General knowledge

Debenture

Investing strategies

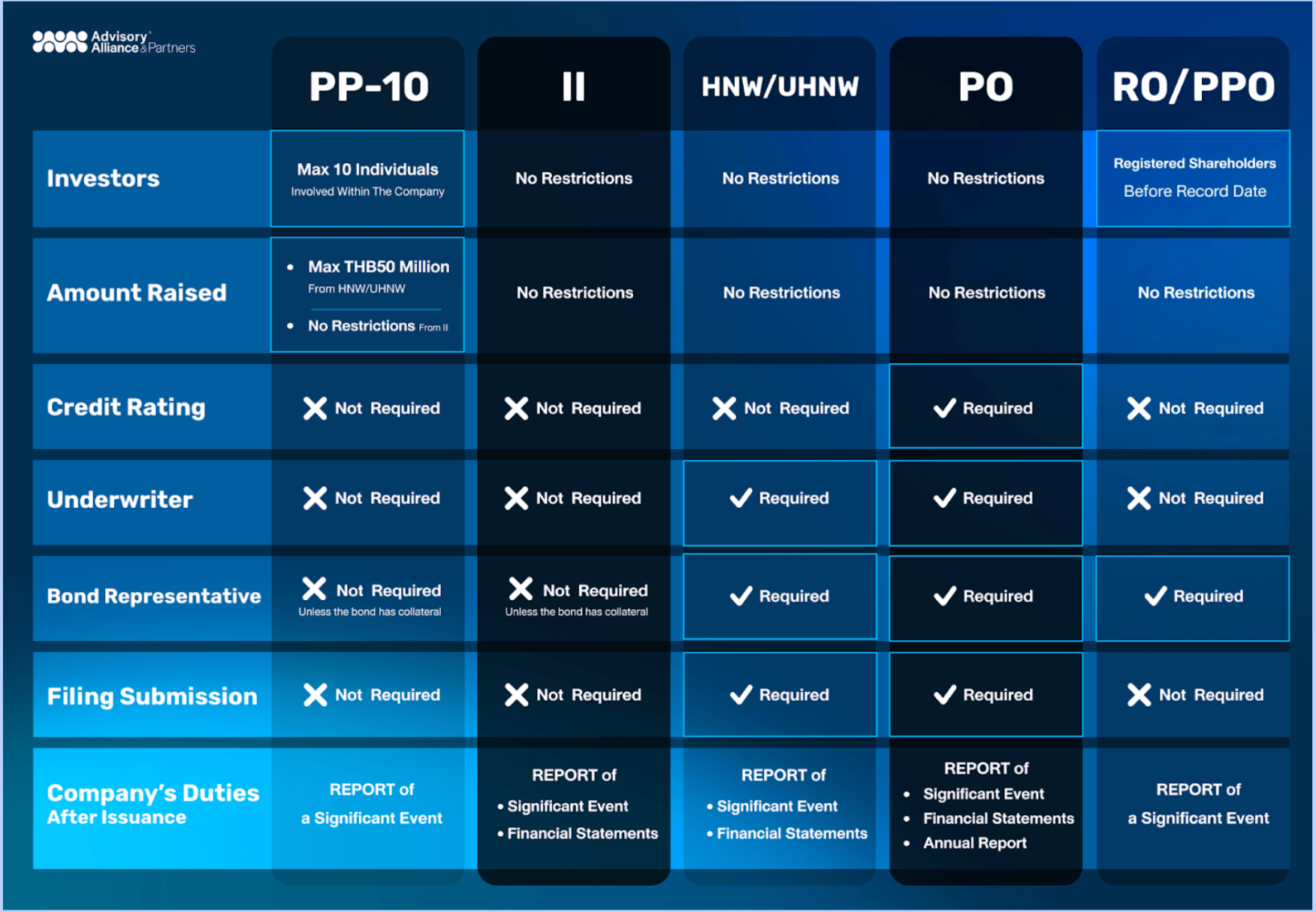

Differences in Bond Offerings to Different Investor Types

2 MIN READ

In Thailand, there are specific regulations governing the issuance of bonds, which vary depending on the type of investor to whom the bonds are offered. Here’s a breakdown of the different investor categories and the corresponding regulations:

1. Specific Investors (PP-10):

- Bonds are offered to a maximum of 10 institutions or individuals.

- No underwriter is required.

- Investors are typically internal to the company, such as institutional investors, audit committees, executives, major shareholders (holding more than 10%), and subsidiaries.

- If offered to institutional investors, there are no limits on the offering amount, but if offered to related parties, the limit is 50 million baht per offering.

- Given the limited and select group of investors, credit ratings are often not required, as investors are assumed to have sufficient knowledge of the company.

- The company must report significant events that could impact investor perceptions.

- Similar to PP-10, no underwriter or credit rating is required.

- Investors are assumed to have access to sufficient information to make informed decisions.

- The company must report significant events and submit financial statements for review by institutional investors.

3. High-Net-Worth Individuals (HNW):

- More regulatory oversight is required compared to PP-10 and II due to the broader range of investors.

- An underwriter is necessary, and the issuer must have a representative.

- The offering must be filed with the Securities and Exchange Commission (SEC) for approval.

- Similar to II, the issuer must submit financial statements and reports for significant events.

4. Public Offering (PO):

- This is the most regulated type of bond offering.

- An underwriter is required, and a registration statement must be filed with the SEC.

- A credit rating is mandatory to assess the investment risk.

- The issuer must submit annual reports, financial statements, and reports for significant events.

5. Rights Offering/Pre-emptive Rights Offering (RO/PPO):

- This applies specifically to convertible bonds.

- The issuer can offer convertible bonds to existing shareholders without a credit rating, assuming shareholders have sufficient knowledge of the company.

- An underwriter is not required, but the issuer must report significant events.

- Subscription rights are based on the existing shareholding structure.

Enter your email to receive news updates from us

Related Articles

-

Warrants: A Deeper Dive

What is a Warrant? A warrant is a financial instrument that gives the holder the right, but not the obligation, to buy a specified number of shares of an underlying asset at a predetermined price (exercise price) and within a specified time frame. The underlying asset is typically the common stock of the company issuing the warrant.

-

Tender Offer: A Comprehensive Guide

A tender offer is a public offer made by one company to the shareholders of another, aiming to acquire a controlling interest in that company. This is usually done by purchasing a significant portion of the target company’s shares. The offering company will specify the number of shares it wants to buy, the price it’s willing to pay, and a deadline for shareholders to accept the offer.

-

What is an IPO? A Simplified Explanation

IPO stands for Initial Public Offering. It’s a process where a private company offers its shares for sale to the public for the first time. This transition transforms the company from a privately held entity to a publicly traded company.

-

Debt Restructuring: Your Lifeline During a Crisis

Debt restructuring is a strategic lifeline that can help businesses navigate challenging financial times. It’s important to understand that financial difficulties aren’t always a result of mismanagement; external factors such as economic downturns or unforeseen circumstances can also contribute.