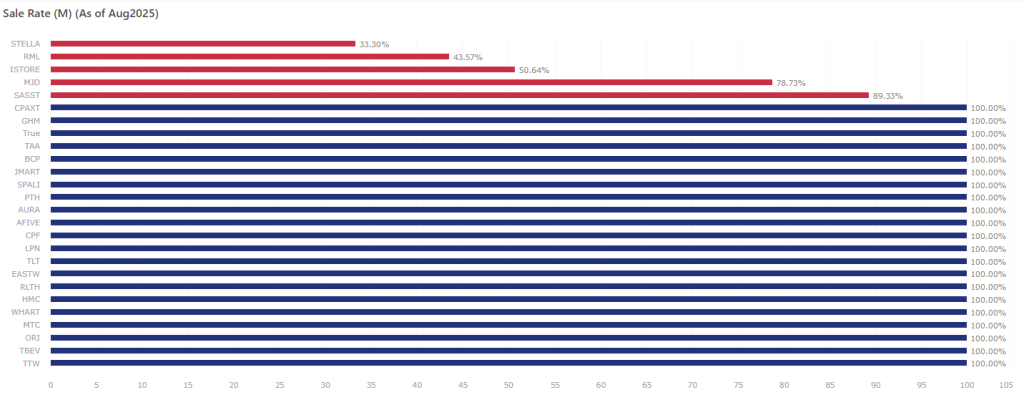

- 5 companies failed to meet their fundraising targets: Out of 26 companies that issued bonds in July, five were unable to raise their targeted capital. These companies were: STELLA, RML, ISTORE, MJD, and SASST.

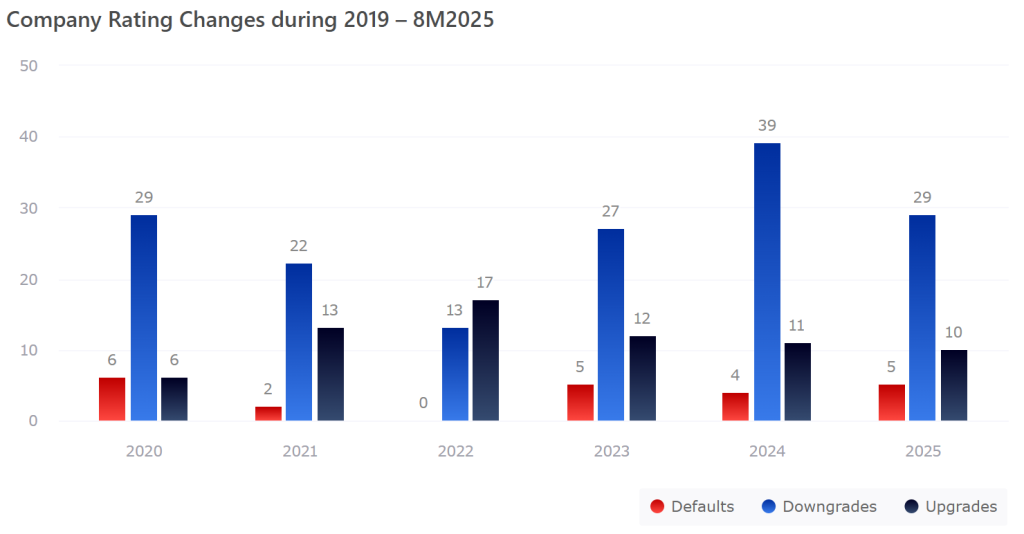

- Credit ratings upgraded: 2 companies had their credit ratings upgraded.

- Credit ratings downgraded: 2 companies had their credit ratings downgraded.

- Default: 1 company defaulted on its bond payments.

Figure 1 : New Registered Bonds (THB Billion)

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

Corporate Bond Issuance in August 2025

In August 2025, the majority of corporate bond issuance value came from large-cap companies. TBEV led the market with the highest value at 38 billion Baht, followed by CPAXT and TRUE, each issuing bonds worth 18 billion Baht. This month marked the first time in 2025 that the monthly corporate bond issuance value surpassed the 100 billion Baht level.

The proportion of new bond issues in August was predominantly Investment Grade, accounting for 92.61%. The remaining 7.39% were Non-Investment Grade.

