General knowledge

Debenture

Understanding Warrants

อ่าน 3 นาที

What is a Warrant?

A warrant is a type of derivative security that grants the holder the right, but not the obligation, to buy or sell an underlying security at a predetermined price before a specified expiration date. When a company issues warrants, it sets specific terms and conditions for exercising these rights. For instance, US companies typically issue American-style warrants that can be exercised anytime before expiration, while European companies often issue European-style warrants, exercisable only on the expiration date.

Warrants vs. Options

While warrants and options share similarities, there are key distinctions. Firstly, warrants have a dilutive effect on a company’s shares as the exercise of warrants requires the issuance of new shares. Options, on the other hand, are traded between investors and do not directly impact the company’s share count. Secondly, warrants are issued by the company, whereas options are created by investors trading existing shares.

Why do Companies Issue Warrants?

Companies often attach warrants to debt securities to make them more attractive to investors, such as by offering lower interest rates. These warrants are usually distributed to existing shareholders without any additional cost and can be traded separately. By issuing warrants, companies can potentially raise additional capital when investors exercise their options to convert the warrants into shares.

Case Study: Warrants in Action

Warrants are often seen as a useful indicator of a stock’s future performance. When a company issues warrants, investors have a period of time to decide whether to exercise their option to purchase the underlying stock at a predetermined price.

For example, consider Company A.

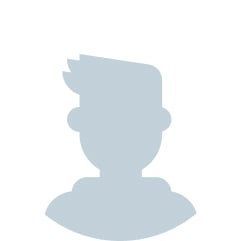

Chart 1 shows the company’s stock price over a period, demonstrating a downward trend.

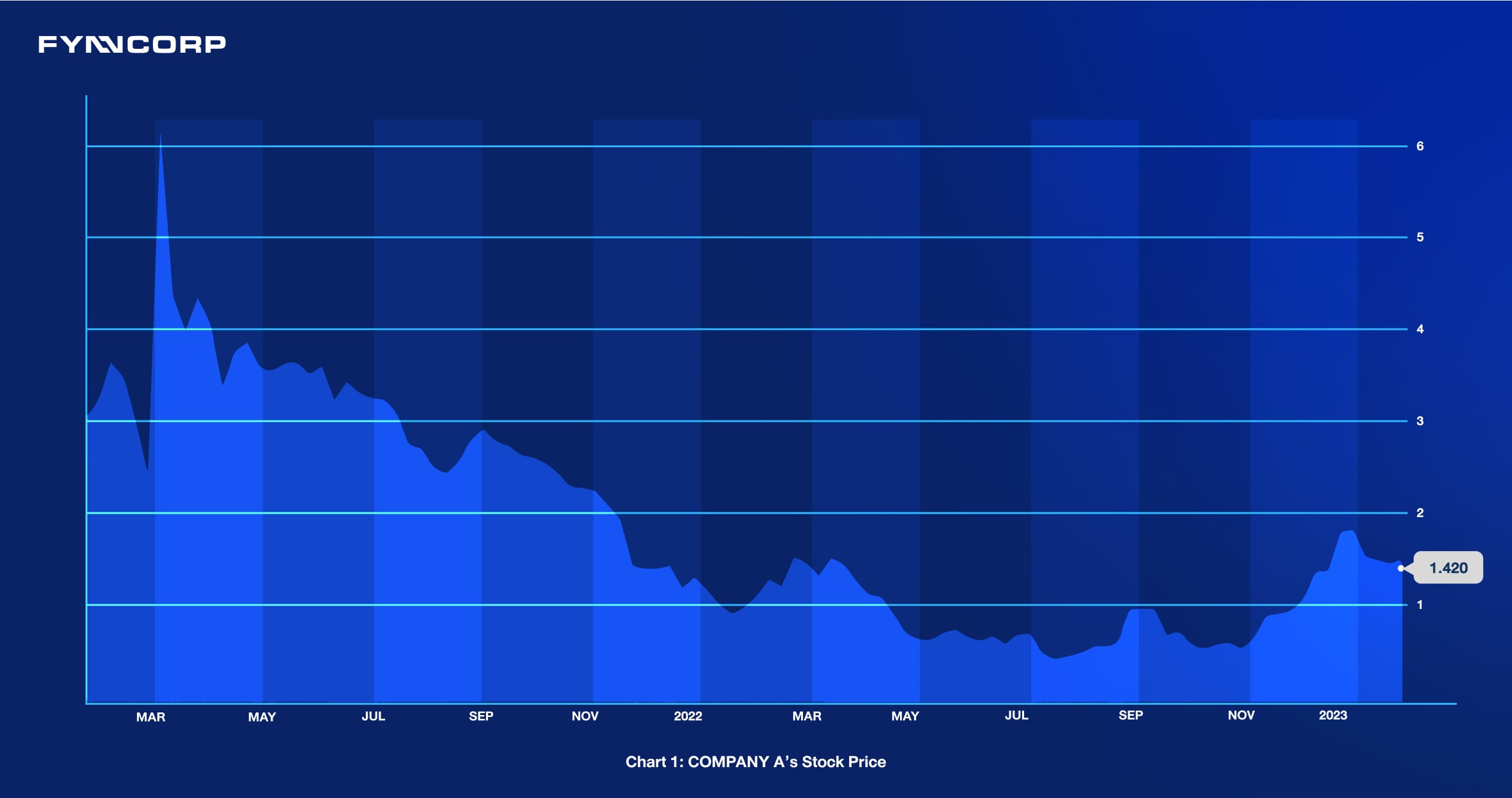

Chart 2 displays the corresponding price of Company A’s warrants. Notably, the two charts exhibit a similar pattern. When the stock price increased in March, the price of the warrants also rose as investors anticipated a higher likelihood of exercising their options. Conversely, as the stock price declined, the value of the warrants decreased due to the diminishing probability of the stock reaching the exercise price.

Enter your email to receive news updates from us

Related Articles

-

Warrants: A Deeper Dive

What is a Warrant? A warrant is a financial instrument that gives the holder the right, but not the obligation, to buy a specified number of shares of an underlying asset at a predetermined price (exercise price) and within a specified time frame. The underlying asset is typically the common stock of the company issuing the warrant.

-

Tender Offer: A Comprehensive Guide

A tender offer is a public offer made by one company to the shareholders of another, aiming to acquire a controlling interest in that company. This is usually done by purchasing a significant portion of the target company’s shares. The offering company will specify the number of shares it wants to buy, the price it’s willing to pay, and a deadline for shareholders to accept the offer.

-

What is an IPO? A Simplified Explanation

IPO stands for Initial Public Offering. It’s a process where a private company offers its shares for sale to the public for the first time. This transition transforms the company from a privately held entity to a publicly traded company.

-

Debt Restructuring: Your Lifeline During a Crisis

Debt restructuring is a strategic lifeline that can help businesses navigate challenging financial times. It’s important to understand that financial difficulties aren’t always a result of mismanagement; external factors such as economic downturns or unforeseen circumstances can also contribute.