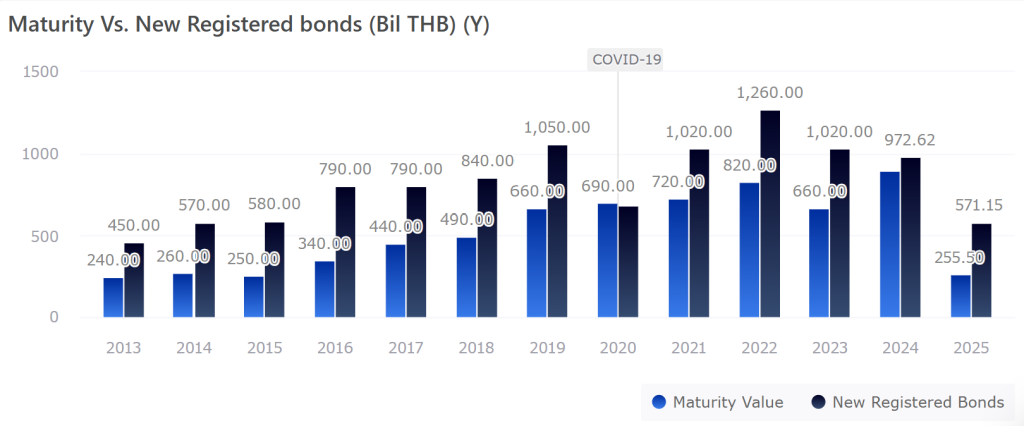

Figure 2 : Maturity Vs. New Registered Bonds (THB Billion)

Figure 3 : Outstanding Value of Long-term Bond with Maturity by Sector

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

Bonds Offered in August 2025

- Investment Grade Bonds: A total of 15 companies issued Investment Grade bonds with a combined value of approximately 124 billion Baht. These companies (based on Issue Rating) are: CPAXT, TRUE, BCP, JMART, AURA, CPF, LPN, TLT, EASTW, HMC, WHART, MTC, ORI, TBEV, and TTW.

- Non-Investment Grade Bonds: A total of 11 companies issued Non-Investment Grade bonds with a combined value of approximately 9.9 billion Baht. These companies (based on Issue Rating) are: STELLA, RML, ISTORE, MJD, SASST, GHM, TAA, SPALI, PTH, AFIVE, and RLTH.

- (Figure 3) From the long-term private sector debt instruments registered in August 2025, we found that a significant proportion—five out of the 26 issuing companies—failed to meet their fundraising targets. The primary factor behind this was the uncertainty surrounding the imposition of import tariffs by the United States.

Figure 4 : Company Rating Changes during 2019 – 8M2025

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

Credit change ( Issuer Rating )

TRIS Rating has upgraded 2 companies.

PF (Property Perfect)

TRIS Rating downgraded the corporate credit rating of Property Perfect Public Company Limited (PF) from “D” to “B-” with a “Stable” outlook.

This upgrade was a result of the company resuming its first interest payment on August 7, 2025, in accordance with the newly revised terms.

DA (Double A)

TRIS Rating upgraded the corporate credit rating of Double A (1991) Public Company Limited (DA) from “BBB” to “BBB+” and changed the credit outlook from “Positive” to “Stable.”

TRIS Rating believes the company has a stronger financial position and improved credit metrics. The satisfactory operating cash flow and disciplined financial management have led to a continuous reduction in the company’s adjusted financial debt, bringing it down to 9.1 billion Baht as of June 2025, from a range of 12–14 billion Baht in previous years.

TRIS Rating has downgrade 2 companies

AQUA (Aqua Corporation)

TRIS Rating downgraded the corporate credit rating of Aqua Corporation Public Company Limited (AQUA) from “BB” to “BB-” and revised the credit outlook from “Stable” to “Negative.”

This is a result of the company’s weaker-than-expected financial performance, business risks related to the food business, and a significantly weaker liquidity position, which increases the risk of repayment for debts due in the near term.

TPIPL (TPI Polene)

TRIS Rating downgraded the corporate credit rating of TPI Polene Public Company Limited (TPIPL) from “A-” to “BBB” and revised the credit outlook from “Negative” to “Stable.”

This reflects the company’s deteriorating risk status due to a recent unfavorable court ruling, as well as a continued weakening financial position. In TRIS Rating’s view, the litigation could affect the company’s reputation and undermine investor confidence, while also creating additional expenses beyond what TRIS Rating had previously estimated.

New Registered Bond in September 2025

- Examples of corporate bonds set to be offered in September2025 include BTSG, TPIPP, JMT, STELLA, ASIA, BANPU, TU, PUEAN, SENA, MQDC, RML, SCC, GULF, LOXLEY, FPT, CPNREIT, PTTC, ANAN. Additional information can be found on ThaiBMA.

Figure 5 : New Registered Bond in September 2025

( Source : FynnCorp IAS’s compilation from SEC and ThaiBMA )

กรอกอีเมล เพื่อรับข้อมูลข่าวสารจากเรา

บทความที่เกี่ยวข้อง